If tariffs reach that point, you wouldn’t be able to afford to buy much and the average American would suffer the most.

Look at some numbers

Federal Income Tax Revenue

- In Fiscal Year 2024, the U.S. government collected about $2.4 trillion in federal income taxes (primarily individual income tax) — which is one of the largest single sources of federal revenue. PBS+1

💰 Tariff / Customs Duty Revenue

- Tariff (customs duties) revenue is much smaller. Estimates vary depending on how recent policies are counted:

- About $77 billion in tariff and customs duties in FY 2024 under traditional tariff levels. USAFacts

- Under newer tariff policies, reports suggest around $195 billion collected for FY 2025 — still far below income tax levels. CRFB

- Some figures show around $257 billion in total tariff revenues so far in a given year under expanded tariff programs. PolitiFact

Are you willing to put the US economy at risk from the many variables associated with global tariffs?

Right now the lower 50% of American earners pay an effective tax rate of 3.7%. Is it worth paying more for virtually all you buy?

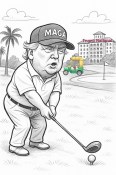

To me, such statements by your president demonstrate again how much he is out of touch with average Americans – and doesn’t really care.