In a previous post I attempted to illustrate that Medicare beneficiaries had a good deal often collecting far more in benefits over a lifetime than they paid in taxes and premiums. Several comments disagreed with my calculations and upon reflection I admit I used overly inflated assumptions.

So I went back and took another look. For example, the weighted average Medicare payroll tax is 1.244%; I used 1.3%. I used a salary of $50,000, but failed to consider that pay of $50,000 in 2015 would have been $11,400 in 1975 assuming increases equal to the CPI thus I overstated the workers payroll taxes.

Starting with the $11,400 pay I calculated an average pay since 1975 of about $29,193 per year which leads to total payroll taxes paid of about $14,526 over forty-years. This is about $2,000 more than the average benefit paid every year😨

Here are some facts to consider and you can decide if the average beneficiary receives more in benefits over their life than they paid in taxes and premiums. Clearly the oldest beneficiaries received the best deal, but even at today’s rates and still growing health care costs, future beneficiaries are in good shape… not so for Medicare.

In 2014 the average benefit paid by Medicare was $12,432, an average for one year. Based on a 17 year life expectancy at age 65 that’s an average total benefit of $211,344 without accounting for future health care inflation. (I know, really sick people may not live 17 years, but they also probably spend more than the average as well).

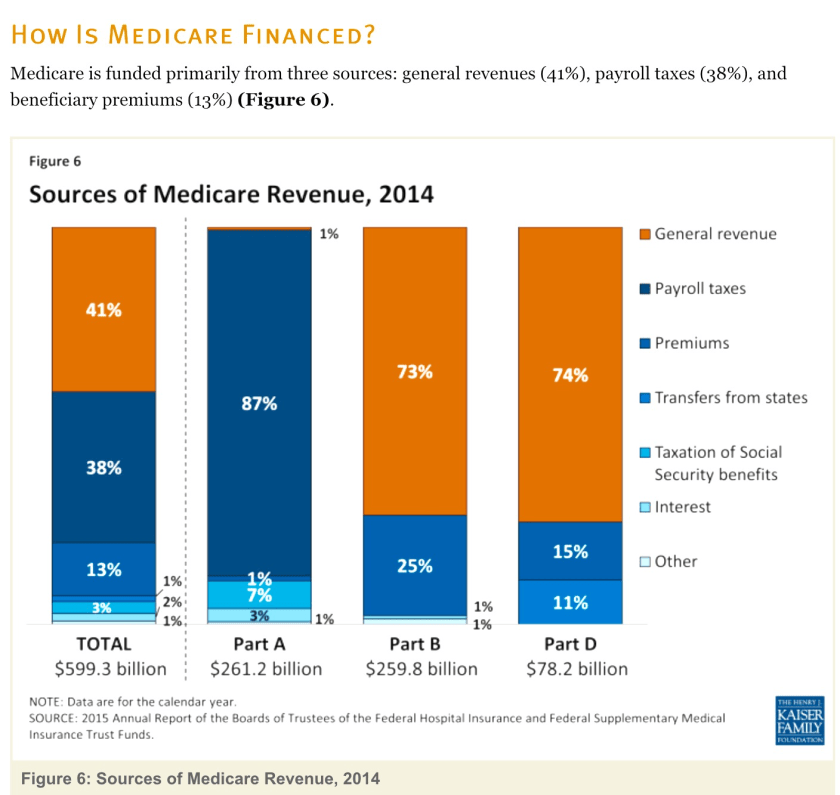

Medicare spent $613 billion in 2014 and 41% of that amount came not from payroll taxes and premiums, but from the federal government’s general revenue.

So, 53.5 million Medicare beneficiaries spent more on health care than all the payroll taxes paid by 144,401,000 working Americans and their employers plus all the Medicare premiums.

Here are some real numbers for you. Don’t ask me why but I have every W-2 since starting work in high school in 1977. I have every W-2 that my wife has received since 1986. Together we have paid $39,412.24 in our portion of the Medicare taxes for the records I have going back to 1977. Our adjusted gross combine income broke $50k in 1990, and broke $100k in 2001, crossed $125k in 2004. We are not on Medicare and are probability richer than the average worker so our taxes should be higher. I do not know what our real doctor visits (5 total for 2015) cost since what is bill and what is paid is often seems like pennies on the dollar. I do know that my total drug cost billed to my prescription plan for 2015 will be $12,881.32 and will be actually paid that amount between the plan and my co-payment. Just on the drugs alone I would say that I will out spend what I put into the fund in about 4-5 years and all this without any hospital stays.

According to our Social Security Statements (available online from SSA) the estimated Medicare taxes that we paid was $42,755 and was slightly more than my records indicate. The employer match basically doubles that figure to $85,510. Which means after about 6.6 years at todays drug prices I would have spend more than I have put in without additional doctor or hospital visits.

LikeLike

Wow, very interesting real life story.

LikeLike