Frequently when experts explain the supposed inequities of a system, in this case saving for retirement, they rely on an argument that suggests higher income individuals have an advantage well beyond the obvious which of course is they have a higher income and thus a greater ability to save.

The fact is that every form of saving supported by the Tax Code contains limitations on the benefits available to higher income people. Thereby limiting the benefits subsidized by taxpayers. For example, compensation in excess of $260,000 cannot be used to calculate a benefit. There are limits on the amount that can be saved as well; all designed to prevent a disproportionate amount of these tax- advantaged benefits going to highly paid individuals. That includes IRAs, 401k plans and traditional pension plans. You can see all those limits here.

Even Social Security skews benefits toward lower income individuals. For example:

Copied from the Social Security Quick Calculator

Born 1950 earns $40,000

For example, if you start taking benefits at age 64 and 1 month, you will receive $1,006 per month for the rest of your life. But if you wait until age 66 to start receiving benefits, you will get $1,189 for the rest of your life. So by waiting until age 66, you can then receive $183 more per month than if you started lower monthly benefits at 64 and 1 month. Remember, these estimated figures are in today’s dollars.

Income replacement ratio from Social Security equals: 35.67%

Born 1950 earns $117,000

For example, if you start taking benefits at age 64 and 1 month, you will receive $1,939 per month for the rest of your life. But if you wait until age 66 to start receiving benefits, you will get $2,271 for the rest of your life. So by waiting until age 66, you can then receive $332 more per month than if you started lower monthly benefits at 64 and 1 month. Remember, these estimated figures are in today’s dollars.

Income replacement ratio from Social Security equals: 23.29%

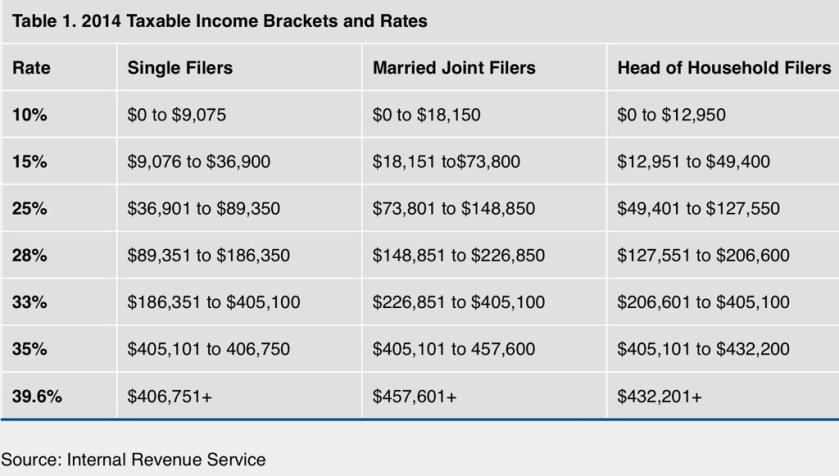

Many times articles like the one below argue that a tax benefit is greater for those in the highest tax brackets. Well duh‼️ yeah, if you temporarily delay paying 39% taxes on $1.00 you would otherwise pay taxes on you save thirty-nine cents and if your tax bracket is 10% you save a dime although in that bracket (see below) you are likely not saving anything – another anomaly in the traditional argument.

But we also tend to lose sight of the fact that really high income people have little interest in 401k pension plans and such. Why, because first they are limited in what they can save making it less worthwhile, but mostly because when the money is withdrawn, it is taxed as ordinary income and they are right back at that 39% we are worried about. Capital gains and dividends are generally taxed at lower rates and some bonds are tax-free.

SANTA MONICA, Calif. — ONE compelling way to turn the ongoing national discussion on wealth inequality into a tangible policy to help Americans increase their wealth and savings would be to fix what I have long called our “upside-down” tax incentive system for retirement savings. In its current form, it makes higher-income Americans triple winners and people earning less money triple losers.

How so? First, the federal government’s use of tax deductibility to encourage savings turns our progressive structure for taxing income into a regressive one: While earners in the highest income bracket get a 39.6 percent deduction for savings, the hardest-pressed workers, those in the lowest tax bracket, get only a 10 percent deduction for every dollar they manage to put away.

[And when the savings and earnings are withdrawn, the opposite is true]

Second, while less than 1 percent of lower- and moderate-income Americans can put aside enough to fully “max out” their benefits on I.R.A. contributions, higher-income Americans can maximize their return on savings by sampling from a menu of tax-preferred savings options. A business owner could theoretically benefit from a 401(k), a SEP I.R.A. of up to $52,000 and a state-based 529 program that allows tax-free savings for college education.

[Again stating the obvious, if you have more money you can save more money. Isn’t the key finding a way to earn more, to get a better job? Anyone can benefit from a 529 plan which is after-tax savings and is limited by the gift tax rules]

Finally, a far larger share of upper-income Americans get matching incentives for savings from their employers. Members of Congress and the White House staff, for example, get an 80 percent match for saving 5 percent of their income. But while half of Americans earning more than $100,000 get an employer match, only 4 percent of those earning under $30,000 and less than 2 percent of those making under $20,000 get any employer match for saving.

[Upper income has little to do with getting a 401k match, but rather where you work is the key. Lower income can actually benefit more because contributions are limited by law in several ways for higher income workers]

Here is a fact; if you earn $30,000 or less a year during your working life, when you retire, chances are you are going to rely mostly on Social Security and you will be poor, poorer than you were before retiring. That should come as no surprise to anyone. So, the real question is what are you going to do about it during your forty or so working years? What needs to change before people reach age 65?