If you retire in 2020 at age 65 and 9 months earning $30,000 per year when you retire, your monthly Social Security benefit will be about $1,067.00 or $12,804, a replacement of 43% of pre-retirement income. A couple would receive $19,206, an amount above poverty.

If you earn $45,000, your Social Security monthly benefit would be about $1,271.00 or $15,252, (couples income $22,878) a 34% income replacement.

Now, if a couple is living paycheck to paycheck on $30,000, how in hell do they expect to be as well off trying to live on $19,206, just above the poverty level? If you barely get buy on 100% of your income how will you do on less than half?

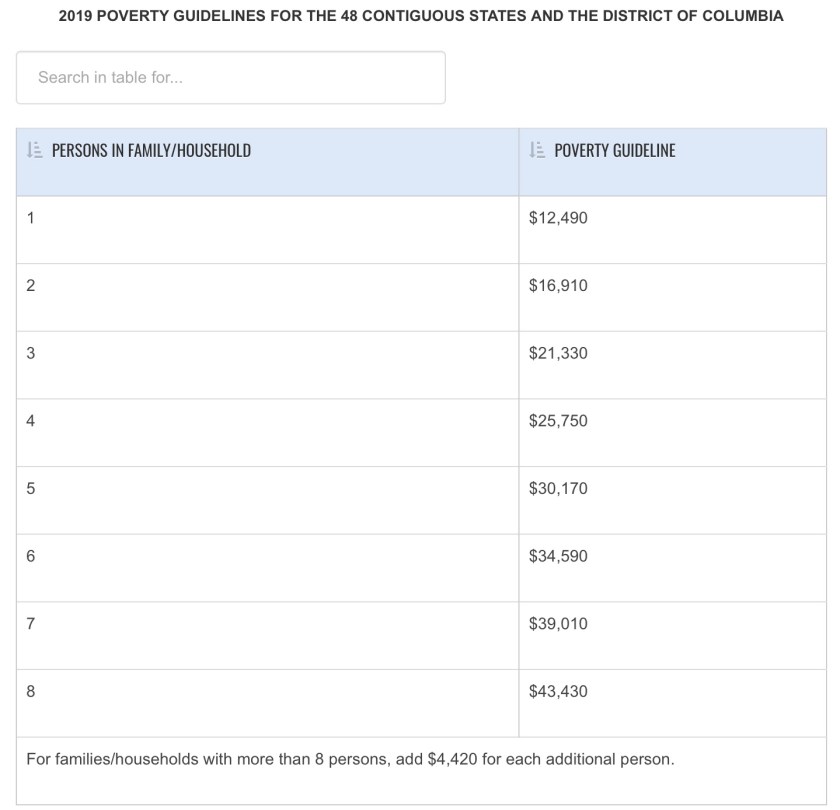

An individual income of $12,490 is living in poverty (not counting benefits from safety net programs).

The chances of Social Security replacing 100% of income in your lifetime are slim to none. Even if any of the current proposals to improve SS benefits are adopted, benefits will not reach 50% income replacement for the $30,000 income level.

So, there is a lesson, a strong lesson. You need to prepare regardless of what you earn.

- Be prepared to work longer

- Find a way to put aside money on your own, even a modest amount that will generate some additional income in retirement; a part-time job, making money from a hobby, working OT if you can, anything just about

- Watch your spending. Virtually everyone can occasionally find some unnecessary spending that can be saved. If you want some tips, check out my article on HUMBLEDOLLAR.

I remember back in the ancient world, my father bought one Irish Sweepstakes ticket per year. State lotteries were then unknown. Many states are dependent on their lottery money to balance their budgets. The citizenry seem to like lotteries as much as the politicians.

LikeLike

I guess if you don’t call a tax a tax, it’s not a tax.Marijuana is up next.

LikeLike

Are those SS income amounts before or after Medicare B premiums are taken out ?! More one bullet point to add: Before retirement be totally debt-free including your house.

I took minimal SS early at age 62. Although I have a nice savings/investment nest egg that I can fall back on in case of emergency, etc… I am able to live comfortably day to day on my minimal SS because I live in a nice low cost urban area [Dallas suburb] and have zero debt.

LikeLike

Before any deductions

LikeLike

Social security was never designed to replace all income. That fallacy needs to be recognized. People need to also save have a 401 k and use it etc

LikeLike

You are correct. But the average American has less than $1,000 in savings but spends that much on lotteries each year.

LikeLike