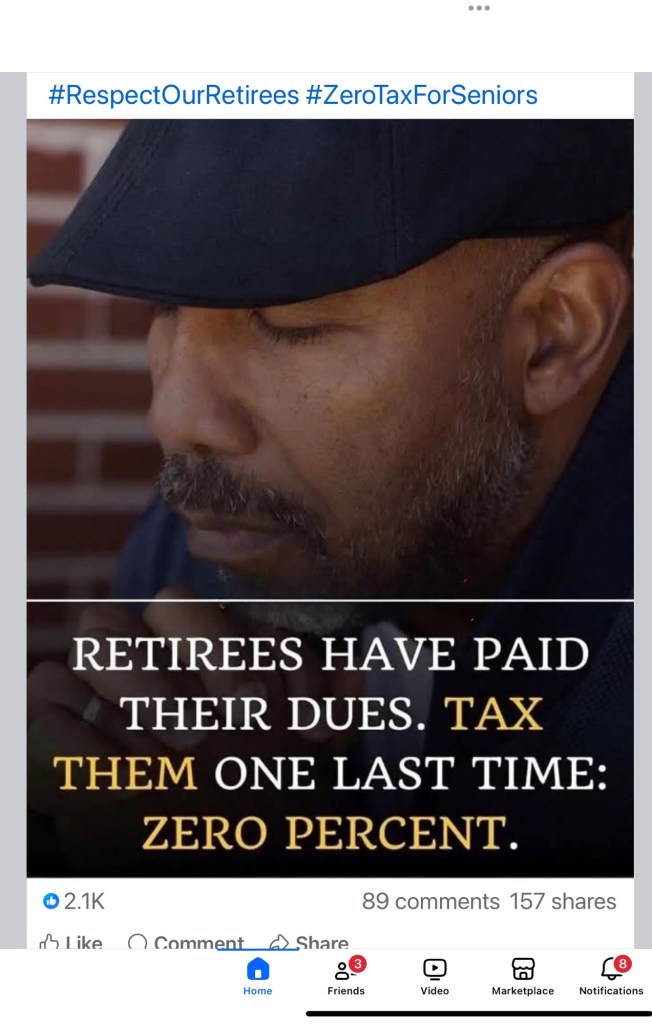

I realize that I have raised this issue before, but the memes and comments never end. The support for this type of nonsense is disturbing – to me at least.

The inability or unwillingness to connect the dots, to consider consequences or even understand basic economics, how government works, etc. is just scary.

What dues have those of us retired paid? There are no dues, no limit, no admission to society. And there is no limit on what we take from society once retired. In fact, older Americans receive many benefits and tax breaks not available to younger citizens and consume the largest single portion of the federal budget.

The most basic and obvious question is, who will make up the lost revenue if everyone retired did not pay any taxes.

Here is a rough estimate of the income of “retired” Americans. That’s a lot of income not taxed.

- 56 million retirees receive Social Security benefits.

- Social Security alone supports about $1.2 trillion in annual payments.

- When including pensions, investments, savings, and earnings, the collective income of retirees likely approaches $3 trillion per year.

Here’s one for you to look at – In Jersey, you repurchase your home every 10 years due to the taxes you pay.

Make a positive difference in someone’s life today. Bill Mitchell

LikeLike

Taxes used to run a town and county and all the services needed plus schools have nothing to do with purchasing a home. The alternative is a new direct tax of some kind which people will also complain about.

Property taxes are progressive taxes too on the basis higher income people have more valuable homes.

The idea there will be property taxes and they will increase is something seniors need to anticipate.

And, it is rare a senior loses their home to taxes, many states including NJ have programs to help on a as needed basis. Seniors can even get their property taxes frozen with no future increases with an income up to $168,268- hardly poor or even lower income.

LikeLike

Remember, when one says “WHAT’S WRONG WITH AMERICANS? one is reminded of:

Folks who fell for the Obama promise of keeping your doctor at a cost of $2500.

Millions crossing the border illegally are really good for this country and if you disagree one is a racist-bigot we were told.

Folks who don’ understand that M-2 money supply drives inflation and rising prices are but a symptom.

Some of us should look in the mirror when we ask what’s wrong with others and ask what’s wrong with us.

LikeLike

Property taxes are not “progressive”, they are “proportional” to the estimated value of the house.

Same is true whether you live in a location with higher than average taxes to fund schools.

And, yes, many Americans, including myself, would prefer a proportional income tax system where everyone pays the same rate on every dollar of income … we could then tell the politicians to stop trying to buy votes.

I would start at the first dollar, so that no one who only has wages subject to withholding, interest income, etc. has to file an income tax return.

If you prefer to exclude a certain amount of income to make the system somewhat progressive, fine, have those people who get the tax breaks file an income tax return – let people like me who don’t qualify for those breaks pay my 17% or whatever the right percentage is on both my first and last dollar of income … from whatever source derived….

LikeLike

And isn’t it reasonable to assume the value of homes reflects the income levels of the owners. Hence progressive. And that the growth in home value and related taxes is then proportional, but still reflecting progressive income levels.

LikeLike

“And isn’t it reasonable to assume the value of homes reflects the income levels of the owners. Hence progressive. And that the growth in home value and related taxes is then proportional, but still reflecting progressive income levels.”

Absolutely NOT! My home equity reflects 50+ years of wage employment and savings and investing, certainly not my current income, which is only a third of my highest level of income … which I earned in 2007, before leaving my last corporate position.

In 2007, I was still living in a home we had purchased in 1989 for less than one third of my 2007 earned income.

In 2019, we moved to a home that had a price tag that was five times the level of my 2019 earned income.

Yes, there may be many individuals where the home equity matches their income, and particularly for those who have retired, there may be no relationship whatsoever.

LikeLike

I’m dying to know how you made this calculation, considering the average property tax rate in New Jersey is 2¼%. Also curious if the purchase price is adjusted for current inflation.

LikeLike

Why do you persist in saying “what is wrong with Americans” when you know good and well there are probably 340 million people under this umbrella. Do you think everyone should have the same opinions? Good luck with that. Some opinions aren’t necessarily valid and they are subject to change. You aren’t the arbiter of what everyone should be thinking all the timer. Go on to some productive endeavor.

LikeLiked by 1 person

Seniors should definitely pay taxes on their income. I can see an argument special treatment to those who make very little in their old age, but nobody who’s middle class or higher income should be getting special tax treatment simply because of their age. You don’t like paying your share of taxes then you can retire in some other country! 😤

LikeLike