2013

I read this debt advice recently and was amazed, nay shocked, nay astounded.

Keep payments less than 25 percent to 33 percent of gross income. As a general guideline, if your debt payments are more than a fourth to a third of your income, you’re going beyond the safe limits of sound debt management. You might look at this as your personal “debt ceiling.”

Holy can’t sleep at night Batman.

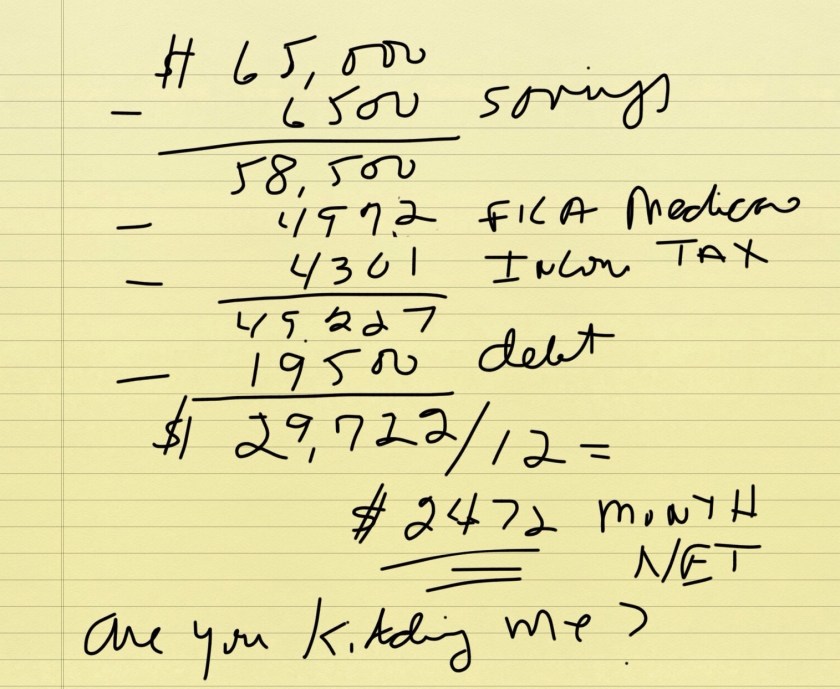

Let’s test this theory on a family earning $65,000 with one child; pretty average I believe. The family has total savings of 10% on a pre-tax basis which is the minimum desirable since we assume no additional savings of any kind. The debt service at 30% is $19,500 per year. The income tax is based on an IRS calculator assuming standard deductions.

Not included as part of expenses are state income taxes, property taxes or payroll deductions such a health insurance premiums which of, course, further reduce net disposable income before normal living expenses.

Could this family possibly carry 30% debt and survive even on a modest basis? Their actual net disposable income is considerably less than $2472 per month and that must pay for food, clothing, auto insurance and maintenance, out of pocket health care costs, etc.

I may be a bit old fashioned, but with this kind of advice no wonder American families get into trouble and can’t get ahead. What’s that you say, they need not save 10% of income? I disagree. Savings come first and affordable debt is a far second. To do otherwise is merely setting yourself up for far greater problems down the road. In this example the living standard should start with $58,500 not $65,000.

I may be a bit old fashioned, but with this kind of advice no wonder American families get into trouble and can’t get ahead. What’s that you say, they need not save 10% of income? I disagree. Savings come first and affordable debt is a far second. To do otherwise is merely setting yourself up for far greater problems down the road. In this example the living standard should start with $58,500 not $65,000.