More than half the U.S. population and nearly 70% of employed adults have health insurance through their employer. Those are big numbers. Do you have any idea what that insurance costs? If you are like most people, you may see the cost as the amount taken from your pay for your share of the premium. That may be your cost, but it is not the cost. Even if your employer is self-insured as are most large employers, the cost of your health benefits is far different from your payroll deduction.

And remember, premiums paid on your behalf by your employer are tax-free to you (for now at least). Think how much more income you would need to pay the full cost of coverage with after-tax dollars. (and don’t forget, many of you are even paying your share of the premium with pre-tax dollars).

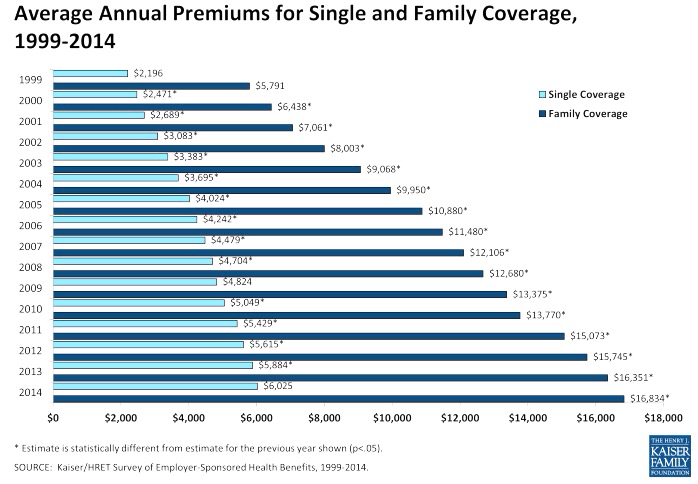

Following is a chart showing average total costs for employer-based health care coverage; realize those numbers go up each year, generally at twice or more the rate of the CPI. For example, $100 in 1980 would be $287.35 using the CPI, but if you use medical-cost inflation, that $100 becomes $581.16 in 2014.