Well no it didn’t, although many Americans like to believe that myth. What is true is that the tremendous liabilities accumulated by Social Security are stealing the future from younger Americans.

Fact: Social Security trusts are running out of money. There are two main reasons. Too few working Americans contributing relative to those collecting benefits and low interest payments made on the Treasury bonds held by the trust. Of course, an implied factor is that, in total, the benefits provided by the system (retirement, survivor, disability, etc.) are too generous for the revenue generated.

Sen Bernie Sanders and others on the left like to perpetuate the myth that Social Security has nothing to do with deficits or debt. The fact is that interest paid on Social Security bonds (and ultimately redeeming these bonds to pay benefits) is a major expense to government.

By 2021, the government will be spending more on interest than on all national defense. according to White House forecasts. And one year later, interest costs will exceed nondefense discretionary spending–essentially every other domestic and international government program funded annually through congressional appropriations. (The largest part of the budget is, and will remain, the mandatory spending programs of Social Security, Medicare and Medicaid. Mandatory spending is over $2 trillion and is set to double to $4 trillion by 2025.) Wall Street Journal

Now we come to the two-edged sword. Low interest rates are robbing the Trusts of vital income needed for benefits. Increase interest rates and the revenue to the Social Security trusts increases … and the spending on interest costs increases for the federal government. Got it Bernie⁉️ You simply can’t look at one side of this problem and make glib statements about the entire problem as our politicians like to do … and as is too often accepted on face value by under-informed voters. Higher interest payments mean growing deficits and debt or robbing younger citizens of government services …. or higher taxes … and not just on the wealthy.

But while this [changing demographics; fewer Americans paying into Social Security relative to the number collecting benefits] is the biggest threat to the primary Social Security trust fund, it isn’t the only one. In fact, the decades-long decline in interest rates is almost just as important.

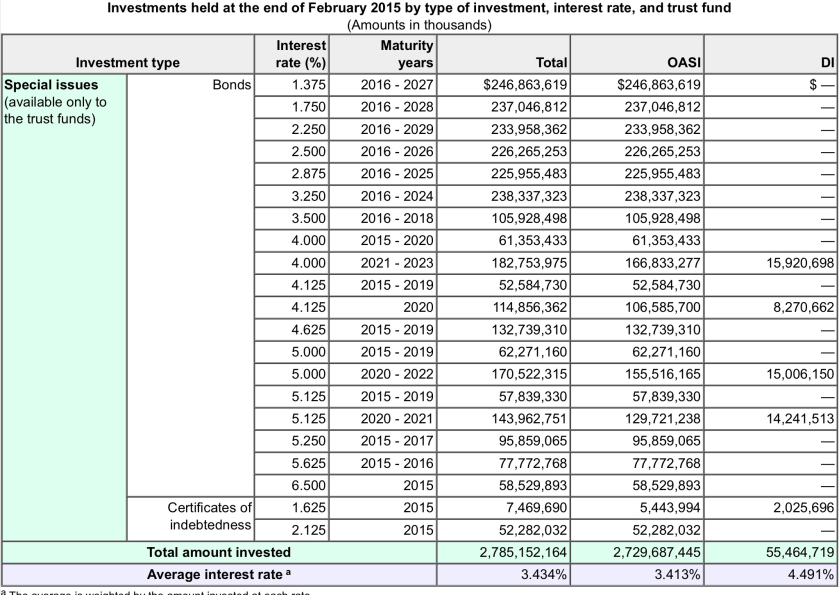

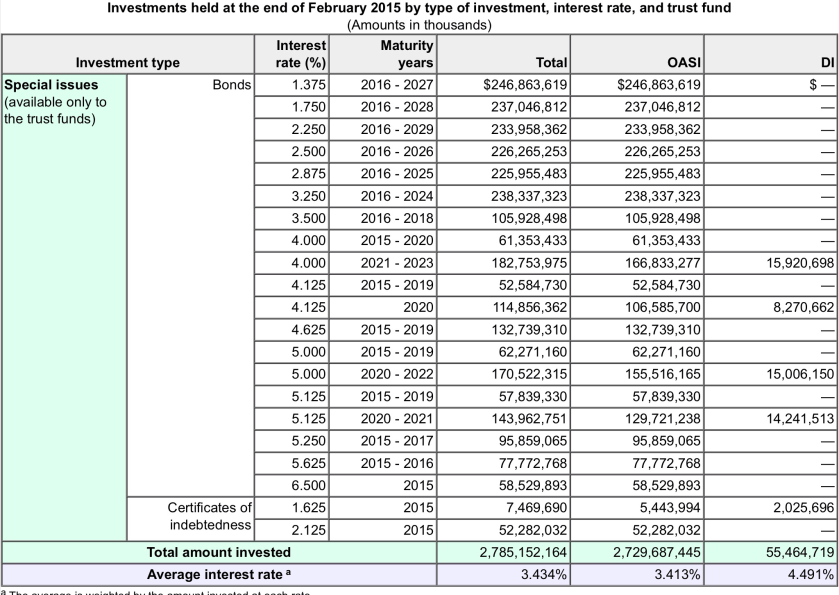

Money in the Social Security trust fund is invested in two types of fixed-income securities. The first are short-term “certificates of indebtedness” that range in duration from one to 364 days. The second are long-term “special-issue bonds,” with a maturity of one to 15 years. At the end of 2014, for example, the trust fund held $57 billion worth of certificates of indebtedness and $2.67 trillion worth of special-issue bonds.

The problem is that the income from these investments is tied to interest rates, and interest rates have been on a decades-long descent since the double-digit inflation of the late 1970s and early 1980s.

In 1990, the Social Security retirement fund earned 9.02% on its portfolio. By the end of last year, it earned only 3.41%.

The problem is that the income from these investments is tied to interest rates, and interest rates have been on a decades-long descent since the double-digit inflation of the late 1970s and early 1980s.

In 1990, the Social Security retirement fund earned 9.02% on its portfolio. By the end of last year, it earned only 3.41%.To put that in perspective, at 3.41%, the trust fund’s $2.73 trillion in assets generate $93 billion in income; at 9.02%, it would earn $246 billion. In other words, the decline in interest rates since 1990 alone is currently costing the fund $153 billion per year in forgone income.

The net result is that the Social Security system is indeed in a perilous situation. That doesn’t mean you can’t rely on it past the year 2034, as the political pressure to come up with a solution will be powerful. But it does mean that there will be changes, some of which could decrease the average size of benefit checks in the future. John Maxfield, The Motley Fool, March 21, 2015

Our poor children and children’s children … they will have to bear the burden of paying down the debt. I assume some ‘needs based’ pro-ration factor will be imposed in the future so those that pull the cart pay for the 51% that are in the cart can vote (oops – I mean can continue to receive their entitlements). What options … delay social security benefits to 66 from 62, provide unemployment benefits for only a defined period of time, move all entitlement benefits management to the state, implement flat rate tax (fat chance – Congress is lawyers and accountants), allow tax free holiday for businesses to bring in foreign held assets without taxation for investing in jobs.

LikeLike