2013

A recent opinion piece in the New York Times suggests one way to solve the Medicare fiscal crisis is to tax the value of benefits received. You have to admit this is creative thinking even if it sounds bizarre. There is no doubt on average beneficiaries receive more in benefits than they pay in over a lifetime, but that might be true for other forms of insurance as well. And what about the person who doesn’t get back more, do they get a rebate?

An alternative suggestion is to charge beneficiaries 50% of the cost of Part B rather than the current 25%. [see the note below] While there is sound logic for that, even the hint of such a change would have the AARP organizing a million walker march on Washington.

Given a significant number of Americans on Medicare and Social Security pay little or no income tax in the first place because of their low income, one wonders how such an idea would work. Is he suggesting a tax on everyone or just an added tax on the proverbial “wealthy?”

Take a look at the full article yourself and let’s have a few comments on this one.

According to a May 2013 poll by the Harvard School of Public Health, two-thirds of people believe their lifetime taxes and premiums at least cover the cost of all their Medicare benefits; 27 percent believe their benefits equal their contributions, while 41 percent think they get back fewer Medicare benefits than they paid for.

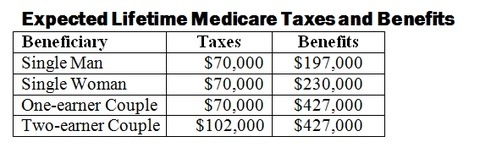

In reality, almost everyone gets back far more in Medicare benefits than they ever pay into the system. What follows below are new data from the Urban Institute on lifetime benefits and taxes for those with average lifetime wages. The figures are a “present value” calculation – all future benefits discounted to today – in inflation-adjusted 2013 dollars.

via Taxing Medicare Benefits – NYTimes.com

Here are some suggested ways to tax Medicare benefits from the Urban Institute.

Medicare is a tough nut to crack and all ideas are welcome, but these free thinkers need to consider the macro picture. Today the average person is struggling to fund retirement, fund education, pay health care bills and more. Going forward meeting all those goals while taxes to pay for Social Security and Medicare are going up will be next to impossible. While employment based benefits disappear, individual responsibility increases and right or wrong the average person simply can’t handle that; fiscally or otherwise.

NOTE When Medicare began in 1966, the Part B monthly premium paid by beneficiaries was set at a level to finance 50% of Part B costs; general revenues financed the remainder. Legislation enacted in 1972 limited annual premium increases. As a result, beneficiary contributions dropped to below 25% of program costs by the early 1980s. Since the early 1980s, Congress regularly voted to set Part B premiums at levels to cover 25% of program costs. The Balanced Budget Act of 1997 (BBA 97) permanently set the Part B premium at 25% of program costs. Certain low-income beneficiaries are entitled to assistance in paying their Part B premiums. Beginning in 2007, certain high income Medicare enrollees began paying a higher percentage.

Dick, did the adjust for Medicare Part B and Part D surcharges? Did they factor in the PPACA taxes, and did they factor in the general revenue taxes? Looking at the comparison,, that does not appear to be the situation.

As we have discussed a number of times, this is a great example of how those who have been shouldering more than their potential benefits are being asked to pick up the slack. So, raise taxes on everyone, and then implement an “estate tax” to the extent individuals incur present value of claims > present value of an individuals contributions. Where taxpayers have funded the difference, there should not be a legacy gift to children or grandchildren. Beyond that is the “social” in social security and Medicare.

LikeLike

The chart of taxes paid versus benefits received is based on people retiring in 2030. We are not quite there yet but on average, people get more than they pay for from medicare. There is no doubt that in their present form, both social security and especially medicare are fiscal failures due to their Ponzi like structures and lack of legislative will to make necessary actuarial changes in a timely manner. The fact that the average “Joe citizen “doesn’t understand or take the time to educate themselves on the economics of the system doesn’t help the situation either. This country needs to go back to the drawing board and entirely revamp the tax code and all its loopholes, expenditures and preferences while at the same time getting a grip on entitlements. Anything short of this will just be putting rubber bands and sealing wax on a terribly flawed system. A perfect example of this is fixing a health care system with Obamacare. Do I think any of this might happen in the near future? That’s an unqualified NO, not with the current state of politics but if it doesn’t happen eventually, government shut downs and debt limit fights will seem like a walk in the park.

LikeLike

Social Security recipients on Medicare already pay over $100 a month for the health benefit as well as have to pay co-pays. With Social Security income down and so many of us losing what little investment we made when the marker crashed, taxing Medicare benefits hardly seems the right thing to do when we are hardly “making it” now. I would think this should be reconsidered when looking at what seniors have to deal with now with low cost incomes from SS, a small investment due to market crash and co-pays and monthly deductions for Medicare. Think twice before making the stastement to tax Medicare!! Stupid thinking!

LikeLike

I think you take a limited view of this. I agree that taxing the Medicare benefits paid is a dumb idea, but the reality is that for most people on Medicare it would have no impact as they pay no income tax.

The $104.00 you pay for Medicare is a fraction of the cost. It is 25% of the cost of Part B alone. You do not pay anything in retirement for Part A which is far more costly.

As far as investments go, the stock market has fully recovered and much more. So unless a person got out of the market after it crashed, they are ahead of the game at this point. The stock market has doubled in value since the bottom in 2009.

Medicare is going broke because it’s spends more money than taken in through payroll taxes, Part B premiums and the income tax some people pay on their Social a Security tax.

How do we fix this? Where does the money come from? Do we ask our children and grandchildren to carry the whole burden?

Dick

Richard D Quinn

Blog http://www.quinnscommentary.com Twitter @quinnscomments

>

LikeLike