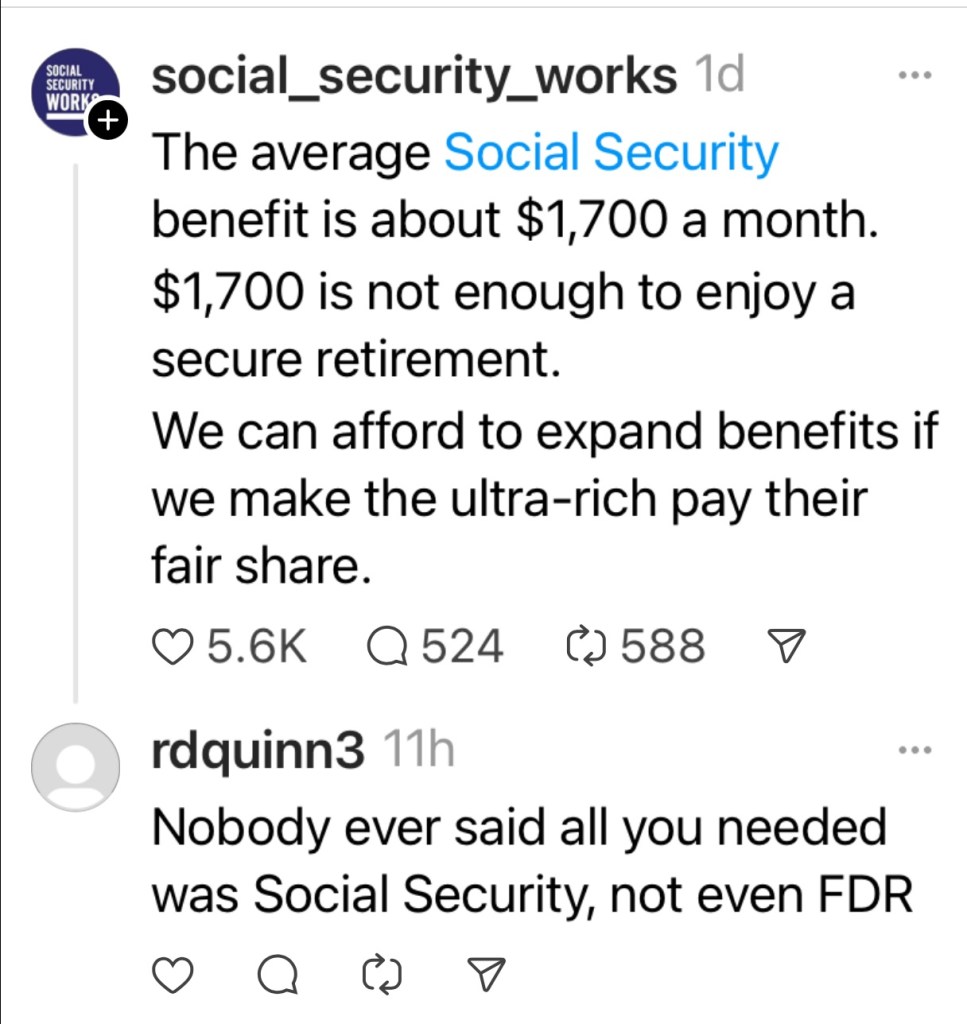

In fact, the SSA estimated average monthly Social Security retirement benefit for January 2024 is $1,907. Add a spousal benefit and you get annual income of $34,326 – and that includes the millions who take a reduced early retirement.

No, I wouldn’t say that level of income means a secure retirement. However, Social Security alone was never intended to provide more than the basics.

Here are some key points about FDR’s goals for Social Security:

- Protecting the elderly: Social Security aimed to ensure retired workers wouldn’t become destitute and could rely on a steady income after leaving the workforce.

- Social insurance: The program wasn’t meant to be a handout, but a system where workers contribute to a fund throughout their careers, providing them with benefits later in life.

- Foundation for retirement: Social Security wasn’t intended to be the sole source of income for retirees, but rather a safety net that allowed them to build upon for a secure retirement.

- Preventing future dependency: By offering financial support, Social Security aimed to decrease the number of elderly Americans relying solely on government assistance.

Can we afford to expand benefits. No we can’t. The priority should be assuring the programs solvency as it is.

Tax all wages without limit and Social Security remains insolvent. The trust funds will run out in 2056 at which point all beneficiaries will face a sudden 11% benefit cut. Source: Social Security Reformer by CRFB.

The idea that the ultra-rich, billionaires and “wealthy” can or should save us is false.

Changing the basic funding process from using a payroll tax for Social Security would be a big mistake by making funding more political.

The idea of shifting responsibility for funding results from the failure of Congress to do its job and maintain the ongoing solvency of SS every year.

The program isn’t insolvent until the 2033 or 2034 year. Alicia Munnell last said the program could be made whole with a 1.75% tax increase on employees and same on employers. This is a big tax hit on lower wage earners and should not be added till absolutely necessary. She and Andrew Biggs or Briggs run the Boston College Center for Retirement Research.

She also recently published a paper about sin tax expenditures on 401K plans to cover the shortfall. I found that interesting. The next 10 years will be full of ideas for SS, that I’m sure of.

LikeLike

Even that is not necessary. A total increase of 2.5% will keep the program solvent for over 75 years. That’s about $11.00 a week on someone earning $45,000 and given it’s for their retirement I think that is reasonable. Or, make it 1% on workers and 1.5% on employers. There are several combinations of changes that will fix this. It’s not that hard if everyone based their thinking on the facts.

Taxing wages above $400,000 while giving an added benefit for those wages closes 66% of the funding gap.

LikeLike

The 2024 Trustees report is where the figures indicate a 75-year fix would require a 3.5% increase in tax. That is based on beneficiary projections, worker projections etc. The CBO has a different figure but not greatly different than the trustees. The Boston College Center is my go-to for Social Security info since they have been studying it for years as well as retirement plans etc. I will stick with their figures.

LikeLike

My first post should read …published a paper about using tax expenditures…

LikeLike