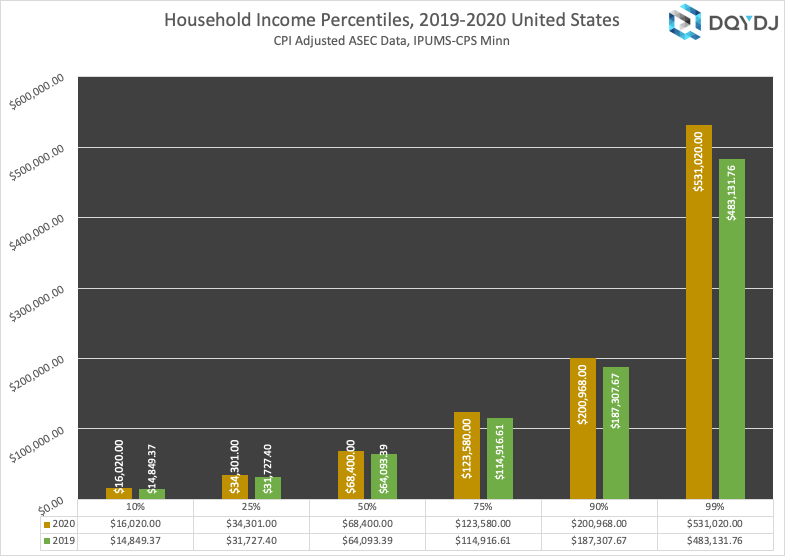

Wages are stagnant we are told. Looking at these data says incomes are not stagnant.

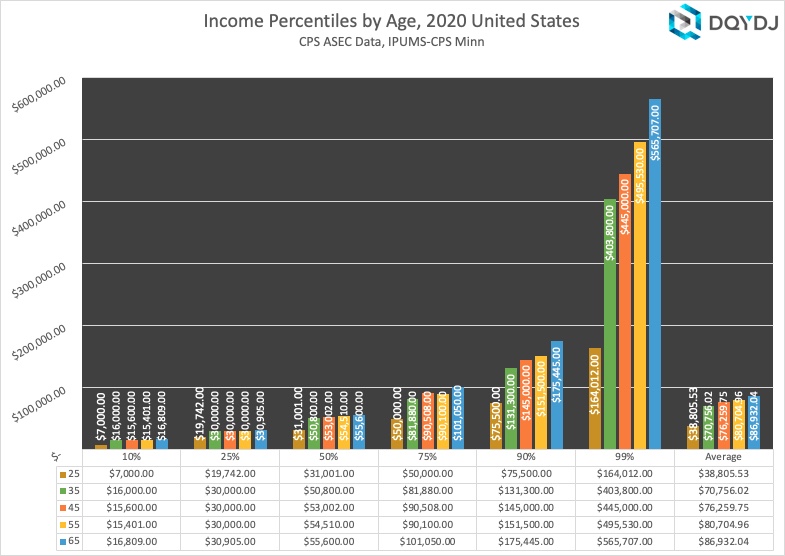

Much is made of the low income for seniors, but at least at age 65 there is little difference among age groups.

We might think of the 1% as only the super wealthy billionaires, but that’s not true.

Public opinion and policy are often based on perceptions and sometimes on misleading or selective data.

The most important – or, at least, most closely watched – income statistics are: Median household income Average household income Top 1% household income

Of these, median household income is the most important statistic. Medians are more resistant to outliers and better represent a “typical” household. Average income is influenced by very high earners, although it is also a decent estimate.

Median means the midpoint of household income: half of US households made more and half less.

The numbers in this section are nominal – they are not adjusted for inflation.

In 2020, $68,400.00 was the median household income in the United States. This is up from $63,030.00 in 2019.

The average household income was $97,973.61 in 2020. It was $89,930.70 in 2019.

To be top 1% in 2020, a household needed to earn $531,020.00. $475,116.00 was the threshold last year.

Source: Average, Median, Top 1% Household Income Percentiles [2020] – DQYDJ

I meant to say $0 – $2,000 in liquid assets (not net worth) as they have to go through spend down).

LikeLike

Hey Dick, good morning. It may be more valuable to readers if they saw ‘where they stand’ as compared to 65, 70, 75year olds in retirement. I saw a youtube … based on https://www.federalreserve.gov/econres/scfindex.htm. You may want to share info from it https://www.youtube.com/watch?v=4K0H9srSxmY. (PS: how do you like the revised PSEG medical plan for retirees. We went plan G as suggested by Via Benefits (although yours may be enhanced as a past officer).

LikeLike

Thanks for the post. Schmidt! does a fine job. The comments are illuminating – about the opportunity that exists in retirement planning/education.

A couple of comments – note that there is a significant difference between income and wealth – Dick’s numbers are income, Schmidt is talking wealth (net worth). The percentage of Americans age 65+ living in poverty has steadily declined from 35% in 1959 to less than 9% today (some estimates that include all transfers suggest it is less than 5%). For comparison, the percentage of children under age 18 living in poverty declined from 27% to 14%. Remember that the determination of poverty in the US is an income determination.

And, Mr. Schmidt misses a couple of basics on why there are differences among the cohorts – perhaps he would have covered them had he extended the video. Obviously, paramount, is that each of those age cohorts are measuring different people. And, as someone once said (I’m paraphrasing here), you are who you are (financially) because of where you were (position, financial status, etc.) when (Depression, WWII, Vietnam, Great Recession, Pandemic).

Separately, if you look at the data, America’s older population is decidedly more female – at age 65, more so at age 70 and even more so at age 75. Finally, this is all about survival and health – the impact of nature (heredity) combined with nurture (lifestyle). One major component is that among lower income older Americans, many are dual eligible for Medicare and Medicaid – in fact, that cohort of the elderly population is growing rapidly, 3+% per year, now in excess of 12MM (about 1 in 5 of all people over age 65). Medicaid eligibility means low or no Part B and Part D premiums, low or no point of purchase cost sharing. So, because Medicaid has a limit on assets, there are a lot of people at ages 70 and 75 with net worth between $0 and $2,000.

You may also take some time to look at the experience of retirees – looking back. If so, you might check out the Society of Actuaries, Committee fon PostRetirement Needs and Risks tsudy / focus group of 85 year olds.

See: https://www.soa.org/globalassets/assets/files/resources/research-report/2019/retirement-experiences-people-over-85.pdf

MFrom that study, from a financial perspective, I felt the most important ifinding was confirmation that most older Americans living in retirement spend some efffort at living frugally – living below their means – and that they are generally satisfied with retirement (so long as health and cognitive capability hold out). .

LikeLike

Thanks, BennyJ … appreciate the information.

LikeLike

I’ll take a look. We have Plan G too. No enhanced benefits for me or any officer that I know of.

LikeLike