This is an interesting article from the WSJ. Conventional wisdom for investing nearing or in retirement seems to be out the window for a few.

Note this example. $3 million portfolio, $150,000 in dividends and live on Social Security benefits. Not your typical retiree for sure.

Older Americans keep rolling the dice in the stock market, ignoring the conventional wisdom to protect their nest eggs by shifting more of their investments to bonds.

Winquist invests 70% of his $3 million portfolio in stocks that pay dividends. He also trades options, pocketing payments for giving others the right to buy his shares for a set price if the stock rises above that level.

He and his wife mainly live on Social Security benefits. Last year, he said they used some of the $150,000 they earned in dividends to buy more stock. A church elder who writes an investing blog, he also used a large chunk of that money for charitable giving.

Older Americans Invest Like 30-Year-Olds

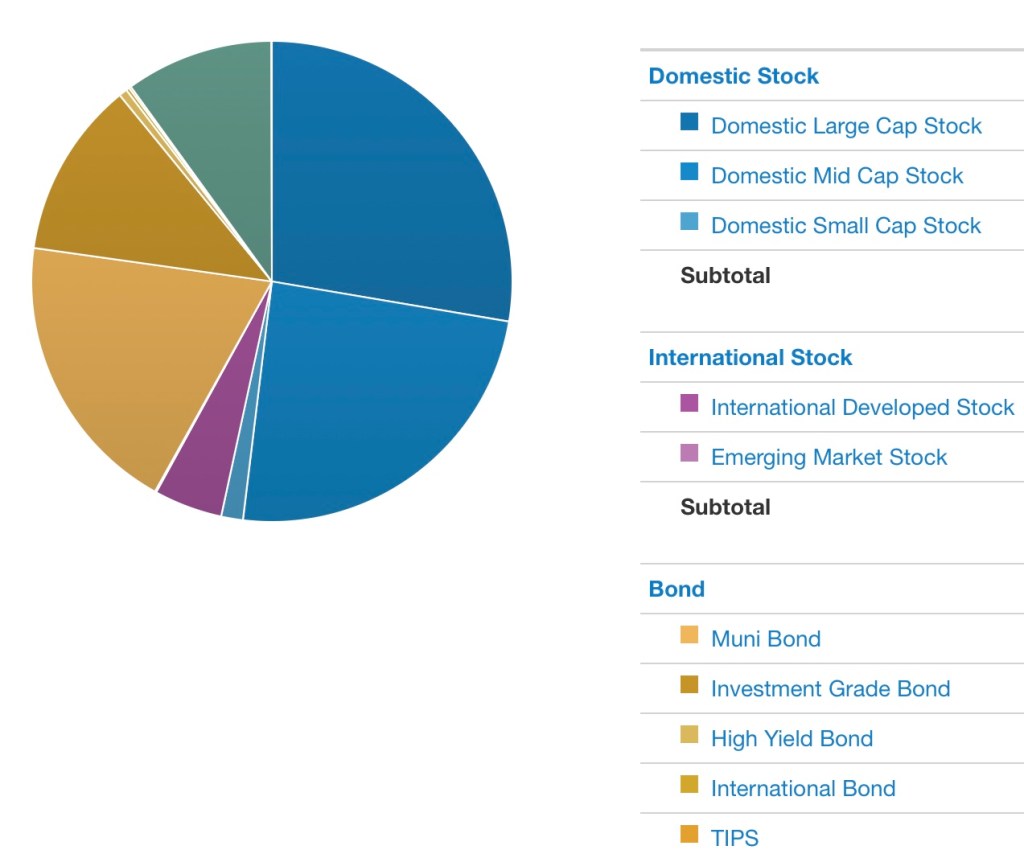

I have been thinking about my 401K portfolio allocation for the past year. When I was young, the conventional wisdom was to have your investments in a 60/40 split stocks (index funds) / bonds. As you approach retirement you wanted to reverse to 40% stock / 60% bonds to ensure a dependable income stream. You needed to keep some stocks to keep up with inflation, so the theory goes.

But what if you are actually one of the few who get a pension and you also maxed out on Social Security so that your Social Security benefit will be the maximum allowed? Isn’t this already a dependable income stream? If these two dependable income streams are enough to live on why keep a higher percentage of bonds in your portfolio?

I have been looking at this for about a year and I think I am going to go to a 80% stock / 20% bond after bouncing it off my financial advisor. This is something that I do not think you can plan for but must evaluate after getting into retirement and actually see your income streams and how you are spending your money.

I realize that this will not work for everybody such as lower income earners or even high income earners who have to self fund their retirement.

And for the record, looking back, if I had a crystal ball, I should have done 80/20 split investing when I was young but there were some upsetting times during the 1990’s that probable would have made me worry too much.

Our current retirement portfolio is about $1.2M so this isn’t just for the $3m people either. I am currently sitting at 65/35 and am thinking about changing that to about 75/25 or 80/20 which is counter to being 40/60 in retirement. But like I said, I have a good pension and we have yet to tap Social Security. One size does not fit all.

LikeLiked by 1 person

Yes indeed. It’s different if you are not using investments as a retirement income stream. I am in the same boat as you are. It boils down to how much risk you want to take, how you would handle a long bear market AND the reason you want your portfolio to keep growing. You may still want modest growth with principle preservation for some reason. Mine is to preserve an estate for my children. You could also structure portfolio so that if needed or desired you can use interest and dividends as income without touching principle.

LikeLike

I am in a smaller boat. My pension is enough to live comfortably. I automatically invest my SS monthly. More, if I can.

My wife panicked in 2008 when her profit sharing account took a hit, and doesn’t trust the stock market at all.

We have joint accounts separately (if that makes sense). She keeps hers in cash and CDs. Mine is all in index funds.

Ultimately, we hope it is all “for the children” unless one or both of us end up in assisted living.

LikeLike