I often criticize the left for its misleading and oversimplified solutions to social problems. However, such tactics or simply naive approaches to problems are rampant on the right as well. Consider this from an American Enterprise Institute publication.

The article argues that saving more for retirement driven by rising health care costs is not the real problem, that health care costs are not rising relative to retirement incomes and that the real problem is not saving more, but controlling health care costs. Talk about stating the obvious. If we had controlled health care costs, there would have been no need for Obamacare.

However, the point is that Americans are not adequately preparing for retirement, including for health care costs. To mislead people into thinking otherwise is counterproductive. To tell people that they may be saving too much is irresponsible. There is no such thing.

The Social Security Administration maintains the best-developed, best-funded, and most widely vetted model of retirement security. The SSA model projects that “replacement rates” for the supposedly undersaving Generation X will be no lower than for Depression-era birth cohorts who retired in the “golden age” of traditional pensions and generous Social Security benefits. SSA’s model estimates that the typical Gen-Xer will at age 67 have an income equal to 110 percent of his career-average pre-retirement earnings, adjusted for inflation. The median replacement rate for the so-called “Depression Babies” is practically the same, at 109 percent. These aren’t exactly panic-inducing numbers.

The SSA projects that ‘replacement rates’ for the supposedly undersaving Generation X will be no lower than for Depression-era birth cohorts.

Consider this statement: “career-average pre-retirement earnings.” Is your standard of living today based on your average earnings over the past 35 or 40 years? I’m guessing it’s not. What does what I earned twenty years ago have to do with today’s lifestyle? What you need to do is have income starting retirement equal to 100% of your income in the year before you retire. While that may be more than you need initially, it gives you a cushion to deal with unexpected bills and inflation. Of course, that 100% includes your Social Security.

How do health costs play into these calculations? According to the Census Bureau’s Consumer Expenditure Survey, in 1989 the typical household over age 65 spent $3,942 (in 2012 dollars) on health insurance premiums, medical services, prescription drugs, and medical supplies, equal to 11.5 percent of after-tax income. By 2012, households’ health spending had increased by 30 percent to $5,116. But retirees’ incomes increased as well. As a result, health spending was practically unchanged at 11.6 percent of after-tax income. If health spending stays constant as a percentage of retirement incomes, there’s no reason that retirement saving should rise as a percentage of pre-retirement incomes.

Let’s explore the above numbers. The standard Medicare Part B premium is $104.90, the typical Part D premium is $31.00 a month, a Medigap policy covering most of the Medicare deductibles and coinsurance costs at least $200 a month. That means that a post-65 household of two seniors pays at a minimum $8,061.6 a year for health care costs plus the Part D deductible and any services not covered by Medicare, which of course, include dental and vision expenses. If they take a lower value Medigap policy, the premium will be lower, but out-of-pocket costs will be higher. Seniors using Medicare Advantage may have lower overall expenses, but that is starting to change.

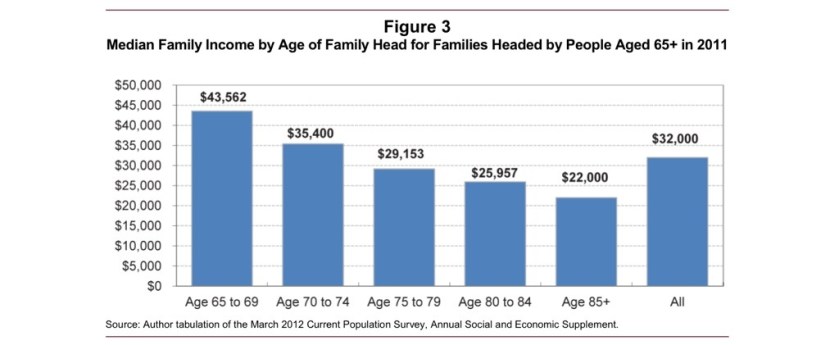

The average monthly Social Security benefit for current all retirees is $1294.00 a month or $15,528 a year. That means that for 52% of seniors with a total income of about $31,056 (see stats below), health care spending can average over 25% of their pre-tax income.

Social Security is the major source of income for most of the elderly.

🔻Nine out of ten individuals age 65 and older receive Social Security benefits.

🔻Social Security benefits represent about 38% of the income of the elderly.

🔻Among elderly Social Security beneficiaries, 52% of married couples and 74% of unmarried persons receive 50% or more of their income from Social Security.

🔻Among elderly Social Security beneficiaries, 22% of married couples and about 47% of unmarried persons rely on Social Security for 90% or more of their income.

None of this means that rising health costs don’t reduce Americans’ standard of living. Since higher health spending often doesn’t produce commensurate increases in health outcomes, higher health care outlays can mean a lower quality of life. But requiring working-age households to put away more for retirement – either by saving more on their own or by paying more taxes for increased Social Security benefits – won’t solve this problem.

Instead, we should enact policies to either restrain the growth of health spending or ensure that higher spending actually produces better health outcomes. Some might argue that this comes through a top-down, expert-driven approach, while others (including me) opt for consumer-driven health plans that encourage greater cost-consciousness. But the broad point is simply that if rising health costs are the problem, the solution lies in policies that reduce the growth of health costs.

Are Rising Health Care Costs Creating a Retirement Crisis? — The American Magazine.

The solution lies in both increased savings and better control of health care costs which must include better coordination and utilization management of health care. Health care costs are not the only expenses those with insufficient retirement income need to worry about.

As far as consumer-driven health plans go, what that really means is more out-of-pocket costs for retirees. Does anyone seriously believe that most seniors can handle consumer-driven, high deductible plans either financially or emotionally? Some “experts” do, but they are living in a fantasy world.