I am now convinced that it is possible to spin news in just about any way you like. Here is an excellent example of spinning left to build your case absent consideration of the facts. Read the following from the L A Times.

Fear-mongers and other critics of Social Security were silenced — momentarily — by the release last week of the annual trustees’ report for the programs. The report showed not only that it’s looking pretty good in the near term, but in the long term it’s more important to the sustenance of millions of Americans than ever before.

But policymakers and pundits have taken the wrong lesson from these findings. The argument they most often put forward is that Social Security is so important it must be “saved,” typically by cutting benefits to bring its outflow in line with its income.

But the right conclusion is that it should be expanded. This is the proper moment to do so, because the shortcomings of the rest of our retirement system have never been so obvious.

Social Security is still recording a surplus of income over expenses, and even looking ahead 75 years, its projected actuarial deficit is manageable within a growing economy. In fact, its trustees say the program’s share of national wealth will stabilize as the baby boom generation moves into and — what’s a polite way of saying this? — out of retirement.

Social Security should be expanded, not cut – latimes.com

The Trust is not recording a surplus in the true sense and even if it was, a more detailed analysis of the Trustee’s Report is required. Rather the situation is like being unable to make the monthly payment on your credit card but continuing to charge new purchases because you haven’t reached your charge limit. The Trust used to create a surplus because incoming taxes exceeded the benefits paid; no more. Now to pay benefits the Trust uses all incoming taxes plus a portion of the interest. And where does the interest come from? It comes from the Treasury of the Federal Government, a government that continues to spend more than it take in. Does that sound like a sound financial plan? Should we ignore (the Trusts) “become depleted and unable to pay scheduled benefits in full on a timely basis in 2033.” So for seven years interest on bonds adds to the Trust and then it’s down hill and in twenty years both incoming taxes and interest are insufficient to pay full benefits.

I will leave it to you to draw your own conclusion about the financial state of Social Security.

Now here is the exact text of The Trustees 2013 report.

Conclusion

Under the intermediate assumptions, the Trustees project that annual cost for the OASDI program will exceed non-interest income in 2013 and remain higher throughout the remainder of the long-range period. The projected combined OASI and DI Trust Fund asset reserves increase through 2020, begin to decline in 2021, and become depleted and unable to pay scheduled benefits in full on a timely basis in 2033. At the time of reserve depletion, continuing income to the combined trust funds would be sufficient to pay 77 percent of scheduled benefits.

However, the DI Trust Fund reserves become depleted in 2016, at which time continuing income to the DI Trust Fund would be sufficient to pay 80 percent of DI benefits. Therefore, legislative action is needed as soon as possible to address the DI program’s financial imbalance. In the absence of a long-term solution, lawmakers could choose to reallocate a portion of the payroll tax rate between OASI and DI, as they did in 1994.

For the combined OASI and DI Trust Funds to remain solvent throughout the 75-year projection period: (1) revenues would have to increase by an amount equivalent to an immediate and permanent payroll tax rate increase of 2.66 percentage points1 (from its current level of 12.40 percent to 15.06 percent); (2) scheduled benefits during the period would have to be reduced by an amount equivalent to an immediate and permanent reduction of 16.5 percent applied to all current and future beneficiaries, or 19.8 percent if the reductions were applied only to those who become initially eligible for benefits in 2013 or later; or (3) some combination of these approaches would have to be adopted.

The Trustees recommend that lawmakers address the projected trust fund shortfalls in a timely way in order to phase in necessary changes and give workers and beneficiaries time to adjust to them. Implementing changes soon would allow more generations to share in the needed revenue increases or reductions in scheduled benefits. Social Security will play a critical role in the lives of 58 million beneficiaries and 163 million covered workers and their families in 2013. With informed discussion, creative thinking, and timely legislative action, Social Security can continue to protect future generations.

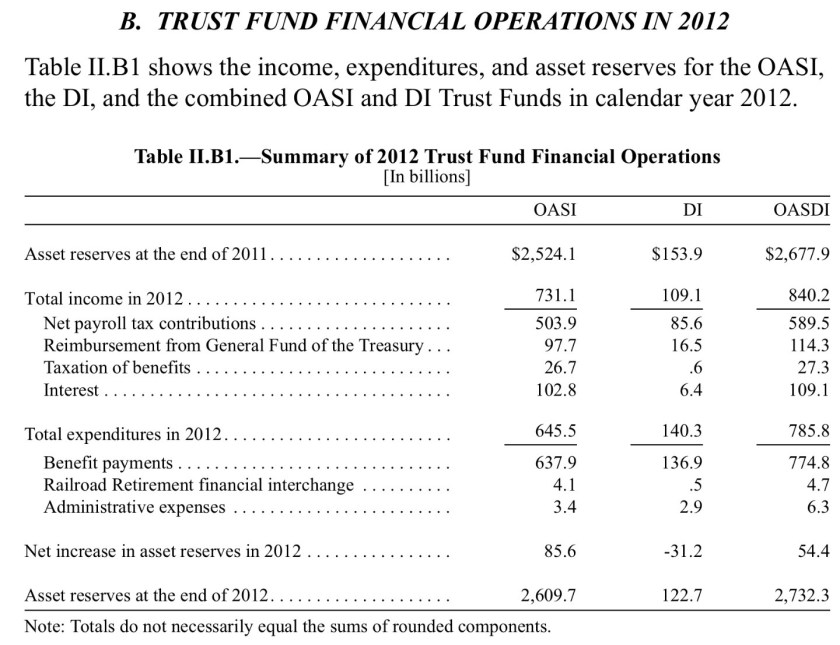

Following are the numbers from the Trustee Report. Note the status of the disability trust. The “Reimbursement from the General Fund” represents the payment to make up for the loss due to the payroll tax holiday.

Sent from my iPad

>

LikeLike