While things may seem quiet on the eastern front, in fact some politicians are asking questions about what it will take to extend the full payment life of Social Security. That focus as you can see below is on the payroll tax.

This means the younger generation will again be transferring more of its wealth to older Americans and in the hope somebody will do the same for them in the future.

This means the younger generation will again be transferring more of its wealth to older Americans and in the hope somebody will do the same for them in the future.

Indeed Social Security is essential today because so many Americans have come to rely on it, some incorrectly thinking they could live on the monthly payment in retirement. But that is the problem with such programs, they create a false sense of security and gradually become more expensive to maintain. So it will be with Obamacare, but in that case there is an additional trap. The means testing for tax credits will cause some people to lose money when advancing in their careers.

From the Congressional Budget Office:

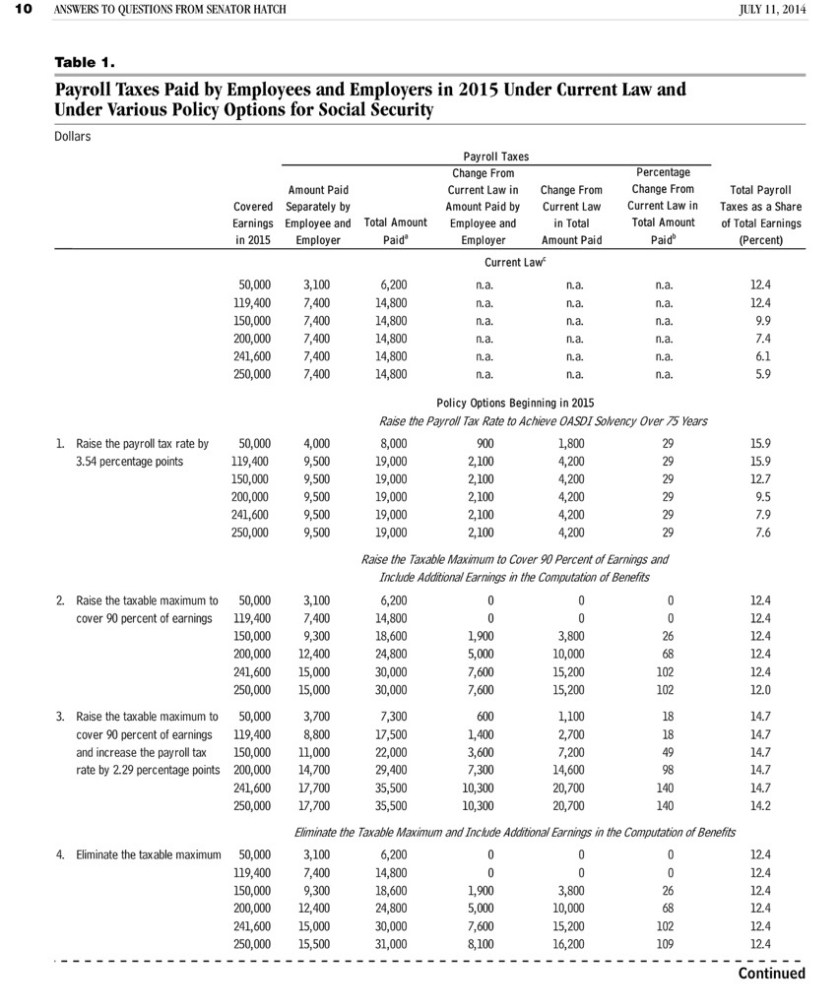

Senator Orrin Hatch asked CBO several questions about the implications of altering the Social Security payroll tax rates as well as the taxable maximum (the maximum amount of earnings on which those payroll taxes are imposed). This document provides CBO’s answers to those questions.

For the various options discussed, CBO presents the changes that would result in the annual payroll taxes paid by employees and employers, and for people born at various times and with various levels of earnings, the change in their median lifetime payroll taxes and median initial replacement rates (benefits as a percentage of career-average earnings).

CBO based its answers on projections issued last September in The 2013 Long-Term Budget Outlook. In that report, the 75-year projection period for Social Security spans 2013 to 2087. All changes to payroll tax rates and the taxable maximum analyzed for this report would begin in January 2015.

Following is a portion of the CBO report showing several of the options under consideration: