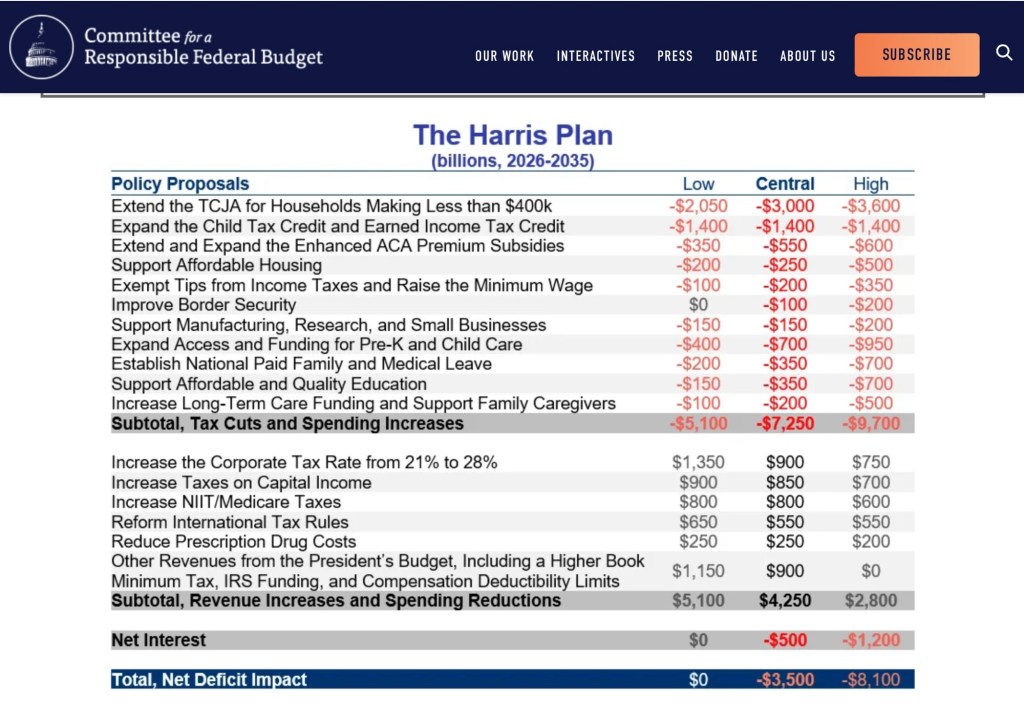

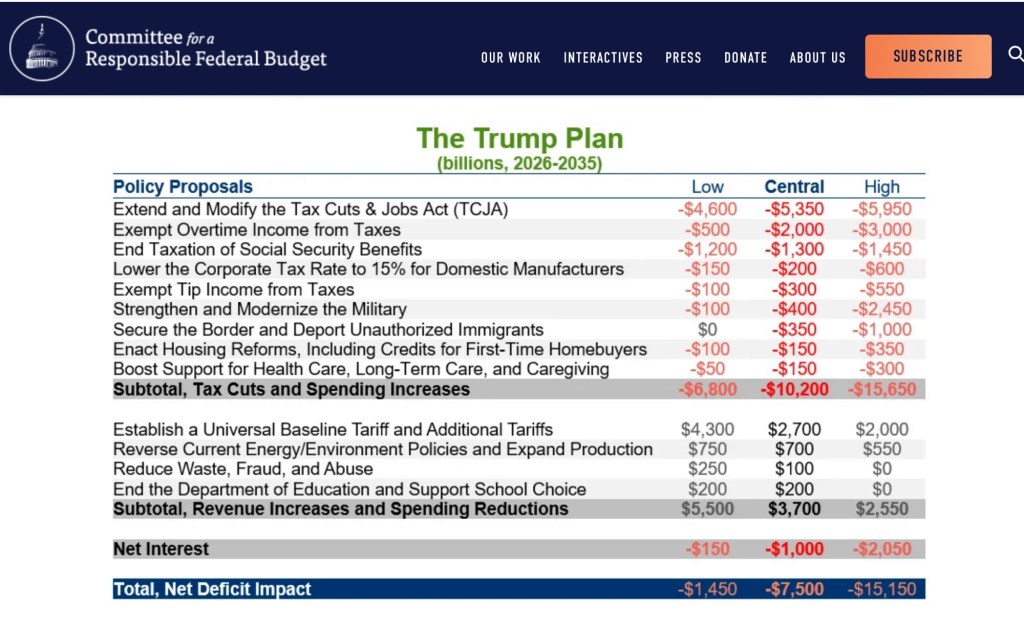

The following estimates were prepared by the Committee for a Responsible Federal Budget.

We need to look beyond the numbers and consider the consequences of these changes and how they may motivate behavior change.

Federal debt can be necessary and at times helpful, but not during these times.

Interest payments: High debt levels can lead to increased interest payments, which can strain government budgets and reduce spending on other priorities.

Economic growth: Excessive debt can hinder economic growth by crowding out private investment.

Debt default: If a government fails to meet its debt obligations, it can lead to financial instability and economic crisis.

Intergenerational equity: Large debts can place a burden on future generations, who may have to pay for the spending decisions of their predecessors.

Also consider that Japan and China are the two largest countries we are indebted to. And one of them is the target for large tariffs. China buys our debt in part to allow the US to import more Chinese goods.

Agree with your analysis. Raising taxes will slow growth and exacerbate the problem. Cut spending would help but it seems that is a major problem.

Growth of the economy could be the magic elixir but even that might not be enough.

LikeLike