Have ever heard the phrase “total compensation?”

What it means is your cash pay, possibly bonuses and mostly your employee benefits in the form of retirement plans, health benefits, sometimes life insurance and more. Among large employers total compensation also includes similar benefits in retirement.

In other words, while you are actively employed you are trading cash compensation for employee benefits while an active employee and during your retirement.

We all know the days of retiree benefits of any kind are disappearing fast which in the long-term will be yet another short-sighted move by American employers.

However, not content to change the deal for future employees and future retirees, more and more companies are pulling the security rug from under those already retired and who, during their working years, paid for these benefits in the form of less cash compensation.

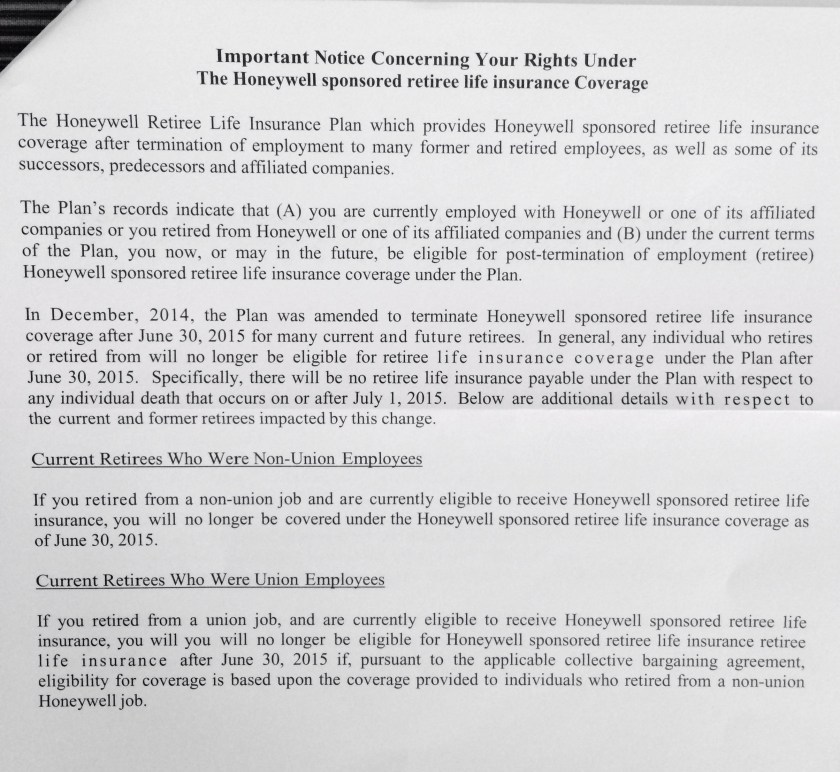

Such behavior is reprehensible in my book. Here is a recent example. This large company simply sent a letter to its retires telling them that on July 1, 2015 the company is terminating the employer-provided life insurance as a “reasonable measure to effectively manage our expenses.”

Reasonable for who, the retiree who was counting on those survivor benefits which for many years were promises made to those retired and planning to do so? Oh, there is no legal promise to be sure, which no doubt is the basis upon which these actions are taken, but there sure is a moral and ethical promise, but these days who cares about that?

Most employers would like a focused, productive engaged workforce. But apparently ethical behavior on the employers part or should I say on the part of the employer’s senior management is not part of the equation.

So, if you are retired and among those fortunate to have retiree benefits of any kind, watch your mail and keep looking over your shoulder. It took a massive federal law to protect your pension or 401k; nothing protects your other benefits, apparently not even the integrity of people running corporate America.

One more time. If the employer had legally committed, had contractually commited, had vested and fully funded these benefits, current and former employees, now retired, would have no concerns and coverage would continue.

But, much like pension plans, where there are legal, anticutback provisions in the statute, beyond contractual provisions, if part of the benefit is not vested, if the benefit is not fully funded, you only get what is vested and insured by the PBGC, and, then, not necessarily all vested benefits as there is a dollar limit on insurance.

What did the employee “earn” as part of his total compensation? Here, the employee did not earn a vested, funded benefit. Had the employer wanted to provide a vested, funded benefit, nothing stopped them – there was no barrier to making that commitment and funding it. Had the employee been provided a vested, funded retirement benefit, it wouold have reshaped the total compensation, the total rewards pie, where a greater slide would have gone towards future benefits, and less to current benefits and current, direct compensation.

No, instead, the employee earned access to that coverage that would be maintained regardless of employment, BUT at the discretion of the employer. They obviously included in contractual language a reservation of rights clause – reserving the right, without needing to seek approval from employees in any way – the ability to amend, modify, terminate or otherwise alter the benefits.

Retirement benefits without funding and vesting are mere dreams. And, frankly, that also applies, to a lesser extent to pension plans. If you work 30 or 40 or more years for a specific firm, and you have accrued and vested a fantastic pension benefit, and the plan is underfunded, and terminated, even though you are fully vested, insurance from the Pension Benefit Guarantee Corporation only goes so far… and you probably end up leaving some on the table. Even Congress has prospectively adjusted this statutory pension promise, some for already accrued and vested benefits, by most recently amending the multiemployer provisions because of widespread underfunding – instead of increasing the insurance and, consistently, the cost to insure those benefits.

For these retiree welfare benefits, where is the insurance policy, where is the trust with funding? That it never existed, it shows clear intent.

You and I know that there is such a thing as a Summary Plan Description and a written plan document. For a reservation of rights provision to have effect, it must be clearly stated. During my 35 years in employee benefits, so far, I have always had access to the SPD, I have always obtained copies of written plan documents, and, I have yet to have the luxury of a plan where the employer has made a European-style commitment – to maintain the same accrual rates, to avoid prospectively changing benefits including terminating coverage, etc.

I have seen such committments, on a limited basis, where perhaps as part of an early retirement window, as part of the consideration for separating at that time, I have seen committments to continue coverage. But, obviously, this was not part of the regular plan – but a committment outside the plan by the employer. So, the guarantee is only as good as the employer’s solvency and committment.

What did the employee earn? They earned access to coverage per the terms of the plan. They never earned, and should not have expected lifetime coverage – it says so, right there in the written plan document, the Summary Plan Description and the insurance policy.

LikeLike

Jack, you know I know all that. And I suspect you know that is not the point. What you can do legally and what is ethically the right thing to do are different things, at least when it comes to this stuff. Except where it’s buried in SPDs as required, no employer touts its ability to unilaterally take away benefits people count on especially in the case of retired people who have no recourse whatsoever. As I said before, it may be legal, but that doesn’t make it right. In addition, this kind of thing plays right into the hands of the Liz Warrens and Bernie Sanders of the world and into general anti business sentiment. These are not solvency vs insolvency

LikeLike

Sorry, insolvency issues, it’s some guy in finance looking for ways to boost earning a half cent in the next quarter.

LikeLike

Yup, spent 43 dedicated years, working my butt off, retire with benefits and after 5 years of retirement they took away my company retiree health coverage, then 5 years later took away the life insurance. Actually they did me a favor with the health insurance as I finally woke up and found I was paying most of preimium. Got AARP at a third the price and MUCH better coverage. So much for employee dedication. American industry is on the down slide.

LikeLike