2013

So, are government workers overpaid? Ok, that’s not a fair question because I am sure that some good workers are actually underpaid, but that is not the real issue. The issue is, are public employees paid a fair total compensation package that is affordable to taxpayers? The answer to that question is probably no. As you can see from the numbers below, government workers are paid on average 44% more than private workers (1). The caveat below notwithstanding, the fact is that public employees have a good deal; better than most workers in the private sector. Much of this good deal comes in the form of tax-free and tax deferred compensation such as generous health benefits and pensions, both rare and still declining in the private sector. Public employee unions with the cooperation and in some cases complicity of politicians, have crafted generous compensation packages while creating the impression these workers are underpaid.

In some cases, but certainly not all, public employees have traded some cash compensation for these tax favored benefits (perhaps President Obama would refer to them as loopholes … or maybe not in this case), but that does not change the relative value of the total compensation package or its cost to taxpayers. How many private sector workers would take a modest cut in pay for a guaranteed pension (frequently with a COLA) and generous active and retiree health benefits sometimes with minimal employee cost-sharing. As I said, it’s a good deal … that you are paying for.

From the Bureau of Labor Statistics 10:00 a.m. (EDT) Wednesday, June 12, 2013

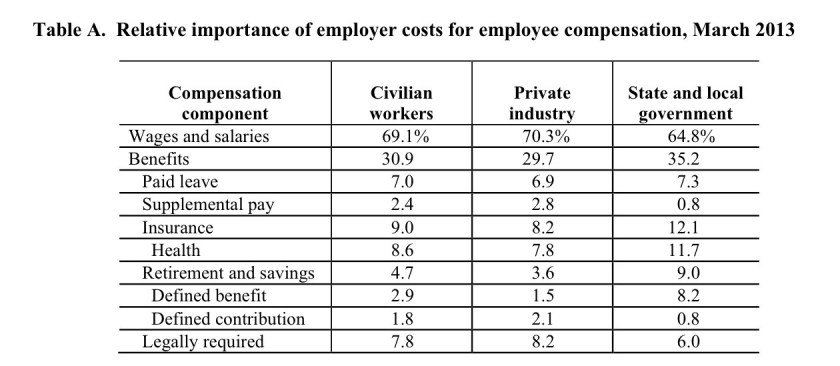

Employer costs for employee compensation averaged $31.09 per hour worked in March 2013, the U.S. Bureau of Labor Statistics reported today. Wages and salaries averaged $21.50 per hour worked and accounted for 69.1 percent of these costs, while benefits averaged $9.59 and accounted for the remaining 30.9 percent. Total employer compensation costs for private industry workers averaged $29.13 per hour worked in March 2013. Total employer compensation costs for state and local government workers averaged $42.12 per hour worked in March 2013.

(1) Compensation cost levels in state and local government should not be directly compared with levels in private industry. Differences between these sectors stem from factors such as variation in work activities and occupational structures. Manufacturing and sales, for example, make up a large part of private industry work activities but are rare in state and local government. Professional and administrative support occupations (including teachers) account for two-thirds of the state and local government workforce, compared with one-half of private industry.

Hello, i feel that i noticed you visited my website so i came to go back the desire?.I’m trying to

in finding issues to improve my site!I suppose its good

enough to use a few of your concepts!!

LikeLike