Those who rely on these words to trim programs and government are accusing the American people and it’s a ruse simply to trim government.

“The tax credits go to some people deservedly. And we think the tax credits actually go to a lot of waste and fraud within the insurance industry,” said Vice President JD Vance during a recent interview on CBS News. “We want to make sure that the tax credits go to the people who need them.”

The problem is they don’t think, because they are so absorbed with a smaller government ideology.

Why would you seek to lower subsidies when they are not the problem of fraud and waste? Why not specifically identify the fraud and address that problem?

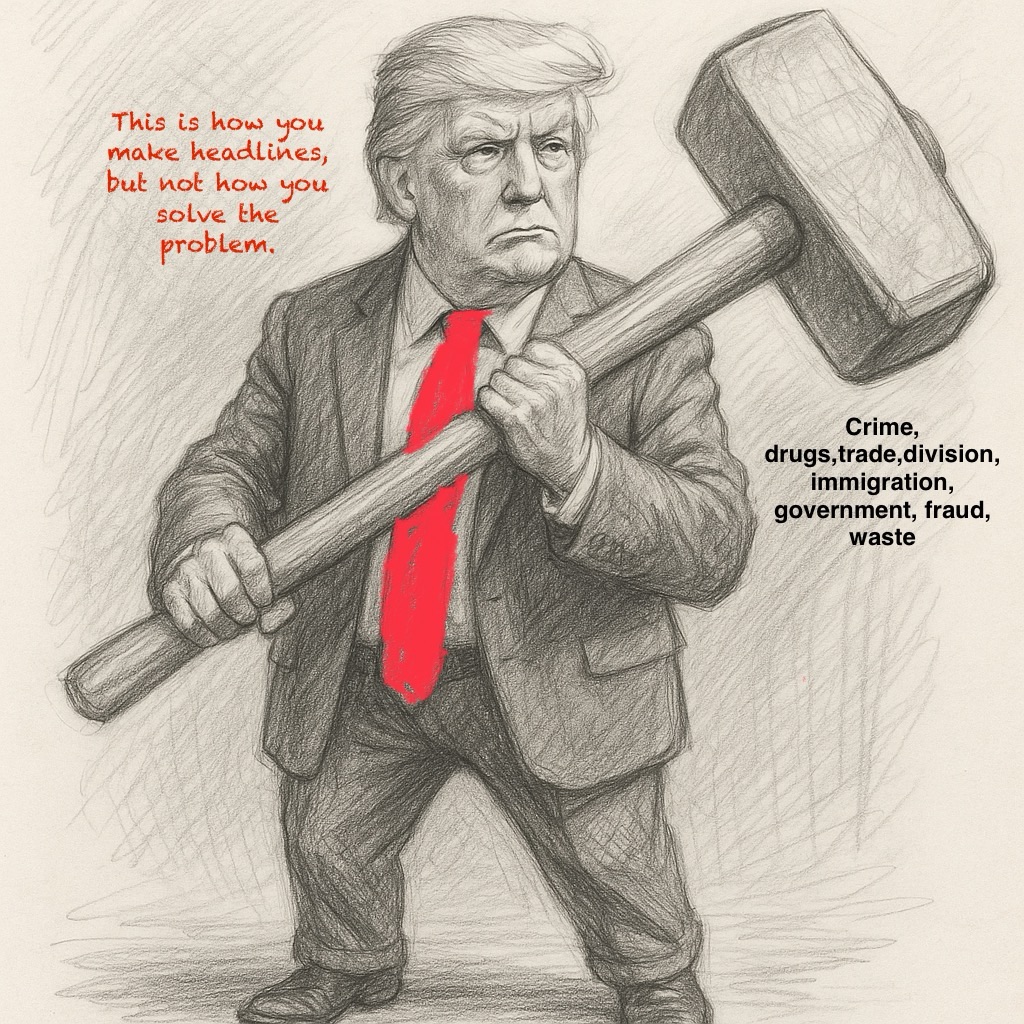

Of course, there is some fraud, waste and abuse. Always has been and always will be, but you zero in on the problems to fix them you don’t apply a hammer to destroy a program.

To accuse the insurance industry in this situation related to premium subsidies is irresponsible and ignorant-but no doubt intentional.

Republicans claim ACA subsidies rebate fraud because many people do not use their health insurance and thus insurance company are paid for nothing and just raise premiums to get more money. That is nonsense‼️

Many people with insurance don’t use it in a given year(s). Many families don’t regularly meet their deductible. That has always been the case and don’t we wish we were among them. Who wants to use any insurance?

As far as the insurance companies go, premiums must be approved before they go into effect. Premiums reflect the claim experience of the enrolled population so if a significant percentage do not use coverage, premiums will be lower and of course, the opposite is true-that’s why adverse selection among plans when people go from one coverage to another can be a problem.

Approval of Marketplace premiums is managed by either a state’s insurance department or the federal Centers for Medicare & Medicaid Services (CMS), depending on which entity operates the state’s health insurance Marketplace. This “rate review” process is required by the Affordable Care Act (ACA) and is designed to ensure accountability and transparency in proposed premium increases.

The authority for review depends on the type of Marketplace in the state:

- State-run Marketplaces: A state’s department of insurance or another designated state regulator reviews and approves proposed rates for health plans sold on its own Marketplace. Some states have stronger authority than the ACA minimums allow, giving them more power to approve, modify, or reject rates.

- Federally-facilitated Marketplace (HealthCare.gov): In states that do not run their own Marketplaces, CMS conducts the review and approves rates. It also acts as a “federal fallback” for rate review in states that have not established an effective rate review program.

How the rate review process works

- Insurers submit proposed rates: Health insurance carriers submit their proposed premium rates to regulators (either state or federal) in advance of the coverage year.

- Scrutiny of significant increases: The ACA requires that any proposed rate increase of 15% or more in the individual and small-group market be thoroughly reviewed to evaluate if the increase is based on reasonable cost assumptions.

- Public justification: The insurer must publicly justify its rate increase, with a summary of the rate review available to the public.

- Finalization: The proposed rates may be modified during the review process and are not final until later in the year, before the start of the next open enrollment period.

We have been getting rid of fraud, waste and abuse for 250 years and yet it persists.

LikeLike