AUG 3, 2023

A high and rising national debt poses a series of risks and threats, including slower income and wage growth. A new report from the Congressional Budget Office (CBO) estimates the effect of the fiscal outlook on Gross National Product (GNP) per capita – a measure of average income. CBO finds:

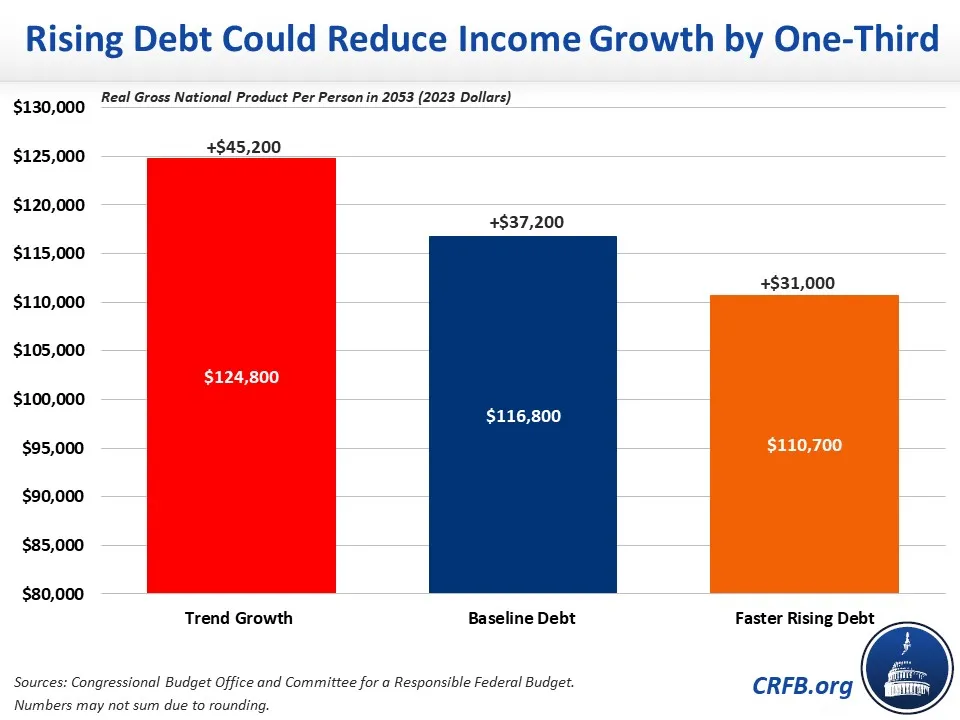

- Before accounting for rising debt, annual income is projected to grow by $45,200 per person over the next three decades.

- Rising debt under current law would reduce income growth by one-sixth, or by $8,000 per person in 2053.

- With additional borrowing for tax cuts and spending hikes, debt would reduce income growth by one-third, or by $14,100.

Higher debt reduces future income by exacerbating a phenomenon known as “crowd out,” where the availability of debt and changes in interest rates lead investors to devote an increasing share of savings toward Treasury securities at the expense of more productive investments. In fact, CBO’s standard model assumes that every new dollar of government borrowing reduces private investment by 33 cents.

Federal debt held by the public is currently 98 percent of Gross Domestic Product (GDP) – about twice the historic average over the past 50 years – and is projected to rise to 181 percent of GDP by the end of Fiscal Year (FY) 2053 under CBO’s baseline. Assuming further increases in debt do not crowd-out investment at all, CBO estimates average income in 2023 inflation-adjusted dollars would increase by $45,200 over thirty years, from $79,600 in 2023 to $124,800 in 2053.

Rising debt would substantially slow that income growth. After incorporating the effects of crowd out, CBO projects average income would only grow by $37,200, to $116,800 in 2053. In other words, rising debt would lower income growth by 18 percent and reduce total income by over 6 percent in 2053.

Further increases in debt would slow income growth even more. If, for example, revenue and discretionary spending were held constant at their 30-year historical averages, we estimate CBO would project average income would grow only by $31,000, to $110,700 in 2053. In other words, faster rising debt would lower income growth by 31 percent and reduce total incomes by 11 percent in 2053. This is despitethe beneficial effects of lower tax rates and larger public investments on income.

Source: Committee for a Responsible Federal Budget. Read more here

Good morning my fellow pensioner! I’m sure that you are aware of PSEG selling our pension to Prudential. Your phone and email must be overloaded, and here is one more email to add ! What are your thoughts about this? They say we the pensioners, won’t notice the change other than the ” return address ” not being PS anymore. Whatever the reason for selling, whether to raise some money to purchase another utility, or to make the plants more attractive for prospective buyers. Whatever the reason is, I guess it doesn’t matter much to us. What typically happens to pensions that are sold? I’ve heard for that PSEG has wanted to access somebof the money in the pension fund, but couldn’t do it because of financial regulations. What is your insight? Regards, Gary Wissen 2 years as a pensioner! 🙂

LikeLike

None of the factors you mention are correct. If you go the the Facebook group PSEG Friends and Family I’ll explain or e-mail me rdquinn3@gmail.com

LikeLike

We are slow dancing in a burning room. Increasing skilled immigration is the best way ahead. It would create economic growth to expand the tax base. And it would help mitigate the oncoming demographic crisis, with too few workers supporting too many retirees and their sky rocketing health care costs.

Cutting spending is very unlikely, with military competition heating back up again, and huge increases in older Americans that depend on Social Security and Medicare. Throw in the VA and that is most of the budget right there.

Although Increasing taxes would be ideal, since we have some of the lowest tax rates in US history, it probably isn’t politically feasible in the current climate. Unless there was some grand bargain on immigration (we build the wall if you accept an increase in H1B visas by 500K per year) could possibly work. Who knows, they pulled it off against all odds with the inflation reduction act, so it might happen even in this polarized era.

LikeLike