Communicating is more than disseminating information or proliferating legalize. Communicating employee benefits means communicating ideas, concepts, the reason for things and how the employee and family can maximize the efficient use of the benefits. All this is to the employer’s advantage because the value of benefit programs will be better understood and appreciated.

Communicating employee benefits requires creativity, an understanding of employee perceptions, reaching the spouse and keeping the message as light and simple as possible. It also requires constant repetition and a variety of media; print, e-mail, interactive websites and more.

To accomplish all this it is best to keep the lawyers at a far distance and leave the crafting of the message to the benefits professional and not business communicators. Employee benefits, like no other corporate effort, is highly personal and at times emotional.

The sad part is that most employers large and small do not follow any of this guidance. Even the company where I worked for nearly five decades reverted to standard, corporate double speak and eliminated virtually all not legally required communication within months of my retirement.

Despite the increased use of high-deductible plans and health savings accounts–47 percent of employers offer HDHPs and 42 percent offer HSAs–consumers still know very little about these types of policies, according to a new survey from Alegeus Technologies.

The survey found that only 30 percent of consumers who currently are enrolled in an HSA could pass a basic quiz about the plan. And more than 40 percent of the respondents said HSAs are spending accounts, not realizing they can actually save beyond the plan year or invest in HSA funds.

Indeed, a separate study released last December found more than 60 percent of the target population for the health insurance exchanges don’t understand fundamental health insurance concepts, including premiums, deductibles, copayments and coinsurance, FierceHealthPayer previously reported.

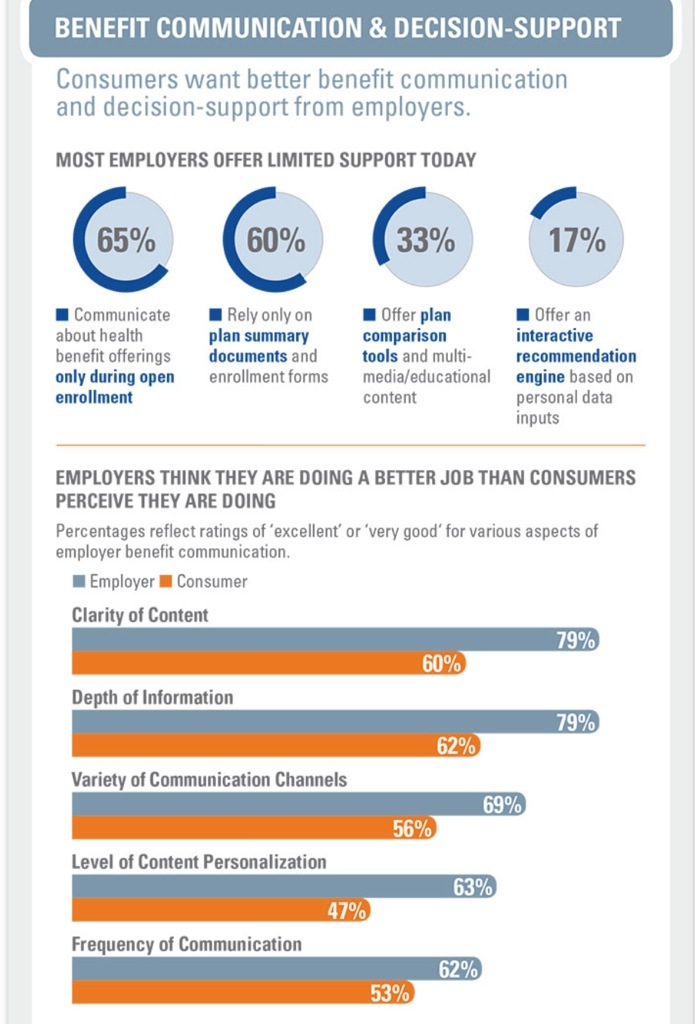

The survey found that 65 percent of companies only discuss and educate employees about health benefits during open enrollment, and almost 60 percent rely strictly on summary documents and enrollment forms provided by the insurers to explain the health plan options.

But Alegeus also found that consumers want the ability to make more individualized choices concerning their health plans. For example, nearly 70 percent said they want their employer to provide a wider choice of plan options, and 47 percent said they want to choose which bank administers their HSA account.

via Account-based plans: Closing the knowledge gap for consumers – FierceHealthPayer.