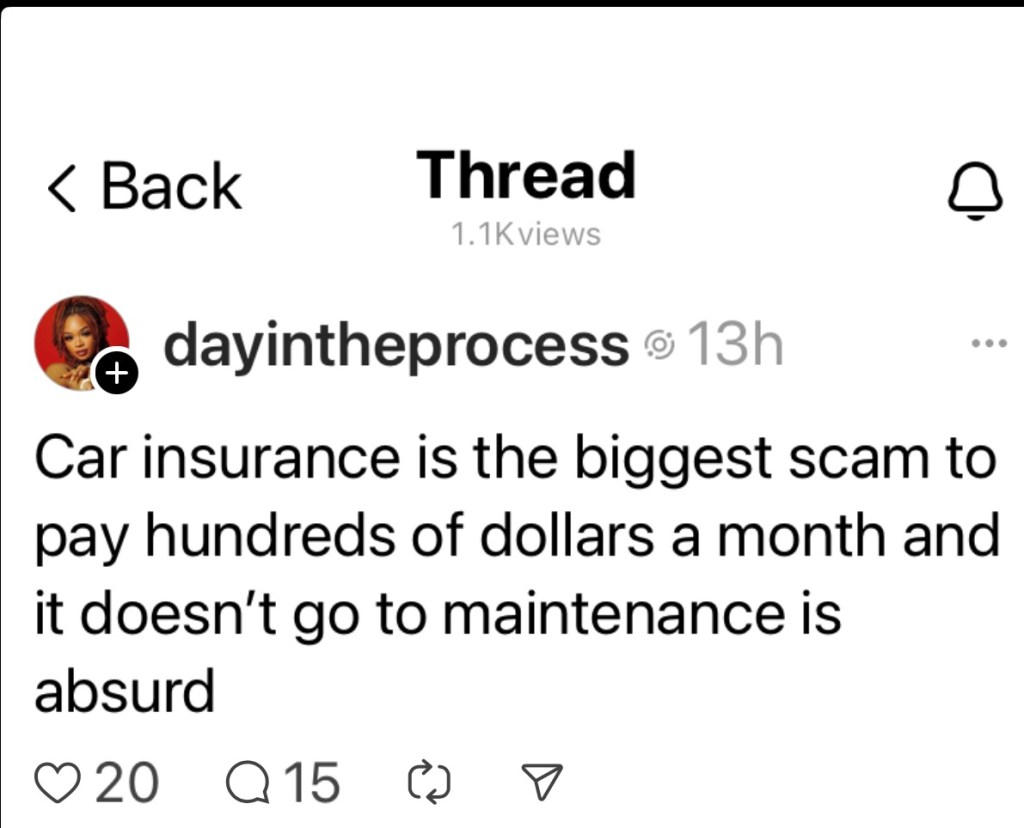

Here is a person who apparently does not. There are many more like her, especially when it comes to health insurance.

Many people don’t seem to make the connection between the coverage and the premiums that fund the coverage.

If insurance reimbursed for minor, predictable expenses, it would not be insurance or affordable to anyone.

Insurance is a risk management financial contract between an insurer and an insured.

The primary purpose of insurance is to transfer the financial risk of potential loss to an insurer in exchange for a premium.

Key Functions of Insurance:

- Risk mitigation: Protects individuals and businesses from the financial consequences of unforeseen events such as accidents, illnesses, or property damage.

- Financial security: Provides a safety net to help recover from significant losses without depleting personal savings or assets.

- Compliance: In many cases, insurance is required by law (e.g., auto, homeowners, workers’ compensation).

By pooling risks from numerous individuals, insurance companies can effectively manage and distribute potential losses.

when you let illegals obtain a driver’s license the chance they will drive a vehicle uninsured is pretty high–you better have uninsured motorist coverage–there are lots of these “unintended consequences” floating around–if the loons on the left (Harris/Waltz) get in it will be “Katie bar the door”.

Whatever happened to the “threat to democracy” the lefties told us about?? the coup they pulled off was pretty good–disenfranchised what was it 14 million voters in their primary–and to think the demented one ran circles around these folks in private–so they told us.

LikeLike

….and people with this level of intelligence get to vote!

LikeLike

What you say is true from a consumer point of view. But the primary purpose from the insurance company point of view is to make money in providing the insurance.

LikeLike

Not exactly true since there are plenty of mutual insurance companies (i.e. State Farm, Liberty Mutual, etc.) that are owned by their policyholders. Their primary goal isn’t to make a profit like publicly traded insurance companies.

Either way – they are filling a customer need. You wouldn’t be able to get a mortgage or auto loan without insurance to minimize the risk to the lender.

LikeLike

Maintenance ? You just can’t cure stupid.

LikeLike

expect Kamala to solve the fact that for the past three decades, and worse today, between 15 and 20+% of all drivers are uninsured or underinsured. You are already if paying for that in your insurance premium – just check.

it is part of the reason we got the term “free rider” in health reform.

she will find a way for it to be an entitlement and have taxpayers subsidize it.

or not – and blame Republicans, and Trump especially.

LikeLike

What you say is true. My insurance problem is that it is increasingly becoming a major expense and that will lead to more uninsured drivers on the road and that will cause premiums to go even higher. My premiums were lower as a result of no daily commute to work and lower annual mileage. The premium cost then reversed to an Increasing upward spiral and I’m paying more than ever and driving fewer miles. I know all the rationale given for the increase but it seems to be excessive.

LikeLike