Go to main Forum page » on HumbleDollar for more discussion

AUTHOR: R Quinn on 10/26/2025

Some people see taxes as unnecessary, even illegal and don’t think they should pay. Many people don’t make the connection between taxes and all the programs and services they provide in a society.

I had someone tell me the 16th amendment of 1913 was temporary and thus income taxes are illegal.

There are those who are convinced eliminating fraud and waste will lower taxes – good luck. Interestingly, fraud is committed by our fellow citizens-Medicare is a good example, tax fraud too.

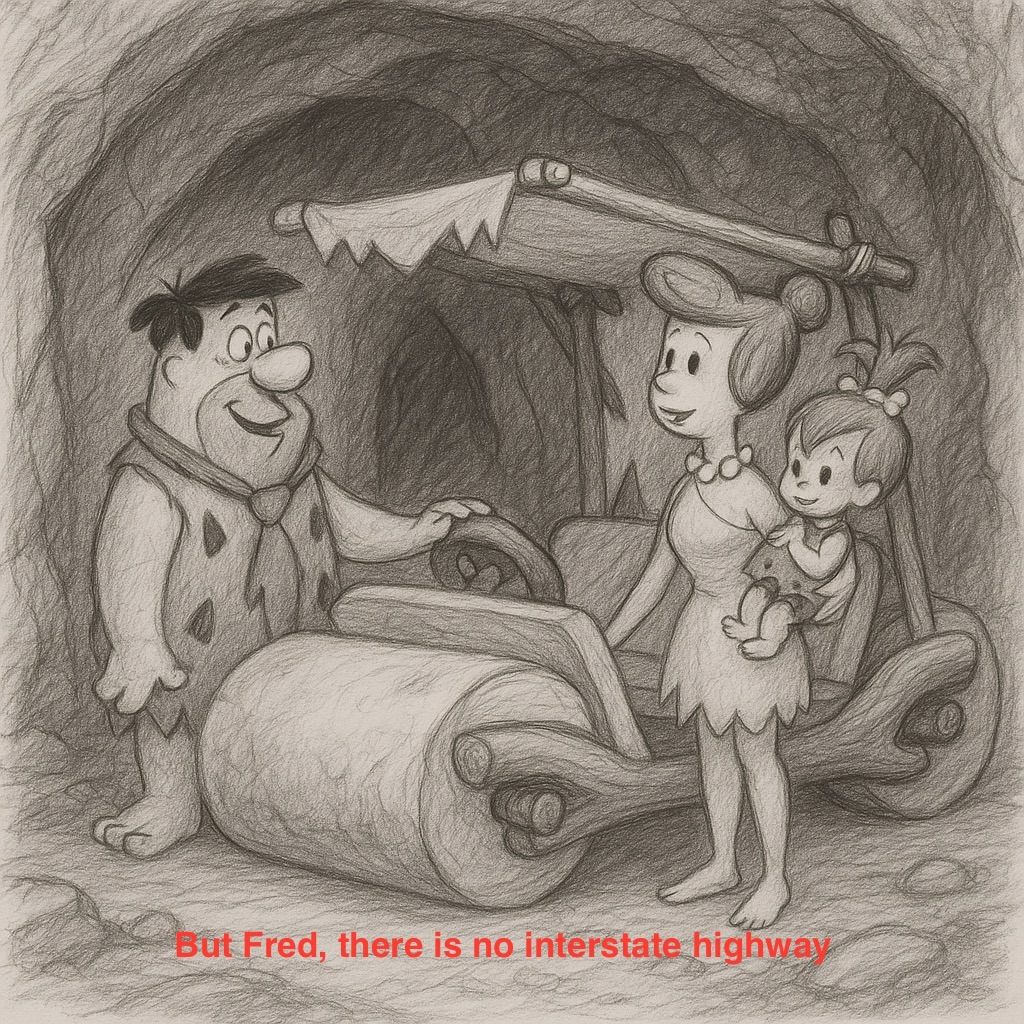

Most underreporting of income is done by small, mostly cash, businesses. It’s not “they” who do such things, it’s some of us. And yes, taxes are necessary. I sometimes wonder, if there were no taxes and no services they provide where would society be? Likely hunter-gathers living in a cave entirely self-sufficient.

When it comes to health care we equate cost with quality. We absolutely do not think we should spend our money on health care. As my friend Jack says, we want the best care someone else’s money can buy. There is some logic to all that. Healthcare is not fun, many times stressful and scary. Who wants to spend hard earned money that way?

I was in a drug store recently. I woman picking up a script was complaining about the $20 copay she couldn’t afford. At the same time she had at least $20 worth of Halloween candy in her cart, at least. You would think $20 is $20, but not when it comes to health care. Our objectivity is clouded.

Many people expect or want their health insurance to pay every service in full, no questions asked, but at the same time complain about their premiums and ignore the absolute connection between claims paid and premiums. When I have challenged such thinking I’m told CEO salaries and profits drive up premiums. That’s is not true. CEO total compensation is a tiny portion of your premium- a few dollars a year in most cases. And, the average net profit margin for the top five health insurance companies was 2.5% last year- far less than even regulated utilities.

Something programmed in us does not want to or cannot deal with the reality of healthcare and money or a society and taxes.

Here is a recent example of a comment I received where the two issues (illogically) merge.

“So you think a 79 year old woman that got hacked up by a surgeon during knee surgery paying for rehab should also pay taxes when her house is paid off 🤔”

In one sentence, claimed poor healthcare, claimed paying for rehab – it is covered by Medicare and other coverages and somehow equating property taxes with a mortgage. And yup, the age factor too as justification for not paying taxes.

Taxpayer money! Spend, Spend, Spend!

My favorite example is in Ohio.

In Cleveland, there is the Gund Arena, now called the Rocket Arena, Home of the Cleveland Cavaliers, and, less than a mile away, the Wolstein Center at Cleveland State University.

In Columbus, there is the Nationwide Arena, home for the Columbus Blue Jackets, and less than a mile away, the Schottenstein Center at Ohio State University.

All four built with taxpayer dollars. Why have one when you can buy votes with taxpayer funding and have two or more.

LikeLike

Taxation and healthcare can cause irritation at times. I can cite a local example. Did local high school here in my area really need a new 62 million dollar football stadium? It looks nice but is the cause of education advanced by building it? That is just one of many examples starting from the local level through the federal level that cause me to regret having to fork over dollars to all their follies.

Healthcare is different in that we want the best care for sure, but then I continually read that we spend by far the most in the world but the results are not the best in the world by far. So I have another cause to regret turning over dollars to that industry.

LikeLike