Yup tariffs do matter, do raise prices, perhaps limit your choices. Whether they trigger inflation is not that simple and depends in part on the actions of domestic producers.

If you are willing to pay more for a foreign product, domestic producers of a similar product will have little reason to charge less … and off we go.

Coffee is largely imported because there are only a handful of places in the U.S. where the beans can be grown – Hawaii and Puerto Rico.

About 80% of unroasted coffee imports are sourced from Latin America, primarily from Brazil, to the U.S. Department of Agriculture.

Products from Brazil that are shipped to the U.S. now face a 50% tariff. As a result, U.S. consumers in August paid 21% more for beans than a year earlier.

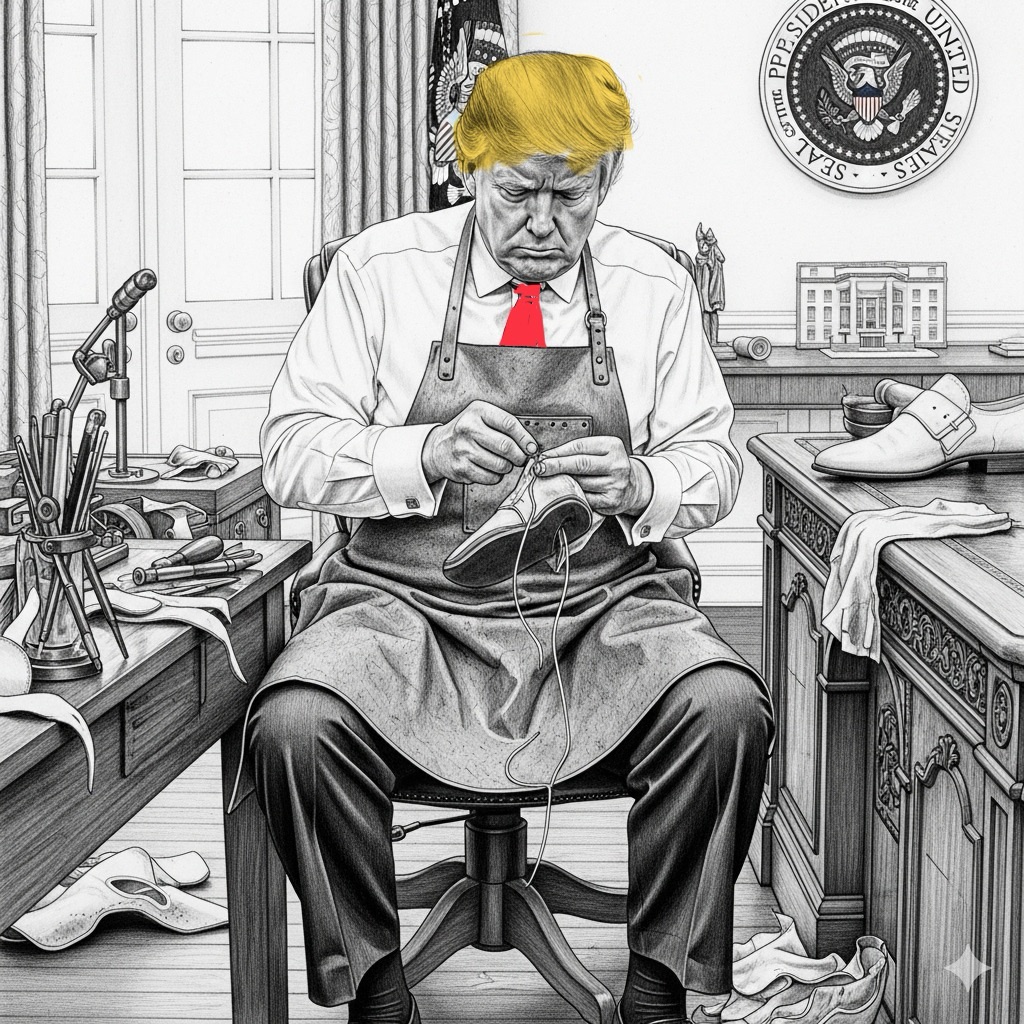

According to the American Apparel & Footwear Association (AAFA), about 97% of the clothes and shoes purchased in the U.S. are imported (virtually 100% of shoes)

Specific Impact on Shoes and Clothing

• Tariff Rates by Country (as of September 2025, stacked on existing duties):

• China: 54% effective rate (34% new + prior 20%). This is the highest due to ongoing trade tensions; further hikes possible in November.

• Vietnam: 46% (major source for brands like Nike, which produces 50% of its shoes there).

• Cambodia: 49%.

• Bangladesh: 37% (key for affordable clothing).

• Indonesia: 32% (27% of Nike’s production).

• Other Countries: Baseline 10% for most (e.g., EU at around 10–25%, UK lower due to deal), but up to 44% for some like Sri Lanka.

• Overall Average: U.S. import tariffs on apparel rose from 14.5% in 2024 to 30.6% in 2025, per University of Delaware calculations. For footwear, averages jumped from 11.9% to 44.2–69.1% under proposed scenarios, though actuals are closer to 30–50% after adjustments.

• Examples:

• A $90 pair of athletic shoes from Vietnam could see an added $20–40 in duties, pushing retail prices to $106–$116 (18–29% increase).

• Clothing like a sweater or tracksuit from China/Bangladesh faces similar hikes, with wool/silk goods up 10–20%.

I do like coffee and I admit that I have stock pilled a few bags of beans. However, I have probably overreacted; President Trump has assured us that “foreigners” will pay the full cost of tariffs.

I remember the inflationary shock of the 1970s; utility rates and the price of gasoline soared. I wonder why consumers were so angry then about price increases and are so complacent now? Oh, I forgot, “liberated” imports are assessed a 40 or 50% duty (tariff), the price US consumers pay will not increase one bit. And the president has further assured us the “groceries are way down”, so nothing to see here, kindly move on.

Maybe President Trump’s “Liberation Economics” doctrine will produce the spectacular results of the Jones Act, enacted by Congress in 1920, requiring all goods shipped between US ports be shipped on US built vessels, with US crews and flying US Flags. Anyone visiting Hawaii or Puerto Rico will know that groceries are “way down” (cheaper) there!

LikeLike

Al Lindquist

Remember prices soared in the 1970’s at a far higher rate, and a sustained rate, than the 9.2% of June 2022. You won’t get too much in the way of inflation unless the M2 money supply gets juiced. Remember, inflation is too much money chasing too few goods. High prices are the symptom. If your temperature rises that is a symptom of something misfiring in your body.

Tariffs are a tax–taxes raise costs–tariffed items will cost more–most likely not rising monthly–just a somewhat permanent one shot increase.

When my lefty friends now want a $20.00 minimum wage or some such scheme they are reminded of costs that will increase for many of us. Good lesson for those wanting to raise taxes.

Saw a discussion on CNBC about tariffs and rising inflation–has not yet happened they say–now wonder if it will happen. A year from now we should know the effects of tariffs on our economy.

LikeLike