All of the following applies to any individual who is running for president. It should be demanded most from anyone prone to platitudes, misinformation, simplistic unworkable solutions, ideas without consideration of long and short-term consequences and demonstrated ignorance of economic and global issues.

Before you decide who to support, who to vote for to run your country and represent the American society to the world, arm yourself with the facts, accept that the best answer for our country may not be the best answer for you.

Be careful of your sources, look both left, right and middle for information. Look to primary independent data for facts.

Don’t let yourself be manipulated🥲

US Budget Watch 2024 is a project of the nonpartisan Committee for a Responsible Federal Budget designed to educate the public on the fiscal impact of presidential candidates’ proposals and platforms. Through the election, we will issue policy explainers, fact checks, budget scores, and other analyses. We do not support or oppose any candidate for public office.

The winner of the 2024 presidential election will lead a country facing numerous fiscal and economic challenges. As it stands, the national debt will approach a new record high, interest costs will continue to skyrocket, vital trust fund programs will approach insolvency, and several costly tax and spending provisions will expire.

Presidential campaigns present an opportunity for candidates to educate the public about challenges facing the nation and to offer solutions to address them. Candidates often use campaigns to introduce new policy proposals and promise new spending or tax changes; some of these proposals would make the fiscal situation better, but many would make it worse. Unfortunately, candidates also often use the campaign trail to attack efforts to improve fiscal sustainability.

Voters should insist that presidential candidates run fiscally responsible campaigns. However, it is often difficult to determine exactly what a candidate is promising, the price tag of various components, and whether their overall platform is fiscally responsible or not.

In our view, fiscally responsible candidates and campaigns should:

- Be Honest about the Fiscal Problems Facing the Country

- Make Deficit Reduction a Top Priority

- Put Forward Proposals to Reduce Debt and Pay for New Initiatives

- Refrain from Taking Solutions Off the Table

- Have a Plan to Deal with the Looming Insolvency of Major Trust Funds

- Propose Solutions to Address Major Expiring Provisions

- Use Honest Numbers and Refrain from Perpetuating Budget Myths

By adhering to these principles on the campaign trail, presidential candidates can avoid making costly over-promises and establish a mandate for reform.

Source:

Remember, the issues are global, it’s not just about America. We can’t succeed alone, we can’t stand alone or have the standard of living we seek alone.

You can’t handle the data.

Ramaswami: “The nuclear family is the best form of governance known to mankind*, not the state. 25% of kids in America & over 70% of black kids don’t have a dad in the house.”

According to …everyone… the U.S. has the highest rate of single parent households. That’s data. That’s facts. That’s the truth.

Everything else he says is opinion. Or lies…

“One of BLM’s self-stated goals was to tear down the nuclear family structure.”

Not true.

There is other interesting data, and I frankly don’t know the causal relationships.

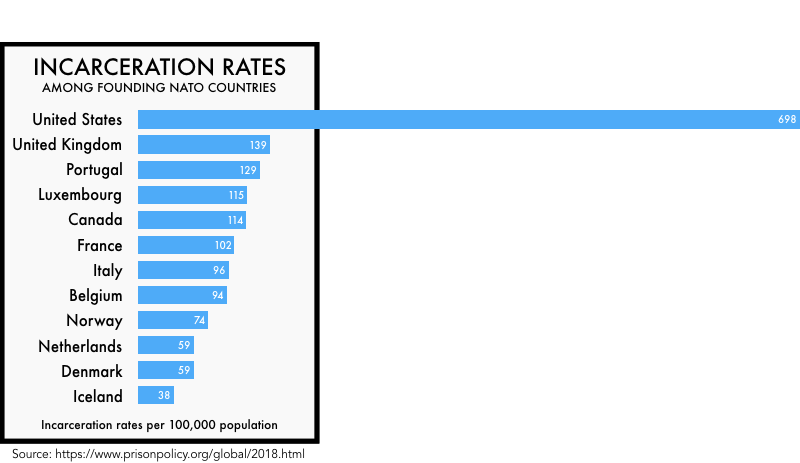

My favorite, because it is literally off the charts…

90 percent of those incarcerated are men, and a vastly disproportionate number are blacks.

Is that a cause or effect?

Data and truth only get you so far. And those are just a few of the independent variables. Maybe your AI can figure it out.

* I don’t know that we can safely assume that, either, just because it’s what most of us grew up with.

LikeLike

RE: Donut Hole

Dick – I remember some time back you had a discussion about entering the donut hole and a re-imbursement.

I am a PSEG Power retiree (technical / professional non-union) whose wife entered the donut hole and just got a prescription of 8 pills for $256. I could request re-imbursement through VIA but I am sure that you have a better way.

Appreciate any suggestions and help

Dave

From: David Just; Address: 9256 Penelope Dr.; Weeki Wachee FL 34613-4007

Email: DaveJust99@Hotmail.comDaveJust99@Hotmail.com; Cell / Text: (352) 584-9696; Home: (352) 597-0345

LikeLike

I’ve seen websites advertise that they are the real, unbiased source of facts, but…

How do you know?

And even if the facts are true and unbiased, how do you understand them in context?

There are reliable sources saying the U.S. has the seventh highest GDP per capita. (Highest of any high population country,Monaco and Switzerland are outliers.)

There are also reliable sources that say the U.S. has the highest poverty rate of any major country.

If you only heard one and not the other, how does that affect your economic outlook?

If you heard …and believe… both “facts”, what does that mean?

LikeLike

I try to evaluate the facts from at least three different sources including at least one primary source, if possible. No guarantee of course, but it helps.

LikeLike

According to the Bureau of Labor Statistics, June 2023…

Quote 1. “Total employer compensation costs for private industry workers averaged $40.79 per hour worked in March 2023. Wages and salaries averaged $28.76 per hour worked and accounted for 70.5 percent of employer costs, while benefit costs averaged $12.02 per hour worked and accounted for the remaining 29.5 percent.”

Quote 2. “State and local government worker compensation costs for employers averaged $58.08 per hour worked in March 2023. Wages and salaries averaged $35.89 and accounted for 61.8 percent of employer costs, while benefit costs averaged $22.19 and accounted for 38.2 percent.”

……………………..

According to the same publication, private industry workers in establishments of 500 or more workers averaged $58.97 per hour. Wages and salaries averaged $38.59 and accounted for 65.4 percent of employer costs, while benefit costs averaged $20.39 and accounted for 34.6 percent. (Table 6, p. 16)

The first two quotes are boilerplate on page 1, above the fold, and show substantial public sector pay advantage. On page 3 is the boilerplate caveat:

“Comparisons: Compensation cost levels in state and local government should not be directly compared with levels in private industry. Differences between these sectors stem from factors such as variation in work activities and occupational structures.”

By making the proper, IMHO, comparison (since most governments are over 500 employees) we find that public workers, on average, earn about the same total compensation as private workers, but receive lower wages and higher benefits (pension and healthcare) Also note on average that private sector workers in large establishments receive more paid time off than public workers.

Facts, data, truth, can be very deceiving, sometimes unintentionally, sometimes not.

LikeLike