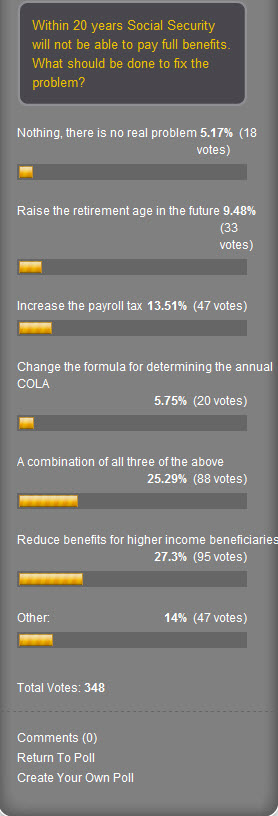

As you can see from the poll results so far on the question of fixing Social Security, there is wide division in how this should be accomplished. Thankfully those in the most denial are relatively few with only 5.17% believing there is no real problem with Social Security. A relatively high number believe the payroll tax should be raised – I’m guessing most of these folks are already retired.

As you can see from the poll results so far on the question of fixing Social Security, there is wide division in how this should be accomplished. Thankfully those in the most denial are relatively few with only 5.17% believing there is no real problem with Social Security. A relatively high number believe the payroll tax should be raised – I’m guessing most of these folks are already retired.

25.29% think a balanced approach including changing the eligibility age, COLA and taxes is the best approach – good for them.

Now we get to the group that is in denial, delusional and apparently buying into the drumbeat of social division. From my perspective a disturbing 27.3% say the way to fix Social Security is to cut the benefits for higher income Americans. Notice I purposely did not define higher income, but apparently that does not matter. I guess anyone making more than you do is higher income.

What do you say? How should we really fix Social Security?

So far we have gone from incoming payroll taxes paying the benefits, to incoming taxes and interest on bonds paying benefits. Next the Trust will be redeeming bonds plus using incoming taxes and interest on remaining bonds to pay benefits. And once the bonds are redeemed, the incoming taxes will only be sufficient to pay about 75% of the promised benefits.

One question keeps surfacing and that is does Social Security have anything to do with the federal deficit? Sen Bernie Sanders and others in Congress say no. Look at the link below referencing Ronald Regan taking that position as well. Here is what the article says:

Reagan said, “Social Security, let’s lay it to rest once and for all… Social security has nothing to do with the deficit. Social Security is totally funded by the payroll tax levied on employer and employee. If you reduce the outgo of Social Security, that money would not go into the general fund or reduce the deficit. It would go into the Social Security Trust Fund. So Social Security has nothing to do with balancing a budget or raising or lowering the deficit.”

Back in 1984 when Reagan said those words, it was accurate, payroll taxes paid all the benefits and there was money left over to buy additional Treasury bonds so it had nothing to do with the deficit. But today things are very different!

You can draw your own conclusion, but here are the facts. When incoming payroll taxes exceeded the benefits paid, the Trust purchased special bonds from the Treasury that paid interest. Where does the interest come from? The proceeds from the sale of the bonds was used by the government for all the stuff the government spends money on – just like your taxes. Now, when the Social Security Trust starts to redeem the bonds, the Treasury must come up with the money to transfer to the Trust to be used to pay benefits. The government currently spends about $3 billion more a day than it receives in revenue so it is a pretty good bet that it must borrow more money to pay the interest on the bonds and even more to redeem the bonds when called by the Social Security Trust. So, does the borrowing of more money add to the deficit? If not, where does it come from?

Here is what the motherjones.com link below says:

What actually happened is that the Social Security surplus was invested in treasury bonds. What does that mean? It means that workers gave money to the federal government, which turned around and spent it. In return, the Social Security trust fund received bonds that represented promises to repay the money later out of the federal government’s income tax receipts. In effect, it gave workers a claim on the income tax receipts of the government at a later date in time. When that time came, the federal government would have to pay up, which would make it less profitable. If the government was already running a deficit, it would make the deficit even worse.

Yes, the current status of Social Security funding does add to the deficit and to change that will take a cut in the benefit payments in some manner and/or an increase in payroll taxes … and that’s the truth.

Related articles

- The World’s Easiest Plan to Rescue Social Security (motherjones.com)

- The truth about entitlements and the deficit. Why Americans don’t want the truth about Social Security and Medicare and why politicians won’t tell you. (quinnscommentary.com)

- Ronald Reagan’s Message for the GOP, ‘Social Security has nothing to do with the deficit.’ (politicususa.com)

- 10 Things You Must Know About Social Security (dailyfinance.com)

- For the Last Time, the Social Security Trust Fund Is Real (motherjones.com)

I blog often and I genuinely thank you for your information.

The article has really peaked my interest.

I’m going to take a note of your website and keep checking for new information about once a week. I subscribed to your Feed too.

LikeLike

Denial, dillusion and division…. I wonder how much of the response to the survey is actually denial or dillusion. I think it has more to do with self interest. Judging from the responses and as a regular reader of this blog, I would venture to guess that most of the respondents are either already receiving social security or close to being eligible. Do you have any idea what demographic reads your blog?

Keep up the good work, Dick.

LikeLike

The Washington Post/ABC polls generally show that slightly less than 20% of the country thinks Social Security is fine. The point here is correct that the support is highly fragmented.

What is missing from the poll is raise taxes on whom. Tax 1 which is very unfavorable is raise the percentage of the tax. Tax 2 is increase the cap. It is less unfavorable because it affects someone else.

The figures from the Trustees already assume that payroll taxes will return to 12.4% from 10.4%. The Trustees already make that assumption. Without that increase the system crashes that much faster.

LikeLike

Without the payroll tax increase back to normal levels the system doesn’t crash sooner, but the federal deficit surely grows because Treasury is replacing the money lost to the Trust with more borrowed money. Either way there are bad results.

I argued from the beginning that workers should have taken that 2% windfall and increased their 401(k) contribution or placed the money in an IRA which not only boosted their retirement savings but when the tax break ended they could adjust with no negative impact on take home pay.

I could probably count on one hand the people who followed that suggestion.

LikeLike

My comment assumes that the government will be unable to extend the subsidy for the system. It is a difficult subsidy to explain because it is one which rewards workers over the unemployed. These people are getting full credit for contributions that they are not making. If you had put the 2% into private accounts the subsidy and who is rewarded would have been much clearer, and politicians aren’t looking for transparency in Social Security.

The payroll tax was not a good idea because it is going to be very difficult to find people who now want to raise taxes for a system that is heading for failure. It shifts the burden of the system from the covered worker to the general taxpayer. There is no reason that millions of Americans who can’t collect from the system should be asked to pay for it. So the question is how temporary is it.

LikeLike

Good points.

LikeLike