Actually I doubt many people understand how any type of insurance works.

Simply put, you need a mix of insured with…

No claims

Low claims

Moderate claims…and

High claims

That mix of users determines your premiums.

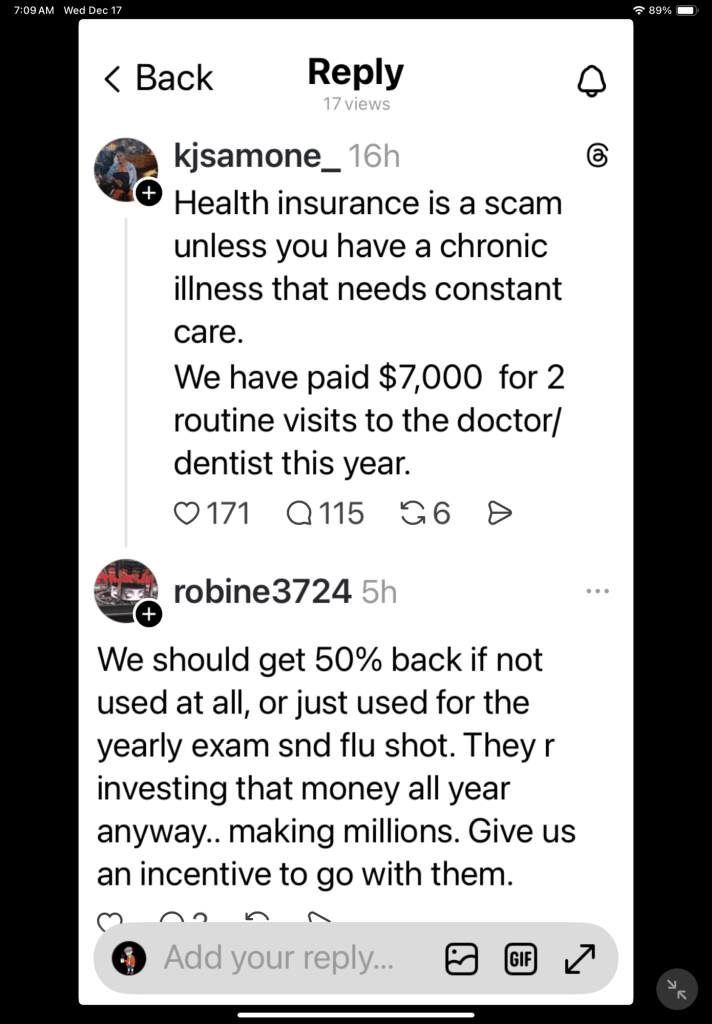

If people view insurance as expressed above in those Thread posts, it is not insurance and cannot function.

The no and low claim insured are funding the high claim insured. In the case of health insurance, a no claim users may become a catastrophic claim users at any time.

Just imagine what premiums would be if only those with chronic illness that needs constant care were enrolled. It wouldn’t be insurance at all.

Who buys any insurance because they want to get premiums back by having a claim❓That’s not even rational.

Are those who complain the loudest willing to forgo health insurance and take the financial risk of illness or injury … on their own, risking their own resources and assets?

Nearly two decades ago, as my 22+ year old son went off to work for a subsidiary of Honeywell in 2007, he left my HSA-capable health coverage and enrolled in coverage at his new employer.

In near-perfect health, the only option he had access to was one that would cost him over $125 a month for single coverage – with no deductible, modest copays, and an out of pocket expense maximum for single coverage that was less than his annual contribution.

Obviously, this was health coverage structured for older workers who anticipated significant expense and executives.

After a few months, knowing he “could have had a V-8” (HSA-capable coverage, where not only the majority of his monthly contribution but a sizeable portion of the employer contribution could be diverted to HSA savings, all with pre-tax cafeteria plan contributions), he asked me for advice on how to get his employer to offer HSA-capable coverage. He planned to work there for a number of years and didn’t want or need the higher value, higher cost coverage – and wanted to build up an account balance in anticipation of future health expenses.

Shocked that they were not offering a HSA-capable option, it only took me a minute to figure it out. I had already recognized the opportunity at my employer – four months after HSAs were approved as part of the Medicare Modernization Act of 2003, we decided to add HSA-capable coverage (and to migrate to full replacement over a period of years).

I suggested he gather a number of his prized, technical, mostly engineer peers under age 40, single or married, with or without children, and have them all pitch the need for that choice. They would remind the employer that HSA-capable coverage could reduce both the cost of coverage and the cost of employment (lower employment taxes) and that it would lower the risk / expense suffered by the health plan where coupled with a health and wealth/health and productivity wellness strategy.

Further, I encouraged him to pitch a separate rationale to the C-Suite – to also position the HSA as an executive benefit, where the employer would drop the executive medical plan and pass that money to the executives to be contributed to their HSA – given their proximity to retirement and Medicare eligibility. Those who wanted lower point of purchase cost sharing would have to pay more or select HSA-capable coverage (same company contribution to all options), or they could opt out to a spouse’s employer’s plan, or if Medicare-eligible, to waive coverage and enroll there.

“… Who buys any insurance because they want to get premiums back by having a claim❓That’s not even rational. Are those who complain the loudest willing to forgo health insurance and take the financial risk of illness or injury … on their own, risking their own resources and assets? …”

You totally miss the point!

That person wanted less expensive coverage that met their anticipated needs. They wanted coverage for preventive services, regular office visits and preventive dental treatment (exam, cleaning, x-ray, the lube oil filter of dental treatment) which most HSA-capable coverage options provide without applying the deductible. They wanted their premiums to primarily fund the out of pocket expense maximum, to avoid catastrophic expense.

That is what HSA-capable coverage is all about. However, keep in mind that HSA-capable coverage only works if the individual contributes to the HSA.

FYI: The average deductible in 2025 in one nationwide survey was over $1,750 for single coverage – which is more than the minimum deductible for HSA-capable coverage. Why not adjust the coverage as necessary so that anyone with a $1,700 or higher deductible qualifies to contribute to a HSA?

LikeLike