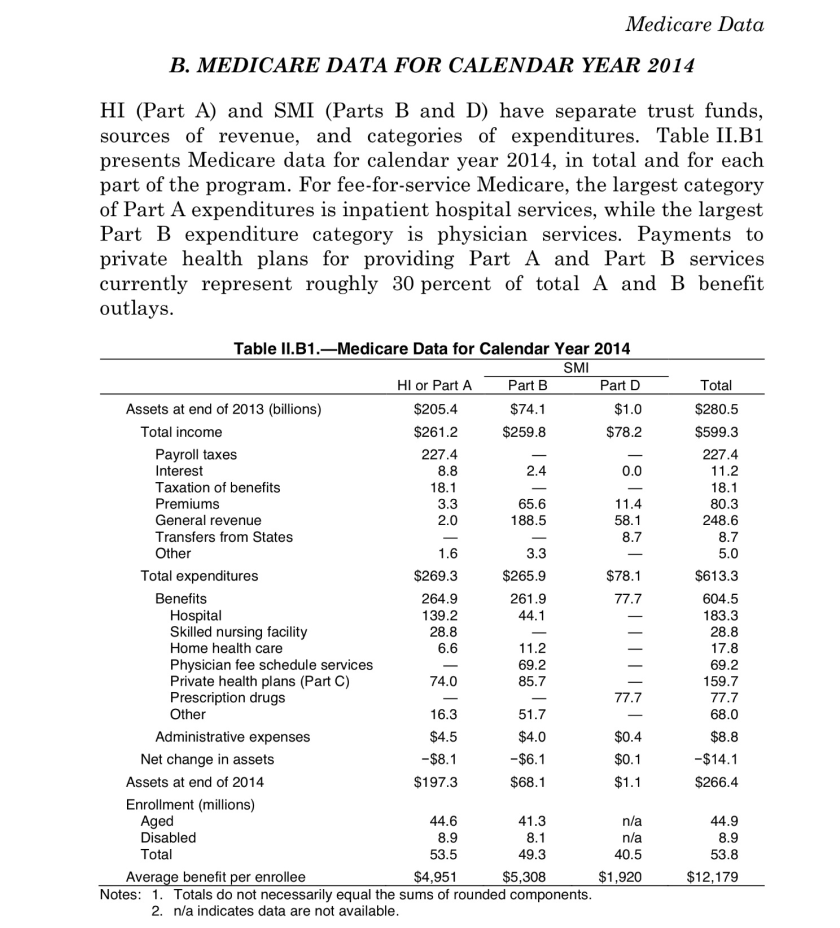

Payroll taxes and premiums in retirement pay only a portion of the cost of Medicare, a small portion when it comes to Part B. And contrary to popular rhetoric, higher income people pay more both in taxes and premiums, including the income taxes they pay on Social Security benefits which are used for Medicare expenses.

Here are the gory details to peruse. Note that for both trust funds there was a decline of $14 billion in assets in 2014 meaning Medicare spent more than it received in income. Note also that the average cost per enrollee $12,179 a year, roughly ten times the typical average premium.

What many people may not realize is the large portion of Part B costs that are funded with general revenue, 72% in fact.