2013

The Affordable Care Act provides refundable and advanceable tax credits and cost sharing subsidies to eligible individuals enrolled through a health insurance exchange. Premium subsidies are available to families with incomes between 133-400% of the federal poverty level to purchase insurance through the Exchanges. Cost sharing subsidies are available to those with incomes up to 250% of the poverty level. The cost sharing subsidies apply to deductibles and co-payments.

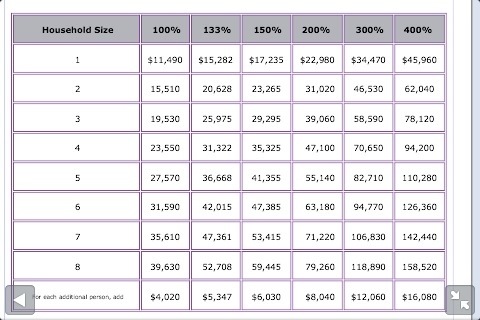

Below are current poverty levels and the multiples. For example, a family of two could earn up to $38,775 and be eligible for both tax credits and cost sharing subsidies.

2 comments