I engage people on various Facebook groups, I follow X, Threads, even TruthSocial. it’s a bad habit, but I can’t break it.

There is a measure of good discussion, give and take, but sadly a very small measure. Mostly it is a display of extreme, short-sighted views and general ignorance on various subjects. .

The worst part is so much of what is said ignores or rejects facts. One person told me what I said were my facts, not his. Another said she had no time to fact check before she posted something.

We read a great deal about they. Who is they? It appears a substitute for the people we elect to Congress or government in general.

Americans seem to have no understanding of the flow of money from them to their government back to them in various forms.

Here is a small, but common, example of misinformation related to Social Security and the inability to link spending, revenue and benefits. The CPI- W used for the COLA uses both those items and more.

The cola should be at least 5% every year they do not count increase in fuel cost or food. No way calculations are all wrong. They need a new way you’re doing it.

It’s like government can spend for us on one hand, but just don’t do it funded by taxes.

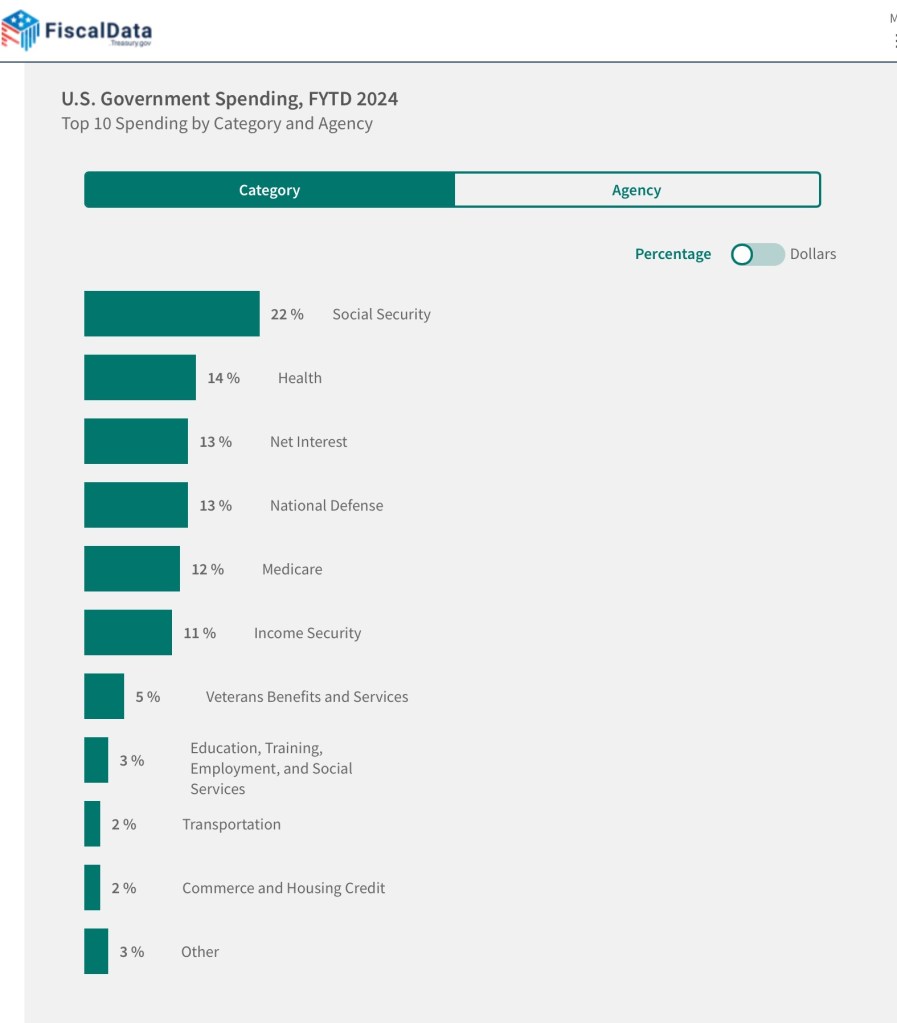

I have repeatedly asked what should we cut spending on to lower taxes? The silence is like a blank stare. certainly there is little understand of how most tax dollars are spent – on seniors by the way.

The United States has one of the lowest tax rates in the world – and among the highest debt. Exactly what do Americans want?

Today by all standard measures the US economy is in good shape for everyone, but the focus is on the price of eggs and a gallon of gas.

In addition to taxes, government revenue also comes from customs duties, leases of government-owned land and buildings, the sale of natural resources, various usage and licensing fees, and payments to federal agencies like the U.S. Department of the Interior.

Lower debt, lower interest expenses before creating new liabilities?

Raise taxes and spend on new programs instead?

Here’s where the money goes. The “other” includes all foreign aid.

So, what do we cut or do we raise taxes? I know raise taxes, but just not on me.

Is anyone surprised!!!! This is all about control–some folks love to control others and the more money, regulations, and court rulings they can get the more they celebrate. They think their sh.. doesn’t stink! Just better folks!

LikeLike

Quinn: The United States has one of the lowest tax rates in the world – and among the highest debt. Exactly what do Americans want?

Al: No it doesn’t.

That right there is the problem. People don’t like facts that mess with their personal views. No way to reach any solutions if you can’t even accept facts.

LikeLike

G–Quinn gave facts about U.S. tax rates v. the rest of the world???–where did you see that in the missive–I missed it.

If all you consider are federal taxes then fine–I look at all taxes–when you write that check for property tax what do you think it is? a charitable contribution–but go ahead have the dufus campaign on taxes are not high enough in this country–the old guy wants more money but can only sell it by the; “pay your fair share” rhetoric–of course down the hall is his cocaine induced son who forgot to pay his fair share for years–isn’t there a trial coming up about that or is that the one about gun possession?

My German born mother-in law; “Joe/Jill you have them the way you raise them.”

LikeLike

In 2021, taxes at all levels of US government represented 27 percent of gross domestic product (GDP), compared with a weighted average of 34 percent for the other 37 member countries of the Organisation for Economic Co-operation and Development (OECD).

Tax Policy Center

LikeLike

@stephendouglas1208. Though Al may be immune to facts, I for one do appreciate you adding this for context.

LikeLike

Back in the day, Senator Daniel Patrick Moynihan quipped “Everyone is entitled to his own opinion, but not to his own facts.” Fast forward 50 years and we can now have it both ways 🙂 When did American high schools drop the required course in Civics and Economics? Around the same time…

LikeLike

“lowest taxes and highest debt”–how do you calculate debt? I hope it’s better than the understanding of inflation–a country’s debt might well be gauged as a % of GDP–highest would be Japan–we are about 11 or 12 in the ranking.

If four of us went to a bar and Bill Gates made five then the average income would be a bit out of place–in other words debt or income needs some context–I have issues with debt because of the consequences to my children and grandchildren and would love to see fiscal sanity but we seem to muddle through.

if we take a devils advocate position; if debt is such an issue then why is it that the world clamors for our bonds–notes–and bills? money floods into the country and when there is any world calamity the dollar moves even higher–in spite of all the talk the business of the world is done in greenbacks–could that change? of course!

Look, Pres. Dufus just added to the deficit yesterday by transferring more student debt to the working man/woman–why would folks like Dick Quinn have any credibility when we hear little or nothing about this–we allow our politicians like Trump/Biden/Obama/Bush to get away with all sorts of deficit raising schemes but refuse to criticize because of our politics. Quinn went on about the Trump tariffs and wouldn’t you know it a day or two later guess what President dufus proposed–TARIFFS!! Quinn was so mad he decided not to let us know.

Trump tax cuts!!! I could easily argue that the dufus is the beneficiary of those cuts–he claims the strongest economy since whenever–so it would be stronger without the Trump cuts–unemployment at 2%?–more money coming in and of course more to spend. Give Clinton credit–when the peace dividend rolled in with the tech capital gains they paid down the deficit. He also raised taxes but in a speech in Houston admitted it was a mistake–look on you-tube it might be there.

“U.S. among the lowest tax rates”–spare me please:: state taxes–property taxes–county taxes–excise taxes–gas tax–transfer taxes on sale of property–you move and your taxed.

Quinn is paying $15,000 property tax and feels undertaxed?? didn’t the Garden State just pass legislation allowing additional taxes to certain school districts? Isn’t the garden state the highest in property taxes? Hey, if you like paying for all those great services then go for it–I think you are # 1 in property taxes and # 4 in overall tax burden–I guess you are shooting for # 1!!

LikeLike

Interesting article–why not admit it has outlived the reasons why the feds thought it important 50-years ago–thank you NPR now that Big Bird has flown from the nest (HBO has it) it’s time for you to go also–a small savings but if we can’t do this then what can we do? So sad it has become a left wing outlet as Mr. Berliner testifies to–public funds should guarantee balance but we all know that has not happened. I am a healthy contributor as we watch Masterpiece which is also available to us thru ROKU and paid for through Amazon I believe–we watch and listen to classical so we feel obligated to pay–but when they call to thank us we have had some interesting conversation. Now 100% of what we give will go to the classical music station

LikeLike

Defund NPR.

then raise income tax on me and everyone above my income level to cover the remainder.

LikeLike

Defund NPR, then raise income tax on me and everyone above my income level to cover the remainder.

LikeLike

Defund NPR, then raise income tax on me and everyone above my income level to cover the remainder.

LikeLike

You can say that again!

Sorry, log in problems.

LikeLike

Worth reading about NPR https://thehill.com/opinion/campaign/3950550-the-truth-about-nprs-funding-and-its-possible-future/

LikeLike

feel free to send in extra dollars at tax time–or give through your worship facility to worthy charities–if you are under-taxed just give the extra amount away and you can assuage your guilt and privilege.

LikeLike

Agreed and here is the website to pay more tax to reduce our debt.

https://www.pay.gov/public/form/start/23779454

LikeLike

“Total proceeds come out to about 0.00047 percent of a national debt that now stands at more than $21.5 trillion.” (2018)

“…such contributions could be deductible on the next year’s taxes – subject to limits on charitable giving, of course.”

“The dirty little secret of the fund, of course, is that it’s not really used to pay down government debt. … No, at the end of each quarter it’s just quietly emptied into something called the Public Debt Redemption Account, according to the Congressional Research Service. From there it becomes part of the general fund, used like every other dollar the government collects to fund infrastructure, education, weapons systems and public assistance, among many other things.”(like NPR?)

USNews.com

LikeLike

We are our brother’s keeper.

LikeLike