Paul Krugman is an interesting character; a political animal applying logic that ignores the political animal. Here is a quote from a recent NYTs opinion piece. His logic sounds pretty good, in fact I would support the temporary debt spending he advocates during times of economic stress. However, the optimum word is “temporary.” Politicians don’t understand that word when it comes to spending. We go into debt for programs with ongoing expenses, not one shot projects. In other words, people running government think just like many people running their households.

I recall an incident in my local town. A deal was made with a local developer to make a certain type of payment for ten years in lieu of property taxes. The town proposed and passed a bond issue to build a new sports field claiming they would use these payments in lieu of taxes and also claiming “there would be no impact on taxes” and taxpayers need not worry. Think about this for a moment. If you don’t get it, you may be a Democrat.

Debt is one way to pay for useful things … and useless things too. Krugman and others seem to ignore the billions wasted by government and that if government was efficient would provide funds for many useful things … like fixing bridges😳

One answer is that issuing debt is a way to pay for useful things, and we should do more of that when the price is right. The United States suffers from obvious deficiencies in roads, rails, water systems and more; meanwhile, the federal government can borrow at historically low interest rates. So this is a very good time to be borrowing and investing in the future, and a very bad time for what has actually happened: an unprecedented decline in public construction spending adjusted for population growth and inflation.

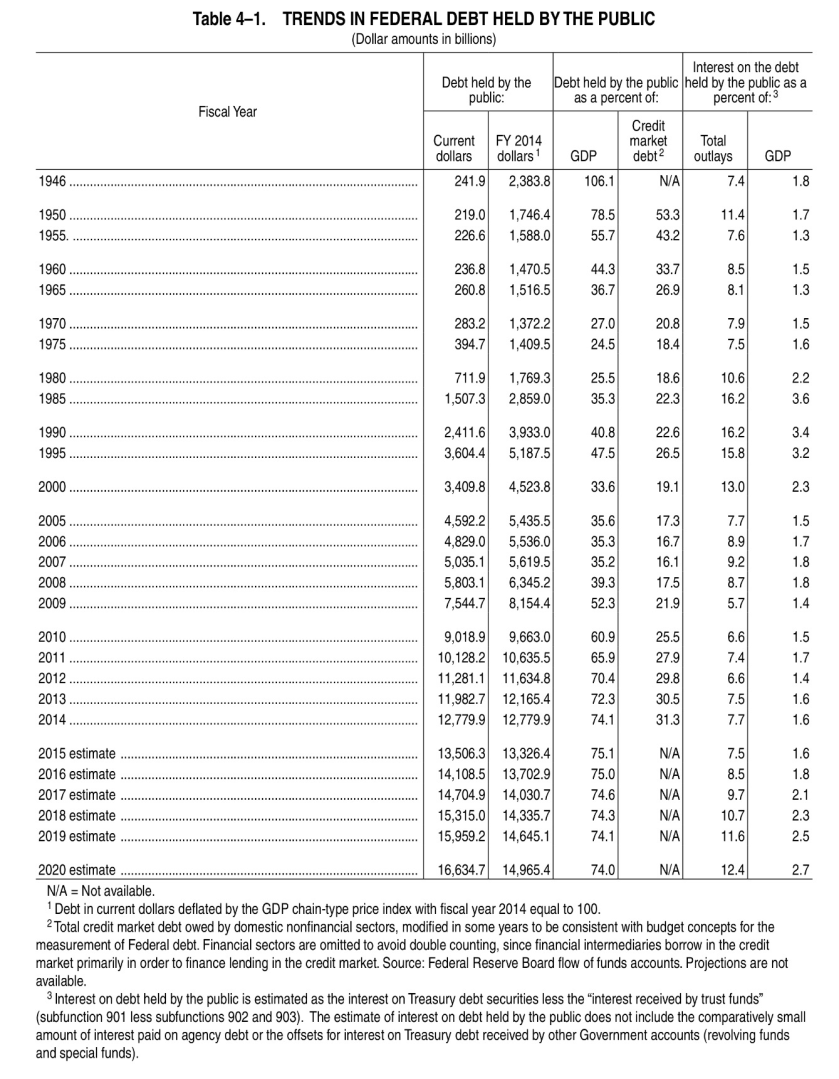

It’s not as if we don’t borrow more each day. The current annual deficit is nearly half a trillion dollars. We are currently in debt in terms of percentage of GDP equal to where we were four years after WWII ended. Look at the chart below from a White House report. But also look at the trends in the sixty years following WWII. If Krugman is right how did we survive all those years with debt levels considerably lower than today and projected for the future? In 2009 we began emergency borrowing to deal with inflation and despite the so-called peace dividend from leaving two wars, our debt never decreased and continues to rise. We have gone from 39% of GDP in 2008 to 74% in 2014. What have we gotten that is useful and not requiring ongoing debt to support it?

The “expert” logic ignores the political logic and ill-conceived justification for spending (and the failure to assess the value we receive in return).

NOTE: The above numbers do not include government debt to government accounts such as Social Security.