When you clear away the fog and the political promises, the fact remains that premiums must cover incurred claims, and the costs of administration.

Obamacare and its far reaching impact may be hitting a point where premiums are in an upward cycle and enrollment downward. Much of the current situation is caused by adverse selection; that is, allowing anyone regardless of their health status to enroll. At the same time young healthy people have no strong incentive to obtain coverage because of the cost and the weak application of the penalty fee for not having coverage. [See below] Add in the extra costs from mandated benefits and you are headed toward a unaffordable upward spiral.

No insurance pool can be sustained unless (1) there is a broad actuarially sound risk pool (meaning some of the insured have no claims and their premiums support others), or (2) you can set premiums at the level that supports the risk of the enrolled group (which Obamacare prevents).

Under the ACA, insurers have seen an influx of new membership in individual plans and in Medicaid plans they administer for the government, expanding the industry’s total U.S. revenue to $743 billion in 2014, the year the law’s biggest changes took effect, from $641 billion the year before, according to a new analysis by consulting firm McKinsey & Co.

But much of that growth has been unprofitable. Health insurers lost a total of $2.5 billion, or on average $163 per consumer enrolled, in the individual market in 2014, McKinsey found. A number are also expecting to lose money on their marketplace business for 2015.

Wall Street Journal November 2, 2015

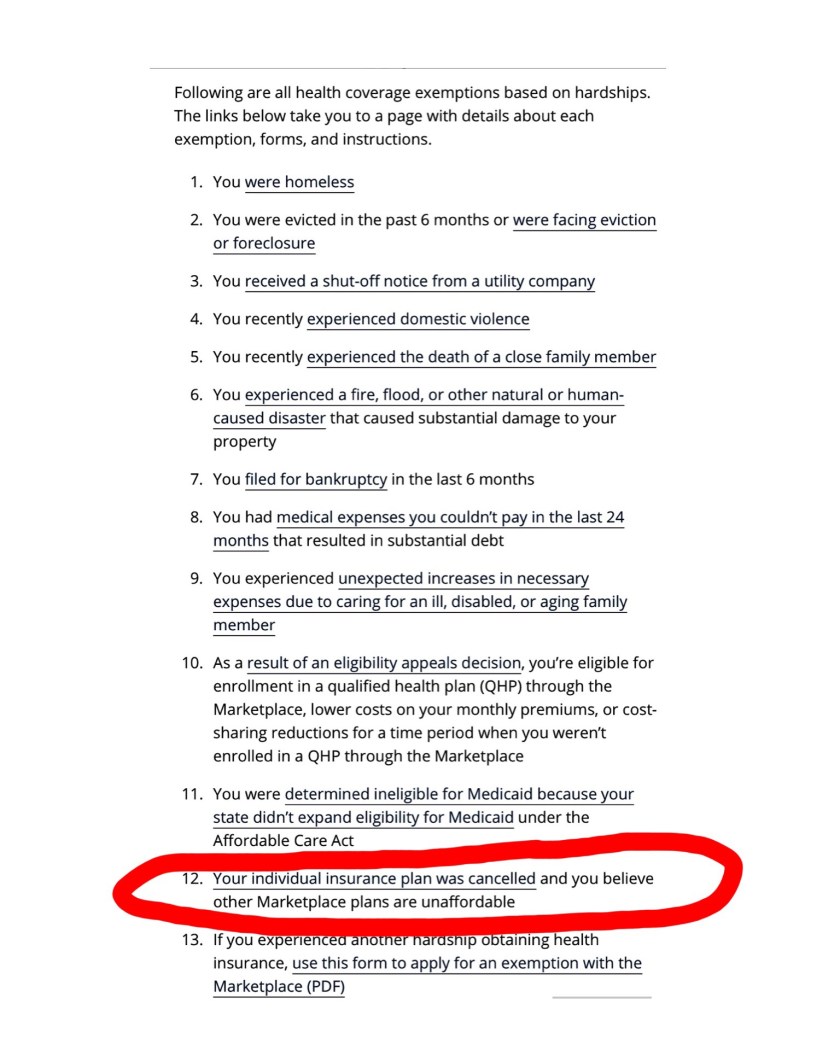

Some of these excuses seem rather strange. I circled one of my favorites. Excuse # 8 seems rather strange as well. If you had the insurance you were supposed to have in the first place … Oh well, it’s government bureaucrats writing this stuff😷. And remember, even if you owe the penalty, the only way it can be collected is if it’s deducted from your tax refund … are you scared?😡

Being a retired USAF MSgt. I have Tricare health insurance, but I went on the gov. healthcare site just to see what my premium would be here in Montana, if I did not. To cover my wife and I, both age 60, it would be $1050 per month / with a $5,000 deductible. I am sure I would get a subsidy with only my $19,644 pension as income. How is this considered AFFORDABLE!

My wife goes to the Dr.twice per year, for medication management and lab tests, I go even less. I have been to the Dr. 4 times in the last 20 years, no way i could ever meet the deductible in a given year. Worthless policies are being sold to the American people, many will go the cash route for healthcare and pay the TAX and come out way ahead.

LikeLike

Actually with that as your total income you would not get a subsidy because you’re eligible for Medicaid. For that price, a $5,000 deductible is actually low believe it or not.

LikeLike

Montana just expanded Medicaid and I might be covered. I know before expansion there was no coverage for any adult under age 65 unless you had children living with you. or cancer. Montana had a very limited program and I do not know, what changes they made.

LikeLike

“And remember, even if you owe the penalty, the only way it can be collected is if it’s deducted from your tax refund … are you scared?😡”

I fear as time goes by and the uncollected penalty TAX grows into the millions / billions, congress will go after the money through debt collection.

LikeLike

Given what you stated here, after paying for health insurance, you have to pay all your property and income taxes (if any) and eat on $170.33 a month. I agree if you did not have Tricare, you might as well roll the dice and take your chances. At least you’ll have money to eat with.

LikeLike