All the following may not mean much to the average person, but it should because whether you work for one of these large employers or any other employer, these costs will be borne mostly by you. It may come from higher payroll deductions for premiums, from higher out-of-pocket costs or lower wages in the future; most likely all three.

Don’t believe me? Check out this report.

No employer is going to pay the so-called Cadillac tax on high-cost health plans; instead they are going to be sure the value of the plan does not exceed the limits under the law. That means those excess costs will be shifted to workers for the most part.

The Cost of the Patient Protection and Affordable Care Act (PPACA) to Large Employers. From Conner, Strong and Buckelew

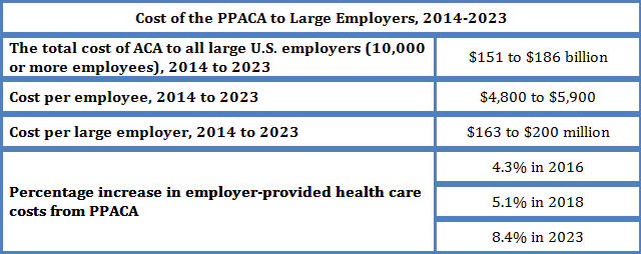

According to a new report by the American Health Policy Institute, the total cost of the Patient Protection and Affordable Care Act (PPACA) across all large U.S. employers (companies with 10,000 or more employees) over the next 10 years is estimated to be between $151 billion to $186 billion or $4,800 to $5,900 per employee. This further translates to between $163 million to $200 million per employer (Table). This is an additional cost over and above projected employer healthcare cost trends without the PPACA.

According to the report, the PPACA is estimated to increase the healthcare costs for large employers by 4.3% in 2016, 5.1% in 2018, and by 8.4% in 2023, with the increase primarily due to the high-cost excise tax that begins in 2018. For just the 31 large employers (those with 10,000 or more employees) that responded to their survey and provided cost estimates through 2023, the total cost of the PPACA over the next 10 years could be as much as $10.5 billion unless changes are made to their healthcare plans. This averages out to about $338.1 million per company that responded to the survey over 10 years.via The Cost of the Patient Protection and Affordable Care Act (PPACA) to Large Employers.