This from work by the Committee for a Responsible Federal Budget

Read the full article HERE

The Social Security COLA Cap

Social Security benefits are adjusted upward each year with the CPI-W through annual COLAs.5 COLAs are meant to prevent benefits from eroding due to inflation. Before the COLAs are applied, initial benefits grow each year at roughly the rate of wage growth.

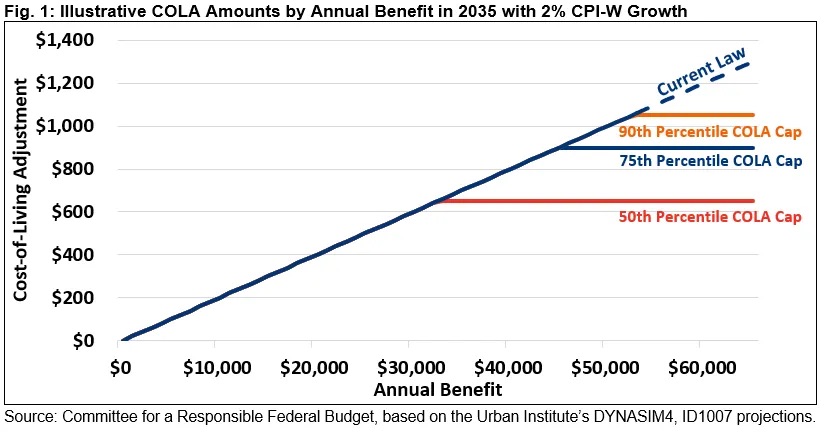

Under this Trust Fund Solution, the COLA would be limited each year to the amount received by a beneficiary with a relatively high benefit level. All beneficiaries would continue to receive a COLA under this proposal – many would receive the same COLA as under current law – and initial benefits would continue to be indexed to wage growth as under current law. However, beneficiaries that would otherwise receive a COLA above the cap – retirees with the largest benefits and the highest lifetime incomes – would instead receive a COLA equal to the cap.

For example, if CPI-W growth in 2035 were 2 percent and the cap was set at $900, a retiree with a $50,000 benefit who would receive a $1,000 COLA under current law would instead receive $900. Those with $45,000 or less in benefits would receive the same COLA as under current law.

According to CRFB, a COLA cap on its own will not be sufficient to restore Social Security solvency. However, setting the cap somewhere between the median and 90th percentile of benefits could close between one-twentieth and one-quarter of Social Security’s 75-year solvency gap and reduce a similar proportion of its annual shortfalls. In combination with other benefit and/or revenue reforms, the cap could help to avoid the looming 24 percent benefit cut and secure Social Security for generations.

Al Lindquist

I would deep six the whole system for younger folks like my grandchildren–tie their retirement to the TSP program –allow the likes of Quinn and Jack to set forth the basic rules (maybe require in retirement at least 20% set aside for a TSP NY Life annuity) and/or a % needs to invested in a Life Cycle fund during accumulation period–they could even guarantee a minimum benefit. Let folks with knowledge of the system figure it out. Upon death the benefit goes to a beneficiary, or maybe have a formula for that.

What to do now for the less than younger folks? The COLA Cap is worth exploring–I suspect a combination of a slight increase in age–a slightly higher increase in contributions–the Cap–and other increases will be proposed and adopted.

Another government program running into trouble–no surprise here.

LikeLike

Another example of others deciding how to fill the gap. Another example of increasing the progressivity of the FICA taxes relative to Social Security benefits.

The benefits are already highly progressive relative to the taxes used to fund the benefit. No need to increase progressivity.

Once more, with feeling,. Each individual should be informed what taxes they should have paid, what would have resulted in a sustainable funding. Each individual should be given a choice of options to fill the funding gap – without chaning progressivity.

LikeLike

Jack, ordinarily I agree with you on most all topics and I see your point on this one. But this time I see the logic in using a cola cap to help maintain solvency in the program. Social Security is a government entitlement program, not an annuity one would purchase from private insurance companies. It is progressive, that’s true, but that’s baked in the cake for government programs. We have to depend on the higher earner to take up more of the burden, no way around it.

LikeLike

Sure, that is already the case – the higher earner is clearly picking up a substantially greater portion of the cost – in that, as Dick would confirm, your benefits bear no (or very little) relationship to the FICA taxes you paid.

My point is simply that we already have a highly progressive SOCIAL insurance system. I don’t see a problem if the funding solution is just as progressive as the current system. That is, I don’t see a need to increase the progressivity of the system. Just as important,

I believe everyone should have to shoulder some of the burden – as everyone, as a group, failed to contribute sufficient funds to make the system sustainable. I don’t think anyone should get a pass in solving the funding challenge – again – consistent with the intended progressivity of the system. So, if some want to pay more taxes, great, and if others want to take a cut in benefits, fine, and there will be some who will opt for a little of both.

LikeLike

As usual, the devil is in the details, but this seems to me to be a necessary part of the process of making Social Security solvent in the long run. It would affect those most able to handle a reduced cola. I hope it gets serious attention when Congress finally gets down to acting on the issue.

LikeLiked by 1 person