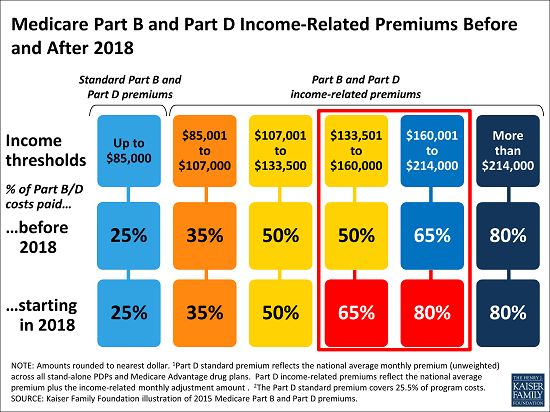

Take a look at the new cost-sharing under Medicare. Come 2018 higher income, but hardly the wealthy 1%, will be paying 80% of the cost of Part B and Part D of Medicare. That is considerably higher than most working Americans with health benefits pay. Note the income levels are not indexed so more and more Americans will be paying supplemental Medicare premiums in the years ahead. These amounts are for a single person.

A Kaiser Family Foundation analysis finds that, as a result of the provision, Part B premiums are expected to rise from $238 per month to $310 per month for Medicare beneficiaries with incomes from $133,501 to $160,000 ($267,001-$320,000/couple) in 2018, based on projections of Part B program costs from the Medicare Trustees. This is because the law raises Medicare premiums to cover 65 percent of program costs (from 50 percent) for beneficiaries in this income bracket. Similarly, for beneficiaries with incomes between $160,001 to $214,000 ($320,001 to $428,000/couple), monthly Part B premiums are expected to rise from $310 to $381 per enrollee in 2018, covering 80 percent of program costs (rather than 65 percent).

Great. Dick, you are always hot on corporations breaking promises they never made – where they have a reservation of rights clause and take advantage of it long after people’s expectations have been set. Here is an example of our fine government taking comparable action.

The first 25 years I paid into Social Security/Medicare, 1969 – 1993, I paid Medicare taxes each year (plus an equal amount from my employer), that ranged from < $468*2 (1969 maximum) to $1,958 *2 (1993 maximum). , Since then, ,I have paid 1.45% on all income (almost every year in excess of the social security wage base), timex 2 for my employer's contribution.

Back in those days, there was no Part B supplemental premium. Then, starting in 2007, Congress decided that in addition to paying much more for Part A based on my income while I was employed, that I should also pay much more for my coverage in retirement – because I successfully saved money, and took less in wages by working for an employer with a defined benefit pension

So, I paid in for 25 years, then they raise my Part A costs dramatically for the same Part A Hospital coverage a person can get by paying in the minimum for 40 quarters -10 years. I'm paying in every year from 1969 – 2015, and likely for the next 3 – 5 years as well (50+ years). So, I obviously funded all of the cost of my Part A coverage, and then some (when you include the employer contribution and adjust for present value).

With regard to Part B, obviously, I have been a taxpayer all those years, so, I was one of many whose general revenue – income taxes – paid 75% of the cost of part B coverage for prior generations, and, starting in 2006, 75% of the cost of Part D Rx coverage for current retirees. Now, I get to pay the majority of Part B and Part D coverage costs – after paying for the majority for others all my working life.

How are these changes in taxation, including the Part B and Part D supplemental taxes, not one of your so-called broken promises? Why aren't you complaining similar to your position when an employer takes advantage of a reservation of rights provision to prospectively change pension and retiree medical benefits?

LikeLike

You’re right of course, but nobody cares about soaking the “wealthy.” Maybe I will do a piece based on your scenario just to see the reaction.

LikeLike

Dick, I’d like to see a reaction to Jack’s scenario too but I know you’re right, “nobody cares” unless they are affected. We might even see a bit of “schadenfreude” if there are comments. When a pay as you go (Ponzi scheme) starts to fail, somebody has to get thrown under the bus in order to keep it afloat. Politicians know that carving out a smaller cohort of voters for the pain is easier and better for the politician’s self-interest than sharing the pain across the board. By not indexing the income levels for inflation, there will be a steady drip of new taxpayers, (again a small group who will not be noticed) into the increased premiums.

LikeLike