When should you begin your Social Security benefit? Damn if I know!

Seriously, there are many personal factors that determine when to start Social Security benefits. Do you need the money as soon as you can get it? If so, age 62 may be for you. If you are still working at age 62, you probably don’t want to begin Social Security before your normal retirement age, or later.

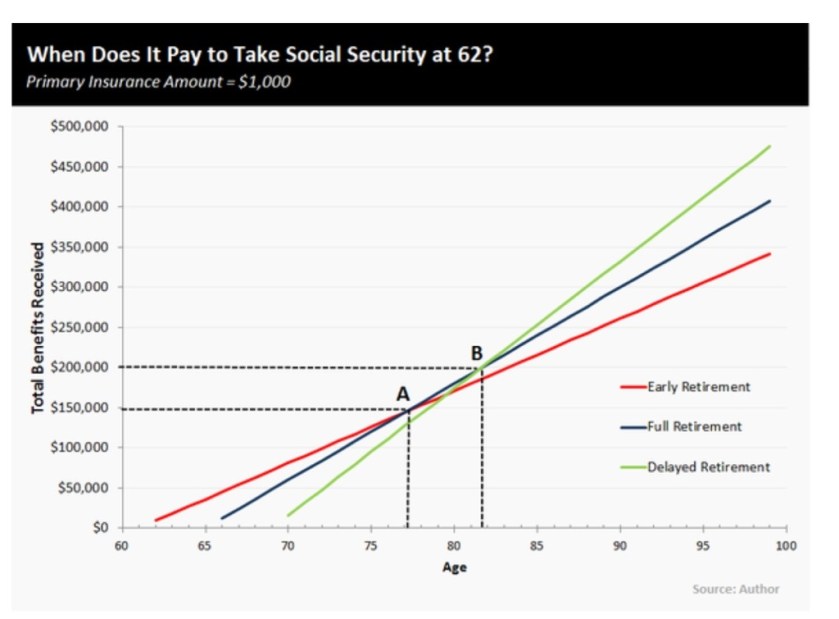

But here is the key question from my perspective. What is more important to you, the largest possible monthly benefit for your life or maximizing the total accumulated benefits you receive?

If you are in the maximize my total cumulative benefits camp, read this article, “Why taking Social Security at 62 is Smart”

The other side of the story is helping you deal with income needs during your entire retirement which can and hopefully will last decades. The longer you wait to begin your Social Security benefit, the larger the payment will be. I look at it this way, if you are 80 years old, do you care that you have reached the so-called break point where your total reduced benefit collected equals the total you would have received had you delayed the start of payment?

The other side of the story is helping you deal with income needs during your entire retirement which can and hopefully will last decades. The longer you wait to begin your Social Security benefit, the larger the payment will be. I look at it this way, if you are 80 years old, do you care that you have reached the so-called break point where your total reduced benefit collected equals the total you would have received had you delayed the start of payment?

Does the total you have collected over the years really matter to you or is it more important to have a monthly benefit 25% or more higher when you need it the most?

Here is a discussion from the Social Security Administration you should read. And here is information from the Congressional Budget Office on the financial impact of beginning benefits at age 62.

</a

</a

.

Neither of my parents lived to the SS break even age.

My sister died at age 66. My grandmother died at 79,

in an auto accident. I would have to go back three

generations to find an ancestor who lived into his 90s.

I’ve based my decision to retire at age 62 on real life,

not on government stats and averages. Delaying SS

is in the government’s interest… not mine.

.

LikeLike

Not sure I understand the logic. If you live to the breakpoint you are ahead in total payout, but what does that do for you if you live five more years and could use that extra 25% or so in the monthly check. I don’t see what’s in the governments interest in any way, it’s your and your employers money.

LikeLike

.

” If you live to the breakpoint…. ”

That small word, ” if “, can make a big difference.

My parents did not live to the break even age.

Only one of my grandparents lived beyond the

break even age. My sister died at age 66.

I understand SSA.gov removed it’s break even age

calculator years ago… wonder why.

.

LikeLike

The SSA has a good discussion of the implications at the kink I put on the blog. I would still argue that the total collected does not matter. What matters is the monthly benefit you get and what you need to live on each month. A beneficiary may die before 62, at 63, or 66 or 77 or 97 each will collect from zero to far more than they paid in. Funding and taxes are both based on all these actuarial variations. It’s like a pension plan. I don’t care about anything other than my monthly check and collecting it for the longest possible time. And unlike Social Security, my pension never increases.

LikeLike

Obviously, for those who retire before age 62 and require social security to survive, there is no choice to be made. For those who social security will be the main source of income in retirement, maximizing benefits should be their main concern for future years.

I would suggest that for those who will not be relying on social security as a primary source of retirement income it may make more sense from the self-interest standpoint to use the breakeven point as primary in the decision making process. A few points to consider that aren’t mentioned in most social security calculators are

Taxes- assuming you have income from pensions, annuities or investments, each extra dollar from social security will be taxed possibly at higher rates.

Medicare premiums- Again, assuming other income, higher social security payments could raise your Medicare premiums.

Guarantee- you have no guarantee that social security payments won’t be means tested in the future. Medicare premiums are already means tested as of 2007.

Life expectancy for males is 77.4 years. That’s an average which means about half will die sooner. Are you feeling lucky? Is a bird in the hand worth more than 2 in the bush?

The decision when to take social security benefits is highly individualized. In my case, the break-even point was about age 79 and the average mortality age is 77.4. The decision was easy.

LikeLike

.

Is it just a tax coincidence that the push to delay SS to age 70

to get the highest monthly benefit dovetails with the beginning

of taxable traditional IRA required minimum distributions ??

Or is government manipulating the herd ?

.

LikeLike