Let’s take a very extreme, virtually impossible example, and say a person contributed 1.45% of pay of $100,000 a year for forty years into Medicare. That would be $58,000. Of course the average person contributes far less and the employer contributes an equal amount.

So, then let’s assume an average pay of $50,000 for forty-years and average Medicare tax of 1.3% which may also be overstated but closer to reality. That person contributed $26,000.

Now let’s say by some miracle these people have no medical costs during their entire retirement, not even a prescription, except one procedure. One has a hip replacement and the other heart valve surgery.

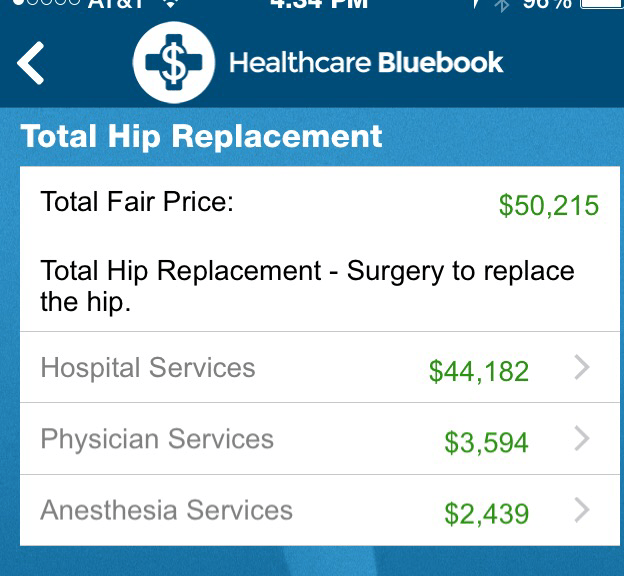

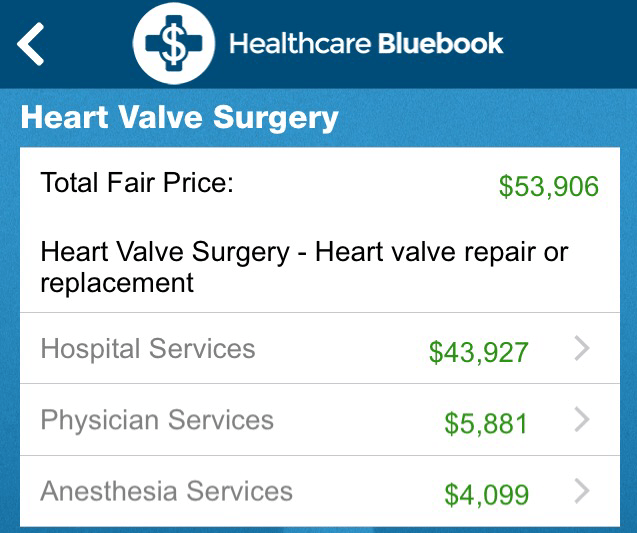

Following are only the three basic costs for these procedures (no Rx, no pre-op or follow-up care, no rehabilitation). These amounts are not the charges, but the negotiated fees. Medicare may pay less thereby raising the cost for non-Medicare patients.

Do you still believe Medicare beneficiaries paid for their health care in retirement?

Very, very few Medicare beneficiaries have health care costs less than what they contributed in taxes (and premiums for that matter). Some consume their contributions in prescriptions alone).

Total hip replacement is one of the most common elective inpatient surgeries in the U.S., with more than 440,000 procedures performed in 2012. Medicare alone pays for nearly two-thirds of hip replacements, with individuals over the age of 65 accounting for 60% of the patient volume. Source:nerdwallet.com

how about the medicare charge in retirement of $104.90 per individual per month and the cost of a meigap polcy to eliminate the deductible. you could also not use the medigap cost and add that to the cost of your medical payments in retirement. I totally agree we get more than we give in the medicare payments and especially again in the social security benefits we get over a “normal” retirement of 15 – 20 years.

LikeLike

You ignore the employer contribution, which reduces an individual’s wages – so, we are talking 2.9 percent of wages, at least for the past few years when the rate was increased, and the cap on wages was removed by president Clinton. As someone mentioned, that takes it to $116,000.

You ignore earnings on those taxes, which, on your accumulation of $58,000 @ 6 percent, ramps that up to $231,137. Double that for the employer’s contribution, to $462,274.

Then, you dramatically overstate the cost of hip replacement. My wife had it done last December, all for less than $15,000 – total, total including follow up care.

And, of course, you ignore 40 years of paying income taxes to fund 75 percent of part b, and going forward, income taxes to fund 75 percent of part d.

Finally, you forget the income taxes that fund much of medicare’s costs for the dual eligibles.

Sorry, your example is quite flawed for those of us who have paid taxes the last 40 plus years.

LikeLike

Earnings on the taxes is theory. People would not save that amount. Of course, some people receive little back, but my example assumed only three services in a lifetime. That too is not typical. Granted Medicare pays less for a procedure. But these examples are typical costs in the market.

LikeLike

Sure. But here, earnings represent an adjustment for inflation. Ok with me if you discount the price of those medical services to the rates/fees in effect 40 years ago. Either way, when you compare the current price of services with a lifetime accumulation, either you adjust the price or apply interest.

Otherwise, you are not even comparing apples and oranges.

LikeLike

I would note also, that $15,000 is the total charge we paid, including some paid by health coverage, and our out of pocket where a portion was out of network. Neither I nor my spouse are Medicare eligible, yet.

LikeLike

Thank you for your correction

LikeLike

Taking your math and analsysis from the top level down to the minutia

The employer doesn’t “contribute an equal amount;” from an economics point of view the entire 3.9% is all the eventual beneficiary’s money; so it’s $116,000, not $58,000

But that money goes into the Medicare Part A Trust Fund only

So yeah – the $116,000 pays the mid $40,000s hospitalization costs you are citing three times over (even the $58,000 pays it so I don’t even understand your example)

But that’s not the way you analyze the money from an insurance perspective (you’re not factoring in the pooling effect from people who pay in but die before age 65 and you are not factoring in a reasonable rate of return to compare the value fairly)

Now for the Part B costs, that trust fund is funded by ongoing premiums starting when you first start using Medicare and a lifetime of income taxes; based on Part A premiums (which no one pays unless they were not part of the SS system but we know what it is), that would equal another $116,000 uplifted by a reasonable rate of return

So yeah – that total $232,000 so even without the reasonable rate of return what the person in your example pays in more than covers the whole cost in your examples and much more than the costs incurred by actual people who have been in the system for 40-50 years (of which there are an increasing number as of 2011); actual people make less than your example so the amount contributed and paid in premiums pretty much balances out for real people

It is true that anyone born before 1945 got a great deal. But that was a purposeful decision by the 1965 Congress, well documented by the legislative record at the time. Medicare was never meant to pay for itself until the people who started working and paying in 1966 started using it in 2010

LikeLike

But the example is one claim in a lifetime only. That’s not typical. Bottom line is still that the average person (considerably lower income than my example) gets back more than they paid in. But of course as you note some get nothing, but that’s true for any insurance. As far as rate of return goes, that’s theory. People would not be investing in lieu of taxes.

LikeLike

You assume the employer would be paying the worker in lieu of the taxes. That is very doubtful.

LikeLike

The sentiments expressed here are so moronic that they bear no response

LikeLike

Sorry, there’s a typo in my comment. That 2.9% not 3.9%

LikeLike