2013

Following is an excerpt from a Congressional Budget Office report released December 20th. You can read it for yourself, it requires no embellishment from me. Suffice to say those who oppose any changes to these programs should take notice … oh I forgot, we can just raise taxes … On everyone.

How Big Are Projected U.S. Deficits and Debt?

Between 2009 and 2012, the federal government recorded the largest budget deficits relative to the size of the economy since 1946, causing federal debt to soar. At 72 percent of GDP, federal debt held by the public is now higher than it has been at any point in U.S. history except for a brief period toward the end of World War II and a few years after; and it is twice the percentage recorded at the end of 2007. If current laws generally remained in place—an assumption underlying CBO’s baseline projections—federal debt held by the public would decline slightly relative to GDP over the next several years. After that, however, growing deficits would ultimately push debt back above its current high level, in CBO’s estimation. In 2038, CBO projects, federal debt held by the public would reach 100 percent of GDP—more than in any year except 1945 and 1946—even without accounting for the harmful effects that growing debt would have on the economy; taking those effects into account boosts projected debt to 108 percent of GDP.

How Are Major Components of the Budget Changing Over Time?

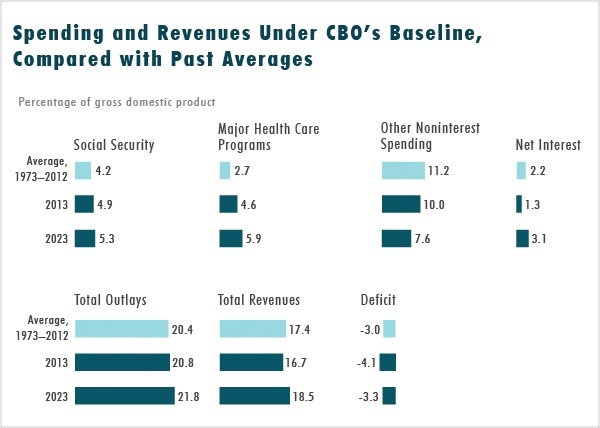

If current laws remained unchanged, Social Security and the federal government’s major health care programs would absorb a much larger share of the economy’s total output in the future than they have in the past (see the figure below). Projected increases would stem from three factors: the aging of the population; rising health care spending per beneficiary; and changes related to the Affordable Care Act, specifically the introduction of exchange subsidies and the expansion of Medicaid in many states. Meanwhile, by 2020, spending for all other federal activities would account for its smallest share of GDP in more than 70 years. Taking those pieces together, total federal spending other than interest on the debt would be greater relative to the size of the economy than it has been, on average, during the past 40 years.

At the same time, under current law, revenues would represent a larger percentage of GDP in the future than they generally have in the past few decades. However, CBO projects that revenues would not keep pace with outlays, so deficits would rise and federal debt would grow at a faster pace than the overall economy.

While expressing the debt in terms of percentages of GDP is OK for economists, I would suggest the CBO, and those who report the news, start also reporting this information in both nominal and inflation adjusted dollars.

Simply, people have no feel for what the percentages of GDP mean/portend.

LikeLike