Fifty years after enactment I’m guessing most people would say, yes‼️ Afterall, most Americans can’t remember a time without Medicare. Certainly it is now the foundation of each American’s retirement, it’s cost has been lost in pay checks and quite modest premiums for most – if you don’t count supplemental coverage necessary to make health care “affordable”.

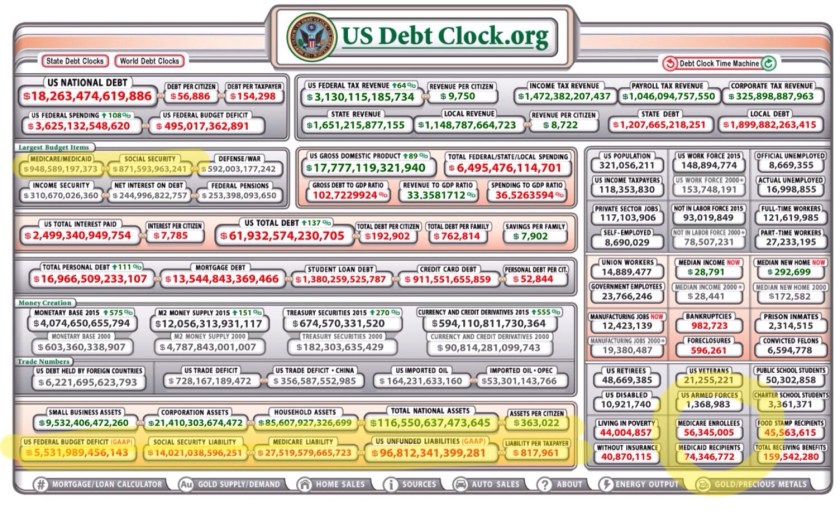

The unfunded liability for Medicare is over $27 trillion dollars. There are over 56 million Medicare beneficiaries and growing daily. Like Obamacare, Medicare greatly expanded coverage, but did nothing to control health care costs, in fact did the opposite.

If you are not worried about cost, the impact on future generations and just how we plan to meet these liabilities you can continue to see only the positive side of Medicare. That’s the way most folks on the left view the world. It’s nice if you can do that forever, but sooner or later the real check arrives.

If you are not worried about cost, the impact on future generations and just how we plan to meet these liabilities you can continue to see only the positive side of Medicare. That’s the way most folks on the left view the world. It’s nice if you can do that forever, but sooner or later the real check arrives.

It’s not as if we are building up reserves while our national debt is in decline. Our progress so far has been a modest reduction in the amount we spend each year that is in excess of revenue.

Entitlements are nice. We all enjoy them in one form or another. They are even nicer if you don’t have to pay for them. Those of us collecting Social Security and enrolled in Medicare have no worries; we have our piece of the pie. For Americans who follow us, it’s a different story.

While the Sanders, Warren’s and DiBlasios want more and better of the same and to topple the wealthy, reality indicates before we expand the pie, we better figure out how we pay for what we have already committed to.

If you think more taxes on the wealthy (which the left wants to use somehow to close the income gap), is also going to solve the issues shown below, you are sadly mistaken. A greatly expanding, robust economy that generates growing revenue may help, but that is not the focus of the left. They approach the problem as more entitlements; free college, free day care, higher Social Security benefits, expanded SNAP.

Take out your handy slide rule 😛 and do the math. Where do you end up if you use growing revenue not to deal with past debt and liabilities, but to create more liabilities? There are two ways federal revenue increases; a larger tax base because of a growing economy and wages or higher taxes (or both I guess). If you focus on the higher taxes approach, do you really make any progress?

I don’t care if Bernie Sanders, Bill DiBlasio, Harry Reed, and Hillary Clinton choose not to accept the reality, if they don’t want to take on long term solvency of the entitlements.

We’ll get out there in a few years, and see federal deficits rising due to Medicare and Medicaid. If one of those folks is in charge, they can explain why we’re reducing defense spending or other “investments”, or if they instead convince Congress to run a deficit, let ’em explain why, as President Obama states, a $500+ Billion deficit is a good thing, a “reduction” (conveniently ignoring that no one else had ever had a $500B deficit in history, let alone a $1+T deficit, even adjusting for inflation).

You see, based on decades of lies by all federal politicians, republicans, democrats and independents, people really do believe they funded those entitlements with their taxes.

And, SOME DID (including myself, still contributing today after 44 years, and my father, who died at age 53 where his beneficiaries received only pennies on the dollars contributed over almost 30 years).

But, most did not and that is why we have the insolvency we face in the future. Consider the 1st Social Security beneficiary, Ida Mae Fuller. On January 31, 1940, the first monthly retirement check was issued to Ida May Fuller of Ludlow, Vermont, in the amount of $22.54. Miss Fuller, a Legal Secretary, retired in November 1939. She started collecting benefits in January 1940 at age 65 and lived to be 100 years old, dying in 1975. Ida May Fuller worked for three years under the Social Security program. The accumulated taxes on her salary during those three years was a total of $24.75. Her initial monthly check was $22.54. During her lifetime she collected a total of $22,888.92 in Social Security benefits. However, it should be noted that Ida Mae might not have received any benefit, or certainly, not so much, had they not amended the law to allow for commencement of benefits in 1940. So, because the funding has never, ever synced up with the spending (different people pay much more than they will ever collect, others receive more than they funded), many people believe they earned what the politicians have promised.

Since it is clear the politicians break promises about entitlements all the time, it is only now, once there is an impact on OTHER spending, that we see any interest in action. See, prior to 1983, when they broke their promise, it was to increase the spending without a commensurate increase in funding. It’s like Health Reform – kids coverage to age 26, no lifetime maximums, no pre-existing conditions – and for those who have health coverage through their employer, it all looks … FREE. No price tags on those improvements, no allocation of the cost to the beneficiaries (in fact, the regulations made such allocations illegal).

But, starting in 1983, someone decided curtailing the growth of benefits and raising taxes to close the gap was a better solution than cutting benefits (it was not an election year).

I believe the only reasonable solution is to “freeze” the current programs (before politicians make them worse) and to allocate the needed increases in taxes in the same proportion as is in place today – concurrently, do not expand the liability, and do not reallocate the relative funding burdens (both solid vote getters in the past). I call my solution “the status quo” – in recognition of just how “successful” these entitlements are. If it is so good, so successful, why change?

Just won’t happen – it will get worse. For comaprison, you remember the (Bill) Clinton initiative from 20 years ago, which became just another blue ribbon study (due to the blue dress), where the excellent report outlining three rational solutions is still sitting on a shelf collecting dust. Those solutions were not pain free. But, until there is “pain” for all (no benefit improvements – you just get what they promised, but greater taxes for all paying taxes), there will be no “solution”. Until it is clear who bears the cost to add to the burden, it will just get worse.

“Don’t tax you, don’t tax me, tax that guy behind the tree” Russell Long.

LikeLike

You are so right, but yet the crowds come to hear Sanders spout off about all the “free” stuff they have in Europe and we should too. Americans are as naive as liberals, perhaps far worse.

LikeLike