Now what?

If you have been prudent (and maybe lucky), having a good 401k and or IRA balance means you have gotten half way to a secure retirement.

Now, as you get closer to retirement, your job will be to plan the best way to use the money you have accumulated.

Keep in mind that whopping balance in your plan has not been taxed, but will be at ordinary income rates, not capital gain rates (unless it was a tax-free Roth plan). So, depending on how you use the money and your other income such as Social Security, 20% to 30% will disappear to the government.

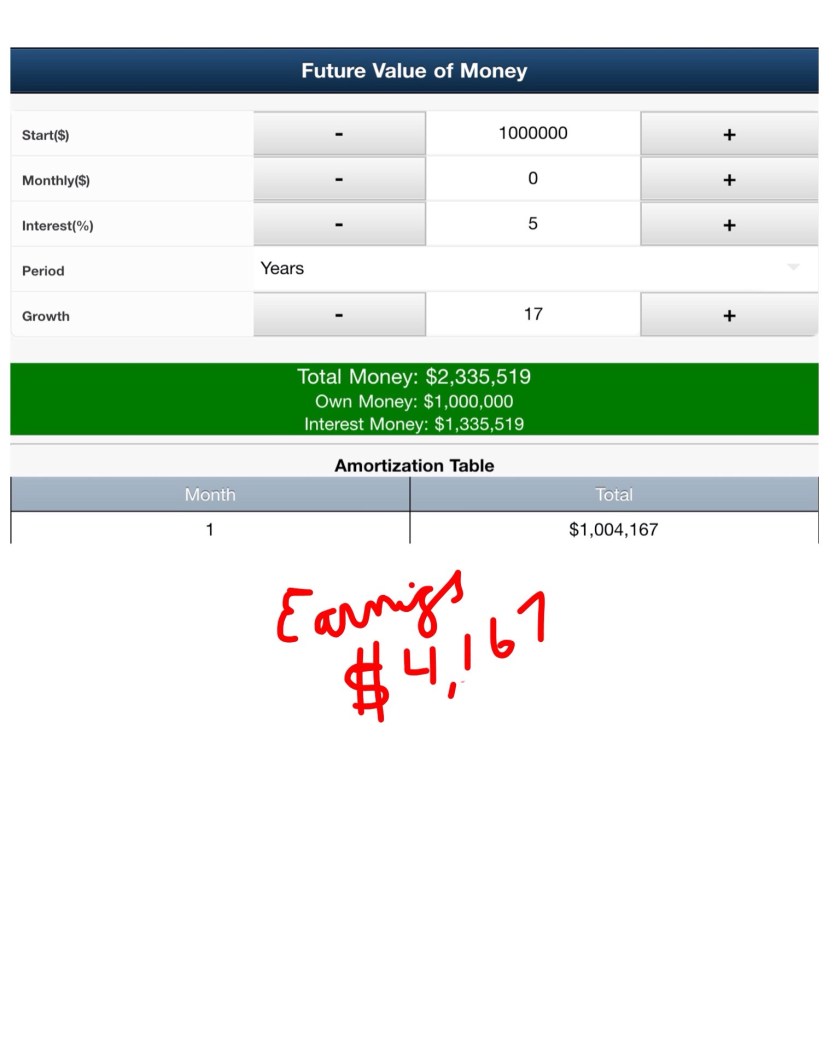

Now, estimate how long the money will have to last over your and possibly a spouses life time. If you are 65 when you start using the money, on average that money will be needed for at least seventeen years with a good chance much longer.

How much do you believe your balance will grow over the years while you are using it? This is important because you want to balance your withdrawals and earnings so you do not run out of money and are able to keep up with inflation. For example, if you assume $1,000,000 will grow at a steady 5% annually, you can withdraw about $4,000 a month and not exhaust your funds while still seeing a small increase in your savings.

Should you take all or part of your account and buy an annuity? There are pros and cons to this.

One thing you don’t want to do is take a large sum out of your savings early in your retirement.

In any case, it’s up to you, but whatever you decide, have a plan in place before you retire.