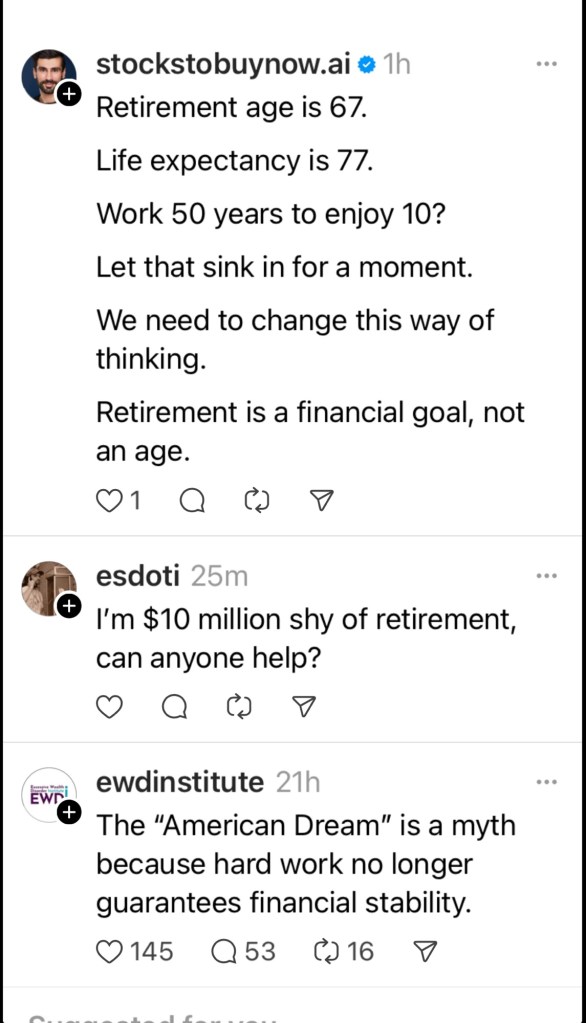

This is just a small sample of nonsense on social media and I do mean small sample. No doubt you have seen it yourself.

This happens to be from Threads where there seems to be an abundance of the woe is me syndrome blaming everyone and everything for their current and future state- except themselves.

For the record life expectancy at age 67 is between 83 and 86. Some of these post use age 65

Ten million you say? If you think you need $10 million (equal to $400,000 a year income), help yourself.

The American dream never came with a guarantee and hard work is only part of the story. Financial stability requires more than just a dream income.

most important factor is how much you are spending–as brother Quinn stated everyone has a different level based upon spending needs.

LikeLike

I can see someone living in SF/NYC, etc. THINKING they need $10MM. But if they subtracted things like :529s, IRAs, a mortgage payment, their current tax rate and so on, they should find they could live on less than half so a $5MM nest egg would do. Heaven forbid they think of lowering their spending if needed. Also if a high earning couple has SS kicking in, that could be around $100k. So let’s half that again to $2.5MM.

LikeLike

Well, maybe this person is young and looking forward while taking inflation into account. A common number I’ve been reading for years now is that a person needs 1 million to retire. Probably higher now but I quit paying attention to it. Anyway, I looked back at the US inflation calculator and a million 40 years ago now takes 3 million and change. So a young twenty something today better get on to it if they want any kind of retirement in 40 years.

LikeLike

The thing is there is no magic number. The amount a person needs is based on their desired income to sustain their desired lifestyle. $1 million will generate about $40,000 a year. That may be fine for some people, but not others.

LikeLike