There is absolutely no viable way to provide universal insurance coverage, reasonable access to care and a fair distribution of costs without a single insurance system for the United States.

Everyone, young, old, in good health or poor health, living in Alaska or Mississippi, rich or poor in one risk pool funded by individual and business taxes, individual premiums, deductibles and co-pays according to their means. There is no such thing as free healthcare.

No matter how you look at it, what we have now is a mess.

And yes, you would continue to select where and from whom you want to receive your healthcare. This is not socialized medicine, it’s insurance.

This is a multi-year transition. It can’t happen overnight. Major issues need to be addressed like fee schedules, assuring sufficient provider resources to meet demand, payment systems and more but we have to start somewhere.

“Everyone in one risk pool. There is absolutely no viable way to provide universal insurance coverage, reasonable access to care and a fair distribution of costs without a single insurance system for the United States.”

You say, a single pool, but your picture has multiple pools!

Seems obvious, different pools for different risks.

LikeLike

Think of car insurance for comparison. Every American driver should be insured, but some are not. While some of the risks are similar, they are not the same. For example, my risk of loss regarding liability is dramatically different, and much higher than someone age 18 who has no assets and who just learned how to drive. They are all but judgement proof. Insurance only works if you group like risks. Someone who only drives three miles to church and back each Sunday shouldn’t pay the same rate as someone like me who, over the past 55 years, likely averaged 20,000 miles a year. Someone who drives 100 mph on the freeway (multiple speeding tickets, many points, etc.) should be charged more than someone who has never had a speeding ticket.

The only health risk that all 330 – 350 million American citizens share is the risk of catastrophic loss. That would be stuff like cancer, etc. So, I am 100% in favor of pooling that risk above a specific dollar attachment point, but only if the program is administered by private insurers, and only if it limits the amounts providers can charge – with fully disclosed (dollars and cents spend for each individual) federal, state and private auditors. Even that won’t work unless each individual (or their parent) is personally responsible for 100% of the catastronphic loss premium – no one gets a subsidy, no one is asked to pay someone else’s premium. Because catastrophic loss is unpredictable, and because there should be a significant attachment point ($25,000 or more), it IS appropriate to charge each individual the same premium. Membership in the pool must be limited to citizens and lawful residents (excluding anyone who is here temporarily, anyone here illegally, anyone here with a pending asylum claim, etc.) Don’t come unless you have been approved to be a resident, don’t overstay your visa, and if you come anyway, come with your own insurance. No medical treatment for illegals beyond EMTALA.

Keep in mind that in auto, homeowners, flood, and other forms of insurance, we encourage insurers to identify the variations in risk, and vary premium accordingly.

Always amazing that some believe in entitlements (food, shelter, health treatment, etc.) – that it is appropriate to burden others to provide those basics – to those capable of providing for themselves, or for their dependents. And, no surprise that some believe Congress should be able to buy votes by ignoring obvious, well documented risks or exposures – by eliminating preexisting conditions (for those who would go without insurance, the free riders), by eliminating benefit maximums, or by limiting appropriate premium rate differentiation based on well documented differences in risks – sex, age, health status, etc. Further, they have no problem insulating individuals regarding behaviors that place health at risk. No problem with ignoring/introducing moral hazard, either.

It would be comparable to charging the same flood insurance premium for someone who owns a beach house and someone living on a mountain top.

But, somehow, they have think it appropriate to allocate costs based on factors that are totally unrelated to reality – such as arbitrary definitions of “affordable”.

LikeLike

So, you would put all the sickest people in one pool and all the healthy people in another?

Aren’t my homeowners premiums affected by my insurers losses in California and Florida? Don’t my car, homeowners insurance premiums increase even without ever filing claim?

Where would you stop breaking down the risk pools? Age, gender, geographically, obesity level?

LikeLike

So, you would put all the sickest people in one pool and all the healthy people in another? No, I would put all Americans, healthy and sick, young and old, male and female, regardless of race, ethnicity, etc. all in one pool, but limit the pool coverage to catastrophic expenses (arbitrarily defined as expenses in excess of 25,000 in a calendar year). I would limit the allowable charge to the Medicare Allowable amount, which averages about 85% of the actual cost of services today. That might force some discipline on medical providers. All Americans would be in the catastrophic/stop loss pool, where everyone would be responsible for their individual premium, that is no government/taxpayer subsidies). Anyone can pay the premium, but, individuals are responsible – and the premium would be treated as an excise tax, where interest and penalties would apply for those who do not pay the premium.

Then, I would mandate coverage for all Americans for expenses up to $25,000 – no free riders.

Aren’t my homeowners premiums affected by my insurers losses in California and Florida? Depends. Not every insurer offers every coverage in every state. One of my favorite quips, when I was working at an insurance company, during an executive meeting where we were informed we were no longer a top five insurer for autos (we had been passed by Progressive), and how our profits had suffered and how our rates had increased, and how folks had left us for other insurers (in part because of auto, homeowners and other losses due to hurricanes Andrew and Hugo, our CEO quipped: ‘Do you think the leadership team at Progressive will be stupid enough to follow our lead and start insuring homes and cars in locations affected by hurricanes?’

Don’t my car, homeowners insurance premiums increase even without ever filing claim? Yes, certainly, as the cost of repairs keeps increasing. We put a new roof on a home 25+ years ago and paid $7,000. We bought a different home in 2019, and last year we had to put a new roof on it of comparable quality and paid $24,000.

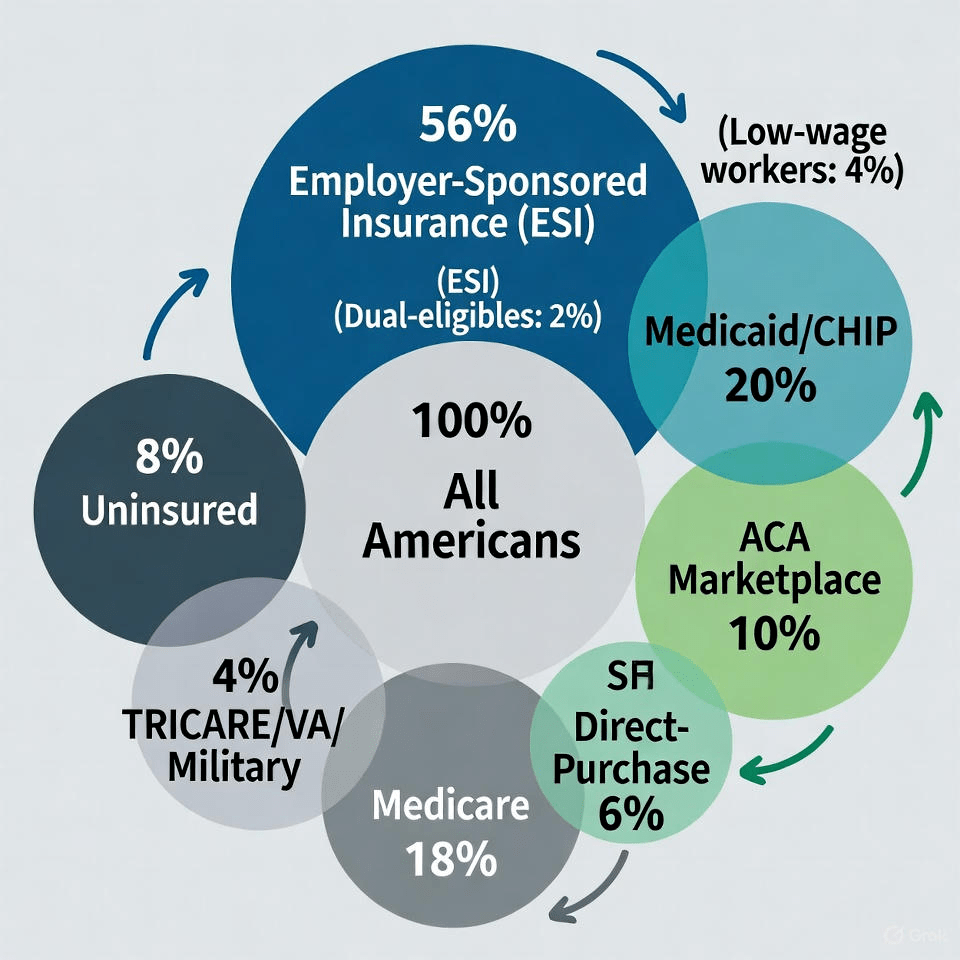

Where would you stop breaking down the risk pools? Age, gender, geographically, obesity level? For the first $25,000 of coverage, I think it would be too difficult to change the status quo. So, I would maintain Medicare, Medicaid, VA, Exchange, Individual, and Employer options for up to the first $25,000 of expense, per person, per calendar year – where capping the risk exposure at $25,000 should make all of those sources more “affordable”.

Obviously, there is pooling in Medicare and Medicaid and the VA. The pooling in the Exchange (which is individual coverage) is significant, at least if you listen to Oscar Health CEO Mark Bertolini.

Employer-sponsored plans, insured or self-insured, are much more likely able to sustain coverage where the stop loss is pooled across all Americans.

LikeLike