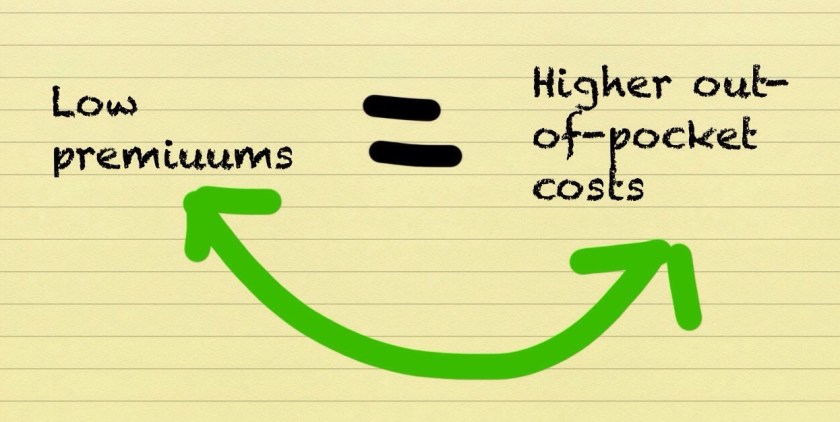

Whether it’s Medicare or any other health care coverage, you should not choose a plan based only or mainly on the premium. That can be very misleading in determining your true costs in a year.

Your true costs include premium, deductibles, co-payments, coinsurance and to some extent services excluded or limited.

You should balance all these elements in determine the best plan for you and your family taking into consideration your health care needs and past experience.

Good Morning Dick:

Predicted to be lovely weather here today…hope you have the same where you are…

Found this story on the web at:

(http://bigstory.ap.org/article/41df6bca84b8454cb059ffe9bef9e222/poll-many-insured-struggle-medical-bills)

and thought your readers might find it of interest. I find it hard to believe that people aren’t going to “vote their wallets” in a few weeks…well as Opa would say “nür die Zeit zeigen”, “gut genug von den politik..Jetzt auf die Geschichte” (Don’t you just LOVE your new daily German lesson RD?…only this time no translation…you’ll have to figure it out or look up the translation on line)

Remember that once you exhaust the deductible you will still have to share the cost. I believe it’s 70/30 on the BRONZE (cheapest) plan (you pay 30 cents of every dollar AFTER you have paid all of your deductible), 80/20 on the SILVER plan and 90/10 on the GOLD plan, so a $12,000 hospital assuming a SILVER plan deductible of $3,100 as noted below. 12,000-3,100=$8,900 then you get to pay 20% of that figure or $1,780 so you pay $4,880 of that bill on the second best plan. I picked

$12,000 because that is the AVERAGE E.R. bill in the County that I live in here in the Northeast. That assumes you are treated and released. If you are admitted, well, go figure (literally).

One government definition sets the threshold for a high-deductible plan at $1,300 for individual coverage, but in practice annual deductibles of $2,000 and even much higher are common.

Edward Frank of Reynoldsville, Pennsylvania, said he bought a plan with a $6,000 deductible last year through HealthCare.gov. That’s in the high range, since deductibles for popular silver plans on the insurance exchanges average about $3,100— still a lot.

“Unless you get desperately ill and in the hospital for weeks, it’s going to cost you more to have this plan and pay the premiums than to pay the bill just outright,” said Frank, who ended up paying $4,000 of his own money this spring for treatment of shoulder pain.

“The deductibles are so high, you don’t get much of anything out of it,” said Frank, who is in 50s and looking for a new job.

The poll found that people are responding to the hit on their wallets in ways that may not help their health:

— Nineteen percent of all privately insured adults said they did not go to the doctor when they were sick or injured, because of costs. Among those with high-deductible plans, the figure was 29 percent.

— Seventeen percent skipped a recommended test or treatment; it was 23 percent among those with high-deductible plans.

— Eighteen percent of all adults went without a physical exam or other preventive care, 24 percent among those with high-deductible plans.

Sandra Chapman, a warehouse worker from Memphis, said she had to go without cholesterol medication last year because of issues with her prescription coverage. Instead of taking pills, she changed her diet.

“They only cover certain stuff and, I don’t know, the rules change all the time,” said Chapman, in her early 30s.

Health and Human Services Secretary Sylvia Mathews Burwell said last week that part of the problem is that many consumers don’t understand what they are buying when they purchase health insurance, or how to use their plan once they get their cards in the mail.

For example, there should be no reason to skip routine preventive care, since the health care law requires insurers to provide it at no charge to the patient.

“People need to understand how to use their health care,” said Burwell. “We need to spend time educating people.”

Only about half of those surveyed said they had a strong understanding of what their plans cover.

Consumers sometimes pick health insurance based on the monthly premium alone. But low-premium plans have higher deductibles and other out-of-pocket costs. People who expect to be going to the doctor can come out ahead financially by paying higher premiums for a plan that features lower out-of-pocket costs.

Indeed, the poll showed that a majority of those with private insurance, 52 percent, would rather pay a higher premium and limit out-of-pocket costs than lower their premiums and potentially face higher out-of-pocket charges.

Many consumers said they are making financial trade-offs to pay medical bills:

—Overall, 33 percent said they cut back on entertainment; it was 43 percent among those with high-deductible plans.

—18 percent said they used up all or most of their savings, 24 percent among those with high-deductible plans.

—19 percent said they dialed down their contributions for retirement savings, 28 percent for people with high-deductible plans.

One government definition sets the threshold for a high-deductible plan at $1,300 for individual coverage, but in practice annual deductibles of $2,000 and even much higher are common.

Some people pair a high-deductible plan with a tax-sheltered savings account to pay their out-of-pocket costs — the poll found 40 percent who say they have high-deductible plans also have such an account. On the insurance exchanges, low-income people can receive additional help from the government for their cost-sharing expenses.

In another potentially troublesome finding for the White House, the poll found signs of dissatisfaction among people who changed plans in the last year, as the president’s health overhaul went into full effect.

LikeLike