The following is an excerpt from an article appearing on HumbleDollar.com. I urge you to read the full article. It’s quite enlightening.

One of the books in my financial library is his work The Coming Generational Storm, coauthored with Laurence Kotlikoff. It came out in 2004, so its 20th anniversary is approaching. It was on Forbes’s 2004 list of the top 10 business books.

Here’s a sample from the back cover: “In 2030, as 77 million baby boomers hobble into old age, walkers will outnumber strollers; there will be twice as many retirees as there are today but only 18 percent more workers. How will Social Security and Medicare function with fewer working taxpayers to support these programs? According to Laurence Kotlikoff and Scott Burns, if our government continues on the course it has set, we’ll see skyrocketing tax rates, drastically lower retirement and health benefits, high inflation, a rapidly depreciating dollar, unemployment, and political instability.”

As you might imagine, the book was an uncomfortable read. The twin threats of unfavorable demographic shifts and unsustainable government debt are laid out in stark terms. The generational storm thesis can be summed up by these two sentences from the epilogue: “The American dream is becoming prohibitively expensive. And unless we act soon, the Greatest Generation will be the last to leave its children and grandchildren a better country.”

Ken Cutler – HumbleDollar

Your elected officials are betraying you, lying to you or too uninformed to understand the situation.

When a politician says spending must be cut, they are saying they want to reduce your tax-funded benefits because they are too cowardly to tell you the truth about paying for all the promises made.

Taxes must be raised and that’s the truth or we are headed for big trouble.

I read the accompanying HD article and I get that demographics are changing; more retirees drawing pensions and fewer workers contributing –and– our politicians are not planning for it, but they aren’t even planning for the demographics we have today. No way we should have the deficits we have now, minor adjustments every year should have kept up with expenses gradually.

Doesn’t mean they don’t understand, or are lying, may be they just can’t agree. Some people believe government should be small enough to drown in a bathtub. They say they want to reduce your tax funded benefits. True. Not because they are afraid to tell the truth, but, very often, because they believe you do not “deserve” those benefits.

This is America, after all. Pull yourself up by your bootstraps. If you’re poor, it’s your fault. And fund your own retirement. Or else?

I agree with Richard, “Taxes must be raised and that’s the truth or we are headed for big trouble.”

We disagree that income/wealth disparity is not a problem (major.) In higher taxed countries with universal healthcare, “everybody” doesn’t pay higher taxes. It’s impossible. There is a transfer of income. The poor effectively pay a negative tax.

Paid for by the rich(er). Where else could it come from?

LikeLike

Look, Homeland Security estimates 8 million illegal immigrants over the past 3-4 years–Harvard a few years said about 20 million illegal immigrants were here–if they are a net benefit why the hullabaloo in the cities like NYC, Philly, DC, and Chicago–they should be welcoming then with open arms–come here legally or do not come at all–this ain’t rocket science–no country in the world that I know of has open borders–

LikeLike

A good part of the reason the debt is so high is due to the tax breaks, loopholes and shelters given to the rich. Trump gave the rich a gift with the so-called tax reform of 2017. Why are billionaires like Bezo paying almost no taxes?

And are you going to pick almonds, mushrooms or other produce out in the fields all day?

We have a lot of undocumented people in my area and they are hard working good people.

LikeLike

Ha! Perhaps that’s the reason for allowing millions of undocumented foreigners into our country??

New source for dealing with our projected generational depopulation and new spenders to stimulate additional taxes and new consumer spending??

Of course, there’s the additional new downpayment to finance them getting productive and their children educated??

Note: Notice all the question marks! New Years 2024 resolution: “sure hope it all works out”!

LikeLike

Not supporting illegal immigration, but the people in this country illegally provide a significant economic gain to this country. That’s just a fact.

LikeLike

Please show the specific economic analysis which confirms, net, net, over time, that all of the illegal immigration (the 8MM to 10MM illegal entrants over the past three years) will in fact result in any economic gain to American citizens, taken as a group (let alone a “significant” gain). The analysis doesn’t exist.

Then, make sure that you adjust the loss in the initial analysis for all of the crime, environmental loss, law enforcement, and other costs. Then, make sure that you adjust the loss for the costs involved when there are Americans receiving welfare and other transfer payments because they won’t do certain jobs. That is, if we didn’t pay them not to work, there would be no work for illegal immigrants.

Make sure you separate out legal and illegal immigration. I am a first generation American-born, my mom came over on the boat through Ellis Island. There was a requirement that she be sponsored by someone here, and there was no government provided food, clothing, shelter, bus tickets, health care, etc.

America has long been a nation of legal immigrants – and with exceptions for certain small countries in Europe, a larger portion of American citizens and legal residents were born somewhere else.

But, it is a fantasy that all those who come here illegally contribute in excess of taking.

LikeLike

Everything I find says there are about 11 million illegal immigrants residing in the US in total, not in the last 3 years. Are you saying they don’t work in necessary (often undesirable) jobs, spend money, pay taxes? All of the crime? Any more than the legal immigrant population of native population? That’s not what the data say. All illegal immigration should be legal, of course, but what makes these desperate masses of people automatically criminals, lazy, diseased or drug dealers? Some, of course are, but any reason to believe a significant percentage?

My great grandparents had to hold secret masses in their home because they were Irish and Catholic. In the late forties their church in NJ was burned by the KKK. What makes today’s rhetoric any different?

LikeLike

11 Million is a dated, government statistic. We don’t know how many illegal immigrants are physically present in America since the federal government does not track them. Remember, they have a hard enough time counting noses in the decennial census.

In terms of my 8+MM number (which does not include known got-aways, let alone the unknown got-aways), the federal government’s Customs & Border Protection is my source: https://www.cbp.gov/newsroom/stats/nationwide-encounters

Yes, there is a dramatic difference between legal and illegal immigrants – in terms of employment, taxes, etc.

I have never seen a study that actually separately identifies all of the economic activity of illegal immigrants, and I have read many studies that purport to show they are a positive economic addition. All of those studies remind me of the famous quote often attributed to Mark Twain: There are lies, damned lies and and then statistics.

In terms of net contributions, how about this report from Kaiser, which comes to us via National Public Radio – More states extend health coverage to immigrants even as issue inflames GOP, 12/29/23:

“… A growing number of states are opening taxpayer-funded health insurance programs to immigrants, including those living in the U.S. without authorization, even as Republicans assail President Joe Biden over a dramatic increase in illegal crossings of the southern border. …”

Jack note: Remember, health reform access to the public exchanges, Medicaid, etc. was supposed to be limited to those “lawfully present”. Is there any wonder why we are running $2+ Trillion a year annual deficits.

https://kffhealthnews.org/news/article/states-health-coverage-medicaid-immigrants-expansion/

https://abcnews.go.com/Health/california-1st-state-offer-health-insurance-undocumented-immigrants/story?id=105986377

Eleven states and Washington, D.C., together provide full health insurance coverage to more than 1 million low-income immigrants regardless of their legal status, according to state data compiled by KFF Health News. Most aren’t authorized to live in the U.S., state officials say. Enrollment in these programs could nearly double by 2025 as at least seven states initiate or expand coverage. In January, Republican-controlled Utah will start covering children regardless of immigration status, while New York and California will widen eligibility to cover more adults.

Given that trend, it won’t be long before those who pay taxes in America will not only pay more for other legal residents’ health coverage (Medicare, Medicaid, Veterans, etc.), they will also pay more for illegals’ health coverage – when compared to what they pay for their own coverage.

LikeLike

The truth always hurts.

LikeLike

“A report published by staff at conservative public policy think tank The Heritage Foundation claimed that the 2001 cuts alone would result in the complete elimination of the U.S. national debt by fiscal year 2010.”

“I do believe it’s very important to send the signal to our entrepreneurs and our families that the government trusts them to spend their own money. And I happen to believe lower taxes is what stimulates economic growth and what we need now in our country is economic growth.”

George Bush

If tax cuts are not increasing revenue, may be we are not cutting enough! When will we ever learn?

LikeLike

Sorry, revenues to the federal government have increased most every year since President George W. Bush took office. The problem isn’t taxation, it is spending. Here’s the budget detail by federal fiscal year.

Other than the recessions in 2002-2003, and 2009-2012, as well as the two consecutive quarters of pandemic-declining GDP in 2020, revenues have steadily increased, including after the Trump tax changes in 2017.

Year Total

Receipts Outlays Surplus or Deficit (-)

2000 2,025,191 1,788,950 236,241

2001 1,991,082 1,862,846 128,236

2002 1,853,136 2,010,894 -157,758

2003 1,782,314 2,159,899 -377,585

2004 1,880,114 2,292,841 -412,727

2005 2,153,611 2,471,957 -318,346

2006 2,406,869 2,655,050 -248,181

2007 2,567,985 2,728,686 -160,701

2008 2,523,991 2,982,544 -458,553

2009 2,104,989 3,517,677 -1,412,688

2010 2,162,706 3,457,079 -1,294,373

2011 2,303,466 3,603,065 -1,299,599

2012 2,449,990 3,526,563 -1,076,573

2013 2,775,106 3,454,881 -679,775

2014 3,021,491 3,506,284 -484,793

2015 3,249,890 3,691,850 -441,960

2016 3,267,965 3,852,615 -584,650

2017 3,316,184 3,981,634 -665,450

2018 3,329,907 4,109,047 -779,140

2019 3,463,364 4,446,960 -983,596

2020 3,421,164 6,553,621 -3,132,457

2021 4,047,111 6,822,470 -2,775,359

2022 4,897,399 6,273,324 -1,375,925

2023 est 4,802,483 6,371,827 -1,569,344

2024 est 5,036,384 6,882,738 -1,846,354

LikeLike

Sorry, forgot to point out that those amounts are in thousands, so in FY 2024, the estimate is $5 Trillion in revenue, nearly $7 Trillion in spend, for a deficit spend of $1.8 Trillion, so our national debt will be about $35 Trillion by FY 2024 end on 9/30/24.

LikeLike

U.S population has increased twenty percent since 2000. Inflation has increased eighty percent, and the U.S. is still one of the lowest taxed OECD countries.

https://www.taxpolicycenter.org/sites/default/files/styles/original_optimized/public/book_images/2.1.4.1.png?itok=9bji6wWG

LikeLike

Agree, population up 20%. But, no, inflation up “only” ~65% using the Federal Reserve’s indicator, PCE. Revenues up ~78% since 2002. Regardless, federal spending up ~300% since 2002!!! Increased from $1.8 Trillion to $6.9 Trillion!!! Even if you measure it as a function of Gross Domestic Product, GDP was $10.8 Trillion in Q1 2002, and $27.6 Trillion in 3rd Quarter 2023. That’s up ~55%.

No, even drunken sailors would be thrifty by comparison.

Our federal government idiots, Republican and Democrat alike, continue to ignore the first rule when you find yourself deep in a hole, stop digging! This is not just Biden, but, Trump and Obama before them. Bush II was a piker when comparing spending, revenues, and deficits. Obama once criticized Bust II as “unpatriotic” because of his deficit spending. However, if Bush II deficits were “unpatriotic”, the next three idiots had/have deficits that are outright treasonous!!!

LikeLike

Interesting…

I haven’t done the math or the research yet, but two words…

Transfers.

Inequality.

How much of “our” money is going to our own people who work hard everyday but don’t earn* enough to support themselves or a family?

And is it enough?

The U.S. is among the richest per capita in the world. Has among the highest income inequality both before AND after transfers, and a much lower percentage of transfers of all major countries.

https://cepr.org/sites/default/files/styles/popup_small/public/image/FromMay2014/causafig1.png?itok=_6BXZjgI

* “earn”? Imagine if employers paid their lower paid workers enough to actually live. If we (US taxpayers) spend money for earned income credit, welfare, medicaid, childcare assistance, rental subsidies, etc., for a Wal-Mart employee, are we subsidizing him/her, or are we subsidizing Lukas Walton, net worth $20 billion at age 36? Did he earn that?

My Dad said, in America, if you work harder, or smarter, you get to keep what you earn. But it’s kind of hard to imagine a man who works a thousand times harder than I do.

LikeLike

Sorry about the length of this response.

For comparison, have you been to K-Mart or Sears or SS Kresge, Sterling Lindner, Halle’s, The Higbee Company, A&P, Filene’s, Bonwit Teller, Marshal Field, Kaufmann, Ames, Gimbel’s, Hudson’s, or Foley’s lately? In my lifetime, I have shopped at each of those, and, they are all gone, kaput, or all but bankrupt. No one works there anymore.

I’ve only shopped at WalMart maybe 20 times in my life – almost all of those times occurred in the last four years after we moved to a location where one is nearby. For comparison, I’ve stopped at Krogers maybe 150 times in 2023. Long ago, I read a number of economic studies that confirmed the favorable economic impact of WalMart on the local community. And, I’m sure there are negatives as well.

Lukas Walton isn’t on the board at WalMart, and he ain’t the CEO. So, not sure why we should link him to WalMart operations – since, as best as I can tell, if he ever worked there, … he wasn’t a decision-maker.

Obviously, someone else owns almost all of the WalMart stock that used to belong to his grandfather and other family members. With respect to Lukas, see: https://www.cnbc.com/2022/09/19/billionaire-lukas-waltons-family-office-fans-impact-investing-push.html I would have thought his efforts in ESG-crap would have earned him some thoughtful praise from those who envy his wealth.

Comparing WalMart to the stores I listed above, last I heard, WalMart is the largest private employer in the world, employing over 2.2 million people around the world. My bet is that employment options are limited for those WalMart employees who have limited skills, experience and education. We support a refugee family from Afghanistan, and the 23 year old would be excited to work at WalMart – if he ever gets the call. But, heck, if you want to take Lukas Walton’s estimated $22 Billion and spread it evenly among the 2.2 million WalMart workers worldwide, you would get less than $200 a week per worker, for less than one year.

Obviously, WalMart is a going concern, sustainable. And, of course, no one needs to accept employment at WalMart – and they can all leave tomorrow … and Many will!

Or, when comparing the legacies of the Waltons, how about Elon Musk (Tesla, SpaceX), Warren Buffett (Berkshire Hathaway), Bill Gates (Microsoft), Larry Ellison (Oracle), MacKenzie Scott (Amazon), Mark Zuckerberg (Meta Platforms), Carl Icahn (Icahn Enterprises), George Lucas (Lucasfilm), David Rockefeller (Standard Oil), Ken Langone (The Home Depot), Bill Ackman (Pershing Square Capital Management), Ted Turner (Cable News Network), Tom Steyer (Farallon Capital), Ted Forstmann (Forstmann Little), Lyda Hill, (Hunt Oil Company), Anne Wojcicki (23andMe), and T. Boone Pickens (Mesa Petroleum). All those folks are still alive, but they have pledged a portion of their fortunes to charities – non-profit foundations just like the one Lukas Walton supports.

You may believe that the Waltons shouldn’t be permitted to control wealth they earned. You may believe the Waltons didn’t earn what they have. Well, there are a lot of people employed at WalMart, and a lot of others who are WalMart customers, who could go elsewhere, who have a choice, but don’t.

So, you are entitled to your thoughts, but, I can confirm that, like the Waltons, I will be passing along my “wealth” to family members, “wealth” that was initially wage income – some inter-vivos, hopefully, there will be some left over as testamentary. Perhaps my family members will come up with some charity or a non-profit enterprise, a la Lukas Walton. Perhaps not. Either way, I will decide who gets what I earned – just like the Waltons, Musk, Gates, Zuckerberg, Bezos … albeit a different order of magnitude …

LikeLike

It’s not about the Waltons. I never heard of Luke before today. Nothing against him. Seems like a nice guy.

Its about the failure of the “free market”. One of the first things we learn in Econ 101 is that “perfect competition” is the most efficient way to allocate resources (including labor). Second thing we learn is there is no such thing as perfect competition.

Government subsidies is not just for welfare. And government subsidies greatly distort the market.

1 Boeing $15,388,954,161 952

2 Intel $8,355,503,416 127

3 Ford Motor $7,718,954,966 684

4 General Motors $7,494,705,750 783

5 Micron Technology $6,786,681,915 19

6 Alcoa $5,727,691,764 134

7 Cheniere Energy $5,617,152,523 43

8 Amazon.com $5,532,086,473 433

9 Foxconn Technology Group (Hon Hai Precision Industry Company) $4,820,110,112 74

10 Texas Instruments $4,286,328,869 69

My brother-in-law was a farmer. He worked very hard. His wife, my sister, also worked hard for over forty years as a bookkeeper. They made thousands of dollars just about every year (it varied) for NOT cultivating a percentage of their land.

My Dad worked very hard also, as a farm laborer, then factory worker. Dad died in debt. My sister* , last I heard, is a multimillionaire.

Subsidies as a rule can be helpful, if done properly. There’s the rub. But why blame the victim? Lowest man on the totem pole?

Should be, “til there are no poor no more”. Nothing wrong with rich, but pay your taxes.

*Dad’s unwritten rule, don’t get nosy about someone else’s finances, and don’t complain (or brag) about your own.

LikeLike

Absolutely agree that is is not about the Waltons – and I wasn’t sure why you brought him up.

And agree, “… should be, “til there are no poor no more”. …” We just differ about the progress made to date and how to resolve the remainder. I’ve paid income and employment taxes every one of the past 54 years, and I will again pay my taxes on 2024 earnings.

As an economist, I also agree. “Free market” has never meant “perfect competition”.

That said, capitalist economic systems, flawed as they may be, have done more to raise the world’s population out of poverty – often poverty is created by the other economic systems, socialism, communism, etc. In a February 2020 report by economists at Oxford and elsewhere, around the globe, 1.1 Billion people, about one-seventh of the world’s population, have been lifted out of extreme poverty in the last 25 years. Those economists confirm that broad-based economic growth (growing the pie, not reallocating slices of the pie) is the most important source of poverty reduction. Their studies show that there is no evidence that anti-poverty programs, those that would shift the distribution of income to those below median levels, have, of yet, been an important source of differences in the rates of poverty or in the pace of overall poverty reduction.

In the US, the Census Bureau reported that poverty increased as a result of the end of transfer payments from COVID. However, studies show that the real rate of Americans actually living in poverty (if you measure it by consumption) would be 2.5%. It isn’t primarily because the Census Bureau’s official number excludes most social-welfare benefits. Bruce Meyer of the University of Chicago and James Sullivan of the University of Notre Dame compared the actual goods and services consumed by poor households in 1980 with the actual level of consumption of households that were being counted as poor in 2017. They found that only 2.8% of households in 2017 were consuming at or below the actual poverty consumption level. The American Housing Survey shows that 42% of officially poor households own homes with an average of three bedrooms, 1½ bathrooms, a garage and a porch or patio. The average poor American family lives in a home larger than the average home of middle-income families in France, Germany and the U.K..

You mention a number of government subsidies to various organizations. Please share the source of that data and the composition of the subsidies. I suspect they are comprised mostly of tax preferences – except, perhaps, the bail outs of auto companies and subsidies designed as incentives in furtherance of climate concerns.

I don’t look at some Americans as “victors” and other Americans as “victims”. No American citizen should.

LikeLike

https://subsidytracker.goodjobsfirst.org/parent-totals

Literally the first site when I searched. You can obviously find extensive arguments/debates on both sides of the welfare question. The reason I was searching was to verify or disclaim the argument that the government “gives” more to business than to welfare per se. I’ve heard it often, but not verified. (Still not verified.)

Blame the victim…

“For most Americans the term welfare is associated with any number of negative images: laziness, illegitimacy, family breakup, irresponsibility, and wasted tax dollars. We hear “welfare” and our minds conjure up a young unwed mother of two or three infants, huddled in front of a TV set in a public housing tenement and living at taxpayer expense on monthly Aid to Families with Dependent Children (AFDC) checks and food stamps. We react negatively because too often these checks subsidize bad behavior and encourage dependency rather than self-responsibility.”

Hoover Institution, May 1, 1999

Not just welfare, but working poor. As I’ve said, my Dad and most of my family retired on SS and died in debt. Several were periodic welfare or SSDI recipients.

“I worked hard, and I was lucky.”

I, and my wife, have a sufficient pension plus SS, and assets to leave the heirs (if the creek don’t rise.) Two sisters are in similar shape. The others all worked as hard as I did, more or less, without the “luck”.

Blame the victim…

It’s not luck, it’s math. The poverty level is endemic.

There we are again. Granted, I would rather be poor in the U.S. than in any of those other countries, but…

Adam Smith The Wealth of Nations:

“Smith thought that high profits were a symptom of serious market disequilibrium: they were ‘always highest in the countries which are going fastest to ruin.’ …

Accordingly, Smith believed wages should be sufficient to provide the ‘necessaries’, defined as middle-class comforts. This was a call for a generous minimum wage, which he expected to occur naturally, following economic growth. It’s only low wages that resulted from concerted action – either government intervention, as when the ‘sophistry’ of merchants and manufacturers manipulated legislatures to pass favourable laws; or when employers used their bargaining advantage to coerce workers.”

Blame the victim…

“The problem isn’t taxation, it is spending.”

May be, but cutting financial and health care aid to the poorest of the poor looks like a recipe for disaster.

Happy New Year!

LikeLike

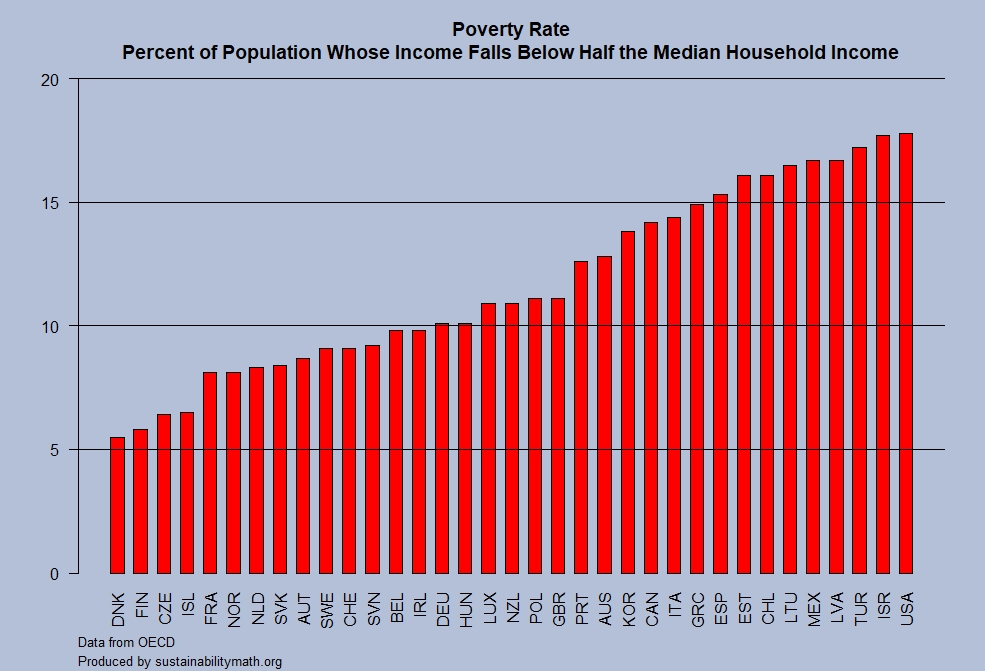

Your chart reminds me of Humpty Dumpty: “When I use a word,’ Humpty Dumpty said in rather a scornful tone, ‘it means just what I choose it to mean — neither more nor less.’ ’The question is,’ said Alice, ‘whether you can make words mean so many different things.’ ’The question is,’ said Humpty Dumpty, ‘which is to be master — that’s all.”

No one defines “poverty” as 50% of the median household income – excluding from income almost all government transfers. The poverty rate in America is 2.5%, not 18%.

The chart is akin to the Mark Twain quote – Lies, Damned Lies and Statistics.

LikeLike

” (if you measure it by consumption)?? ”

Meanwhile, back in the U.S.A, according to the Census Bureau, those below poverty level ranged from 19.1 percent in Mississippi (2022) to 7.2 percent in New Hampshire.

The OECD approach to measure and monitor income poverty across countries

“It describes and discusses the methodological and conceptual approach used by the OECD to measuring and comparing household income poverty across member countries under a consistent, comparable and standardised framework.”

The chart is one of many similar charts showing poverty levels —and income disparity— worldwide when using similar methods.

A 2.5 percent poverty rate is comparing apples to oranges.

All generalizations are false. Including this one.

Mark Twain

LikeLike

And Congress sits on their hands.

LikeLike