Progressive rhetoric about taxes is misleading, inflammatory and unfair. “Fair share” is a rallying cry designed only to garner support for a greater bureaucracy, more wealth transfer and greater public dependence on larger government and the politicians who control it.

If that sounds a bit radical; sorry, but that is what’s happening to America.

Mr. Buffett said Monday that he earned adjusted gross income of $11.6 million in 2015 and paid $1.8 million in federal income tax. He said his income was offset by $5.5 million in deductions, which included $3.5 million in charitable donations and almost all of the rest in state income taxes.

The size of the charitable deduction was limited by law, Mr. Buffett said, even though he donated a total of $2.86 billion last year…

Tax specialists said Mr. Buffett’s 2015 income was low relative to his net worth, which Forbes recently pegged at $65.2 billion. The numbers help show how wealthy Americans who earn money from investments can end up paying taxes at lower rates than people who rely on wages.

“It’s less than 0.02% of his wealth,” says Roberton Williams, a tax expert at the nonpartisan Tax Policy Center in Washington. “Almost all of his income is in unrealized capital gains, which aren’t taxed until he sells assets.”

Mr. Buffett’s effective tax rate was 16%, less than half the 34% rate paid by Bill and Hillary Clinton on their 2015 income of $10.6 million.

“Every share of Mr. Buffett’s Berkshire Hathaway stock has been pledged to philanthropy. None will ever be sold by him, so he will never receive anything from Berkshire except for his $100,000 a year salary,” said Mr. Buffett’s assistant.

Excerpt: Wall Street Journal 10-11-16

So what?

Of what relevance is the fact “It’s less than 0.02% of his wealth?” Buffett’s wealth is in Berkshire Hathaway stock and like every other person and entity holding stock, you can’t spend it unless you sell the stock and you only make money if the stock you sell is worth more than when you bought it.

“Almost all of his income is in unrealized capital gains, which aren’t taxed until he sells assets.” Guess what unrealized means? It means “not made real or actual; not resulting in accomplishment” So, Buffett’s capital gains are not yet real and could be considerably lower than they are now or conceivably they could eventually be non-existent. So the fact is, it is not his income at all and yet, the words used in the article create the impression that this “income” is not being taxed. Would you like to pay income tax of any kind on the increased value of your home even while you have no plans to sell your home?

“Almost all of his income is in unrealized capital gains, which aren’t taxed until he sells assets.” Guess what unrealized means? It means “not made real or actual; not resulting in accomplishment” So, Buffett’s capital gains are not yet real and could be considerably lower than they are now or conceivably they could eventually be non-existent. So the fact is, it is not his income at all and yet, the words used in the article create the impression that this “income” is not being taxed. Would you like to pay income tax of any kind on the increased value of your home even while you have no plans to sell your home?

What makes more sense; for the Buffett’s to give billions directly to charity and pay less in taxes or to give billions more to the bureaucracy of the federal government? If you believe the later, it’s time to stop reading.

The article fails to make the strong point that Buffett gave away 4.4% of his total net worth in one year.

Warren Buffett’s income other than a meager salary, is from dividends and interest outside of Berkshire Hathaway which does not pay dividends. Every American who earns dividends from stocks pays a lower tax rate on those payments then on salary and wages. If you earn it from municipal bonds, you pay no taxes. The only difference between Buffett and the rest of us is the $$$ involved … and the fact he is far wiser than most of us.

Very average people can (and probably should) build a portfolio that over time generates income from interest and dividends. That income can provide a steady income stream in retirement at lower or even no tax rates. The fact that the amount of income or wealth involved will differ vastly from the Buffetts of the world is irrelevant in my mind.

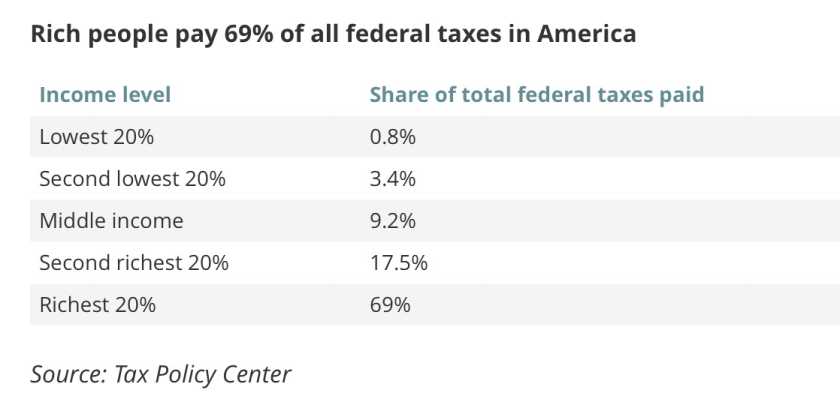

The idea that higher income Americans don’t pay their fair share is media and political hype. Even if you include all taxes beyond income taxes, higher income American pay the lions share of all taxes.

What is unfair, however, is that the income from a 401(k) plan or IRA, etc. is taxed as ordinary income and not investment income. Many middle-class Americans forced to take a minimum distribution would benefit from taxing the earnings portion of the distributions not as ordinary income, but the same as capital gains and dividends, which it actually is.

But you see, the progressive elite view this not as a benefit for more average Americans, but as a loss of revenue they can control and distribute according to their priorities, not yours.

Remember as you read the following. You only need a family income of about $111,000 to break into the top 20%. In many parts of the US that can include the income of a couple of teachers, or police officers or government workers. Are they the “rich people?”

I am betting that $1m of Mr. Buffett’s donations have more of a direct impact to the receivers of said donations whether they are employed by a local museum or a woman in a shelter than $100m spent by the federal government. I believe in this sense he helps save other taxpayers money.

Even Mr. Buffett realizes that he doesn’t pay a fair share compared to his secretary, it not the amount but the percentage of the tax that is not fair. This is another case for a flat income tax where everybody pays the same percentage and based on real income, not total assets.

But I like your thinking. Imagine if your income tax was based on your assets. It would be fun to watch all those people sell their McManson homes not because of the property taxes but because of the income taxes. It doesn’t matter that they still own $400k on the house, but it is their unrealized wealth that caused them to sell. See how fast they will yell that they want to be unequal and keep their unfair share.

LikeLike