This whole inequality debate is troublesome, not because it’s a problem but because politicians say it is. Clearly it’s a fact the very top income folks have done better than the rest of us, money makes money and if you make most of your money by investing, you should have done quite well in the last seven years. But that doesn’t mean the middle class is doing poorly or if some are, that it is the fault of the one percent. For example, those 401ks should have done very well since 2008 if people had stayed the course and continued to invest all during the recession. In other words, not only would these investors have lost nothing, the S&P 500 has more than doubled since July 2009. A 401k invested in an S&P index mutual fund would have done the same. However, there is much more to it as the following article explains. I urge you to follow the link and read the story.

Our politicians take more delight in doom and gloom rather than sparking the American spirit and can do attitude. They are the ones taking advantage of the low and middle classes.

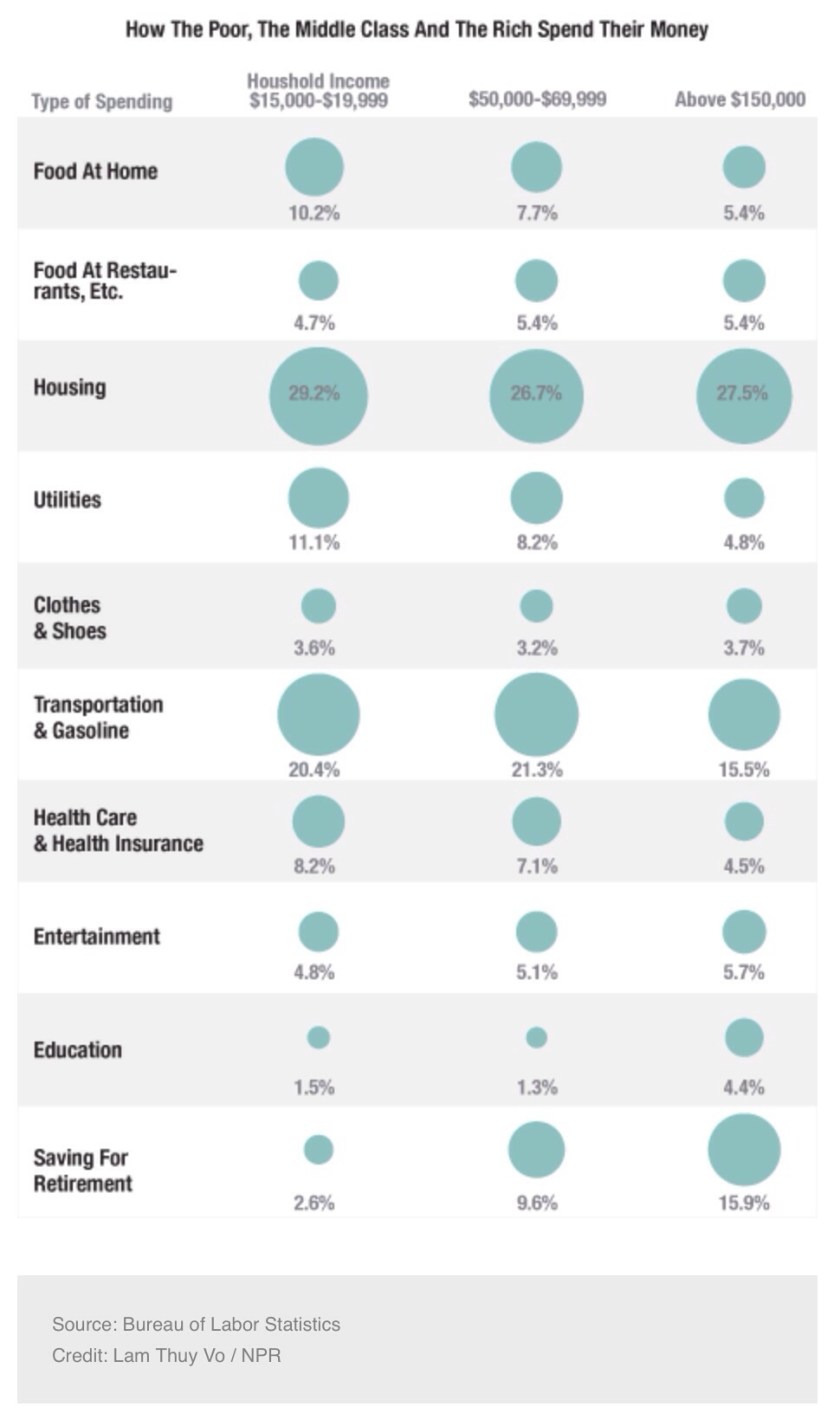

As this article notes the American middle class is still far better off that the rest of the world. They have more disposable income and they have far more stuff. All this is quite relative. If Americans had no money to spend on other than necessities, all the fast food restaurants, tattoo shops, entertainment venues, beauty and nail salons, sports events and much, much more would have shut down long ago … it’s all relative. 📵

Countless reports now claim that the middle class is being crushed by inequality, declining mobility and diminishing income. A closer look at the facts suggests otherwise: Members of America’s middle class are better off than they were 30 years ago, and they live much more comfortably than counterparts in other countries.

The problem with the research showing middle-class stagnation is that it looks at market incomes, which exclude taxes, government transfers and adjustments for household size. Market income is an accurate gauge of employment compensation but a misleading way to consider a family’s financial resources. It overlooks the welfare state’s enormous power to redistribute income.

The Congressional Budget Office’s 2011 report on income inequality trends offers a more precise accounting, dispelling the notion that the past three decades have been characterized by the rich getting richer at the expense of the poor while the middle class stays about the same. The CBO adjusts market income by subtracting taxes and adding the cash value of social benefits. When households are then divided into five equal income groups, the data reveal that average disposable household income has increased across all groups since 1979. The average household income grew by 40% for the middle quintile and increased by 49% for the bottom quintile.

via Neil Gilbert: The Denial of Middle-Class Prosperity – WSJ.com.