Writing with his usual naive, liberal ideological style, Paul Krugman’s opinion piece The Medicare Miracle paints a rosy picture of Medicare even giving credit for lower spending to Obamacare. I am always amazed by the lack of reality in liberal thinking, even ignoring important caveats contained in relevant reports, in this case the Medicare Trustees, including members of the current administration.

The fact is Medicare costs are still high and growing and the future is highly variable and difficult to predict. Not even the Trustees are sure where things are going. There is no miracle, but there is a great deal of uncertainty surrounding current efforts to make health care more efficient. And keep in mind that efficiency can only go so far. Medicare can squeeze providers to a point, but there are limits. Efficiency for payers means paying less but for providers it means less revenue. That lost revenue will be made up somewhere.

The fact is Medicare costs are still high and growing and the future is highly variable and difficult to predict. Not even the Trustees are sure where things are going. There is no miracle, but there is a great deal of uncertainty surrounding current efforts to make health care more efficient. And keep in mind that efficiency can only go so far. Medicare can squeeze providers to a point, but there are limits. Efficiency for payers means paying less but for providers it means less revenue. That lost revenue will be made up somewhere.

Following is an excerpt from The Medicare Miracle (there is a link to the full article).

But a funny thing has happened: Health spending has slowed sharply, and it’s already well below projections made just a few years ago. The falloff has been especially pronounced in Medicare, which is spending $1,000 less per beneficiary than the Congressional Budget Office projected just four years ago.

This is a really big deal, in at least three ways.

First, our supposed fiscal crisis has been postponed, perhaps indefinitely. The federal government is still running deficits, but they’re way down. True, the red ink is still likely to swell again in a few years, if only because more baby boomers will retire and start collecting benefits; but, these days, projections of federal debt as a percentage of G.D.P. show it creeping up rather than soaring. We’ll probably have to raise more revenue eventually, but the long-term fiscal gap now looks much more manageable than the deficit scolds would have you believe.

Second, the slowdown in Medicare helps refute one common explanation of the health-cost slowdown: that it’s mainly the product of a depressed economy, and that spending will surge again once the economy recovers. That could explain low private spending, but Medicare is a government program, and shouldn’t be affected by the recession. In other words, the good news on health costs is for real. [Isn’t this ridicules? The spending on health care is spending and demand by patients who are concerned about their finances and thus defer as much spending as possible. Why wouldn’t that include seniors on Medicare who have out-of-pocket costs? What has the fact Medicare is government-run to do with such spending? Seniors are also concerned about spending through their private supplemental plans?]

But what accounts for this good news? The third big implication of the Medicare cost miracle is that everything the usual suspects have been saying about fiscal responsibility is wrong.

For years, pundits have accused President Obama of failing to take on entitlement spending. These accusations always involved magical thinking on the politics, assuming that Mr. Obama could somehow get Republicans to negotiate in good faith if only he really wanted to. But they also implicitly dismissed as worthless all the cost-control measures included in the Affordable Care Act. Inside the Beltway, cost control apparently isn’t considered real unless it involves slashing benefits. One pundit went so far as to say, after the Obama administration rejected proposals to raise the eligibility age for Medicare, “America gets the shaft.”

Now here is a more realistic view from a Forbes columnist. I urge you to take a look.

What is most important is this. Here here is what the Medicare Trustees say in their latest report:

In recent years U.S. national health expenditure (NHE) growth has slowed relative to previous historical patterns. There is some debate regarding the extent to which this cost deceleration reflects one-time effects of the recent economic downturn versus the extent to which it reflects positive reforms in the health care sector that may carry forward to produce additional cost savings in the years ahead. The Trustees are hopeful that U.S. health care practices are in the process of becoming more efficient as providers anticipate a future in which the rapid cost growth rates of previous decades, in both the public and private sectors, do not return. Indeed, the Trustees have revised down their projections for near term Medicare expenditure growth in response to the recent favorable experience. In addition, the methodology for projecting Medicare finances had already assumed a substantial long-term reduction in per capita health expenditure growth rates relative to historical experience, to which the ACA’s cost-reduction provisions would add substantial further savings. Notwithstanding recent favorable developments, both the projected baseline and current law projections indicate that Medicare still faces a substantial financial shortfall that will need to be addressed with further legislation. Such legislation should be enacted sooner rather than later to minimize the impact on beneficiaries, providers, and taxpayers.

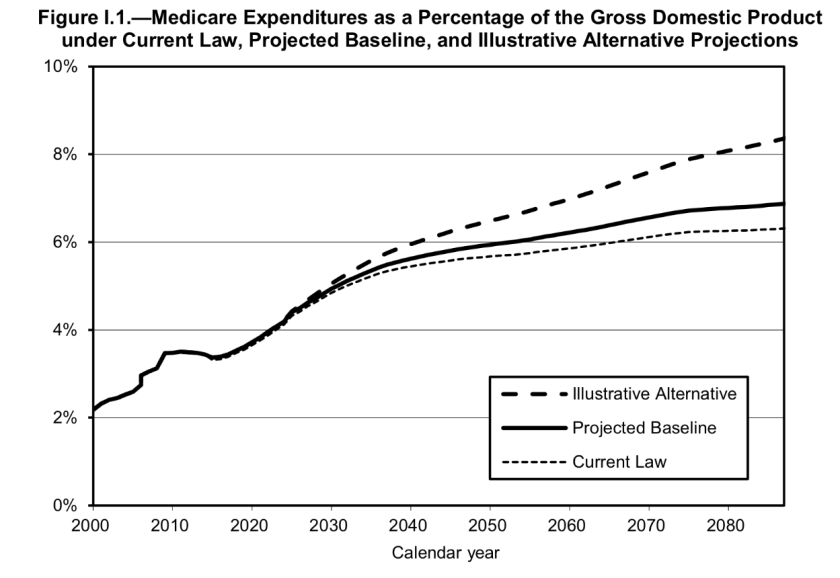

Figure I.1 shows Medicare’s projected costs as a percentage of the Gross Domestic Product (GDP) under three sets of assumptions: projected baseline, current law, and illustrative alternative, described below.

The projected baseline, which is shown in the middle line of figure I.1 and is the basis of estimates presented throughout the main body of this report, assumes that the scheduled SGR reductions are overridden so that physicians’ payment rates increase at a 0.6-percent annual rate from 2016 through 2023. This is the same average update that has been occurring over the 10-year period ending with March 31, 2015. From 2024 through 2038 (after the short-range valuation period has ended), the payment updates in this scenario are assumed to gradually rise so that Medicare expenditures per beneficiary for physician services are increasing at the same rate as per capita national health expenditures by 2038.

The current-law cost projections reflect the scheduled SGR reductions to physicians’ payment rates and the ACA-mandated reductions in other Medicare payment rates, but not the payment reductions and/or delays that would result from the HI trust fund depletion. The difference between the projected baseline and the current-law projections represents the financial impact of the current practice of overriding the scheduled SGR reductions.

The illustrative alternative shown in the top line of figure I.1 incorporates the override of SGR physician payment rates included in the projected baseline and a partial phase-out of the ACA reductions in Medicare payment rates from 2020 through 2034, as well as an assumed legislative override of the cost-saving actions of the Independent Payment Advisory Board (IPAB). The difference between the illustrative alternative and the projected baseline projections demonstrates that the long-range costs could be substantially higher than shown throughout much of the report if the ACA’s cost reduction measures prove ineffectual or are scaled back.

As figure I.1 shows, Medicare’s costs under the Trustees’ projected baseline assumptions rise from their current level of 3.5 percent of GDP to 5.6 percent in 2040 and 6.9 percent in 2088. If the SGR reductions under current law were implemented, projected Medicare costs would rise to 5.5 percent of GDP in 2040 and 6.3 percent in 2088. Under the illustrative alternative, in which adherence to the ACA cost-saving measures also erodes, projected costs would rise to 6.0 percent of GDP in 2040 and 8.4 percent in 2088.

As the preceding discussion explains, and as the substantial differences among the Trustees’ projected baseline, current-law, and illustrative alternative projections demonstrate, Medicare’s actual future costs are highly uncertain for reasons apart from the inherent difficulty in projecting health care cost growth over time.