2014

As just about every American knows, Obamacare provides subsidies to those who purchase health insurance through a marketplace plan.

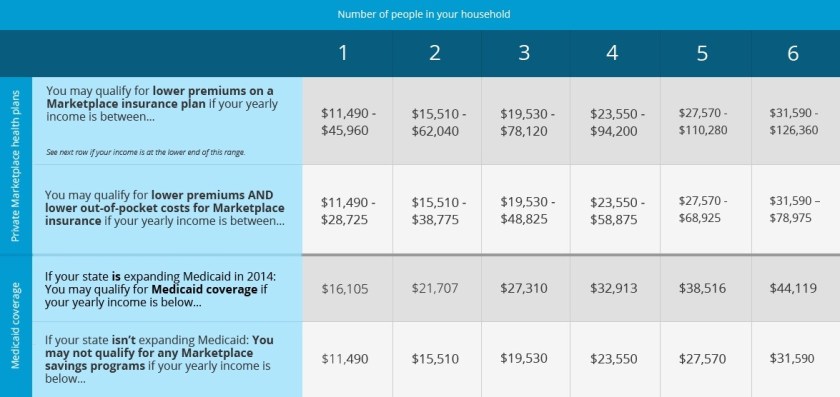

The amount of the premium subsidy (tax credit) and subsidies for out-of-pocket costs such as co-pays and deductibles (only if you purchase a silver level plan) depends on the household income and family size.

So as you earn more, you get less. If you have another child, you can get the less back. Economists call these disincentives to work a tax.

Following is a chart showing the income levels for subsidies. And here is a complete explanation from healthcare.gov

The recent political flap about the Affordable Care Act costing jobs or more accurately causing people to decide not to work is all about these subsidies. The fact is, getting a raise, a spouse starting to work or working more hours could easily change the scope of tax credits and other subsides for health insurance and could change them retroactively for an entire year.

The extent to which all this will motivate people to work or not work and how much is open to debate. However, I’m pretty sure most people have not taken the time to look at the complexities of all this to enable them to make informed decisions.

Humm, dear, if we have another baby our subsidy goes up. Even better, while I’m on maternity leave our income drops so we get even more subsidy, but if I go back to work, we lose some subsidy and I have to work more hours to afford the insurance. Should we do this all in one year? Should we do this at all? Not tonight, I have a headache‼️