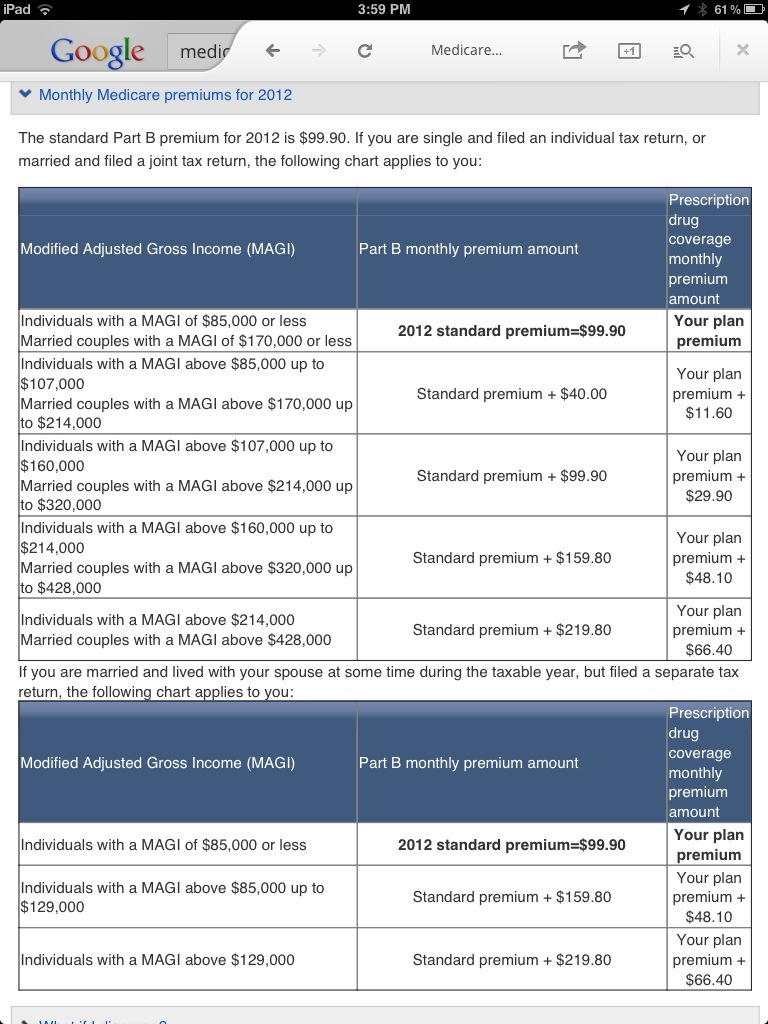

Medicare beneficiaries with higher than average incomes pay the standard Part B premium plus an additional amount based on the total income (Modified Adjusted Gross Income (MAGI) meaning that income not subject to income taxes such as municipal bond interest still counts in the MAGI).

The same is true for Medicare Part D, higher income beneficiaries pay the standard premium for the plan they select, plus the additional premium. The additional premium for Part D also applies to individuals in employer operated Part D plans call Employer Group Waiver Plans. These plans have increased in number as a result of Obamacare changing the tax status of the retiree prescription drug rebate provided to employers who maintained prescription benefits in lieu of Medicare.

Obamacare made another change affecting Medicare premiums by freezing the income threshold for income-related Medicare Part B premiums for 2011 through 2019 at 2010 levels resulting in more people paying income-related premiums, and reducing the Medicare Part D premium subsidy for those with incomes above $85,000/individual and $170,000/couple.

Here is a screen shot from the Medicare website showing the additional premiums applicable in 2012.

What a lot of people might not understand about this until it affects them is that as you move from one MAGI income threshold to another, your premium can go up dramatically as the result of 1 dollar of income. It is not like the progressive income tax where you only pay the increased rate on those dollars that are above the next rate threshold. This is where tax planning can play an important role if you are near one of these thresholds. People who might be thinking of converting tax deferred savings into a Roth IRA or those who may have to take required minimum distributions may find themselves affected.

LikeLike

Very good points. Some people will be in for a nasty surprise two years after taking required minimum distributions from their IRA or 401(k) plan when the higher premium hits.

LikeLike