Sen Elizabeth Warren wants to lower student loan interest rates to the rate the fed charges banks, currently 0.75%. She categorizes the interest paid on student loans as “profit” for the federal government that is not justified (a recent article in the WSJ illustrates how government accounting machinations hides the real cost). In addition, there are already in place student loan forgiveness programs and the Obama administration wants to expand that program.

If you want to tax every American 40% of their gross income and provide “free” college educations, fine, but have the guts to say so instead of playing political and accounting games.

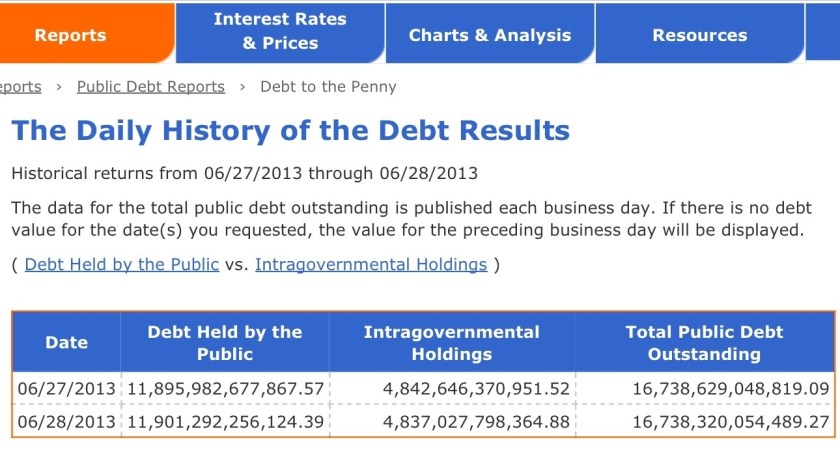

Exactly what goes through these politicians minds that they think nothing of making these kinds of proposals in isolation of the issues facing the entire government. For example, here are the Treasury figures showing the increase in the federal debt in just one day. Look at the debt held by the public. The so-called profit from student loans is part of the overall calculation. Why shouldn’t students pay a fair interest rate and be required to repay loans under every circumstance?

It seems to me the estate tax is also a “profit” at least as egregious as student loans in the Warren mindset. This money was earned saved and already taxed several times. The liberal mind likes the broad brush approach to everything without consideration of the need or value to be achieved, everyone is simply entitled. A useless degree is the same as a professional women earning $100,000 a year receiving free contraceptives.

The current buzzword for this spending is “investment.” But student loans don’t distinguish between an education that might be an investment for our Country such as in the fields of science, technology, engineering and math (STEM) and the history of dance among the indigenous people of Bora Bora.

In addition, a recent article in the Washington Post illustrates the fog surrounding government accounting.

Under the mandated accounting approach, the federal government is estimated to gain $184 billion from issuing federal student loans between 2013 and 2023, CBO says. But under fair-market accounting, the government would lose $95 billion in the same period, though it would make a small “profit” in 2013.

In other words, that’s swing of nearly $280 billion depending on which accounting method you use.

The CBO’s spreadsheet, meanwhile, shows that the Stafford loan program in 2013, now pegged to earn $4.6 billion in “profit,” would actually lose $3.5 billion under fair-value accounting. Presumably those losses would climb sharply if interest rates were cut as Warren demands. (She would drop the rate to as low as 0.75 percent.)

Obviously, when so much money is at stake, people disagree vehemently over this issue. Adjusting the accounting rules potentially means less money in the budget for other programs.

The left-leaning Center for American Progress has labeled the fair-value concept as “dangerous,” saying it would create phantom budget deficits, because the current system already accounts for credit risk. Critics maintain also that the federal government is significantly different from private firms, with more tools at its disposal to recover defaulted debts. Indeed, in another report, CAP claims that, looking back over the past 20 years, nonemergency federal credit programs generally cost less than expected.

However, there is a larger issue beyond the cost of providing student loans. It is well accepted that the very existence of health insurance contributes to the cost of health care. Employers have been trimming benefits and raising cost sharing for years in an attempt to raise worker concern over health care costs. In other words, because they are insulated from the true costs, the average person does not care what health care costs. Add to that situation the highly emotional aspect of health care and you have the perfect storm.

When it comes to college education we are doing the same thing. In recent years college costs have risen faster than health care and have for decades outstripped inflation. Why, because of the fact somebody else is paying much of the bill plus the emotional component of parents wanting the best for their children and society’s assumption that a college education, regardless of the degree, is an investment. Colleges and universities have no incentive to be efficient, or to hold down their costs and the easier we make it to pay those prices and the more we insulate students from the costs, the less incentive there will be. If you know you can borrow a great deal of money at very low interest rates and then after a few years have the loan forgiven, do you really care what you paid or if you got your money’s worth?

Many years ago I took a college course on creative thinking (or some such thing). The first night the so-called professor entered the room and announced the only exam would be a final paper, the topic of which could be anything. He then proceeded for the following two sessions to write on the board examples of “anything” followed by weeks of watching a movie and him leaving the room. Not one student complained about this travesty (including me). Hey somebody else was paying and after all these were easy credits needed toward graduation. Repeat this or a similar scenario thousands of times in our education system and then tell me how much you want to pay for unrestricted student loans that often end up as grants.

As with health care, there is no transparency in what college costs. Each student pays something different. The published tuition is rarely what is actually paid. Colleges spend millions on buildings and other facilities unrelated to actual teaching to make themselves attractive to parents and students and nobody asks how all that adds to costs or improves the education. Again, just like health care where hospitals must add the latest technology and imaging centers pop up like Chinese take outs without regard to duplication or added costs.

Let’s just think this through and set added value targets before we start writing more blank checks that make our friends on the left feel good.